DeFi, or decentralized finance, lastly discovered its footing this yr, with quite a few DeFi tokens and protocols gaining widespread traction among

DeFi, or decentralized finance, lastly discovered its footing this yr, with quite a few DeFi tokens and protocols gaining widespread traction amongst crypto customers. Powered by sensible contract know-how, improvements like yield farming have allowed on a regular basis customers to earn unprecedented curiosity on their crypto belongings.

DeFi is booming, and as we speak, the market is stuffed with every kind of borrowing and lending protocols, lots of which compete with each other on the premise of offering customers with meteoric yields. It’s not unusual to see protocols promoting double or triple digit rates of interest – a far cry from the ~0.5% rates of interest generally seen on so-called “high-yield” conventional financial savings accounts. Whereas many of those protocols will show to be unsustainable, make no mistake: Look again in just a few years, and it’ll be clear that this emergent wave of protocols have set bigger forces into movement.

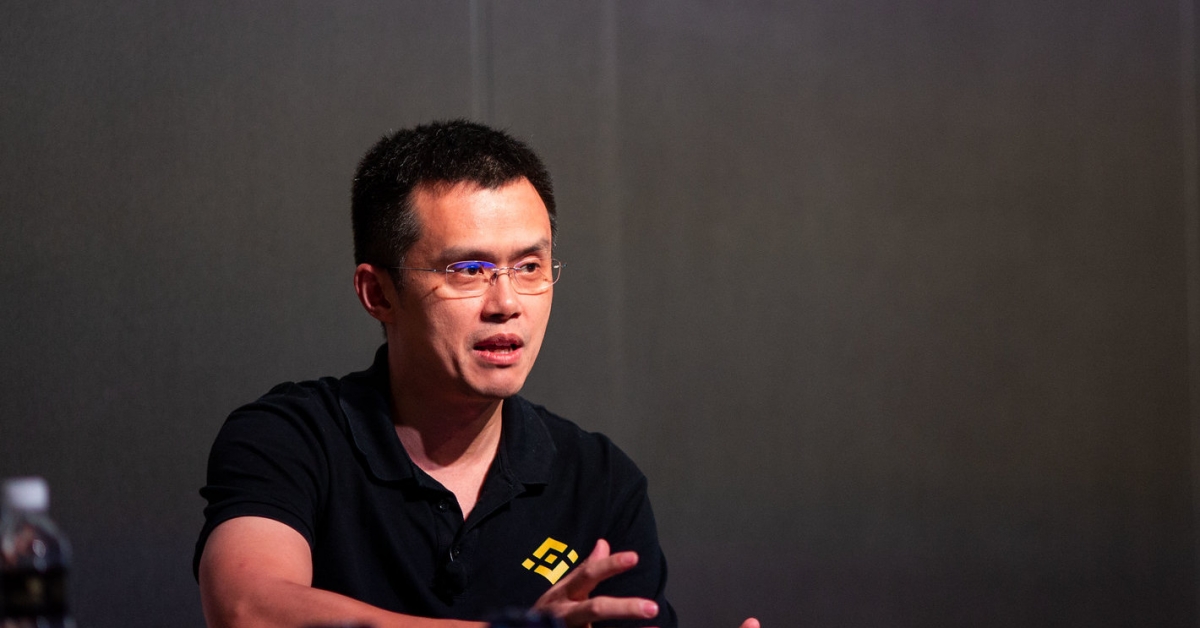

CZ is the founder and CEO of Binance, which operates the most important digital asset change by quantity.

As we speak’s most promising DeFi apps all share an analogous imaginative and prescient for the long run: The creation of a divergent monetary system the place capital and information flows extra equitably, shifting management away from establishments and in direction of the person. Nonetheless, there isn’t a straight path from level A to level B. The most well-liked DeFi apps are nonetheless dwarfed by most centralized exchanges, which wield outsized impression and affect throughout the cryptocurrency and blockchain house. One of the best centralized exchanges provide a compelling mixture of user-friendly companies which are extra simply understood by end-users.

As an illustration, our cryptocurrency change, Binance, gives a complete suite of economic merchandise that mirrors these present in conventional markets. Customers can purchase, promote, and commerce crypto, select choices and futures buying and selling, apply for crypto loans, earn passive earnings and extra with a single login. These centralized merchandise are easy-to-use and comprehend, and might be accessed utilizing an internet browser, desktop or cell app. At earlier phases of improvement, it’s additionally simpler to extend the tempo of innovation with centralized know-how, as groups can work in live performance to construct new options, repair bugs, and produce the sorts of fantastic iterations that enhance the general consumer expertise. By specializing in delivering a superior consumer expertise in tandem with top-notch safety, centralized exchanges primarily reside or die primarily based on their potential to “create belief” amongst their customers.

Belief additionally occurs to be the key battle that DeFi should win to succeed in mainstream success. Customers primarily care about three issues relating to monetary merchandise: liquidity, safety, and stability. These are the traits that allow belief (and dependable earnings) to happen. Whereas as we speak’s DeFi protocols might be notoriously obscure and entry, through the years, CeFi platforms have step by step turn into extra accessible and multi-dimensional, with refined order-matching engines, asset custody and secure know-how.

We imagine the way forward for the business lies in decentralization, and with the momentum growing, it’s time to go all in.

These traits are telling, as they replicate the crypto change’s raison d’être: to advertise market and business building. CeFi’s considerations begin and finish with the constructing of mature infrastructure for the way forward for the crypto market. As soon as the inspiration is in place, the platform itself takes a backseat to the various and progressive functions being constructed on the platform. Quite than driving the market as innovators, centralized exchanges will step by step settle into a job as an infrastructure supplier for trailblazing initiatives. Finally, centralized exchanges are a transient product that can present customers with a bridge to the world of DeFi.

Right here’s what we predict will occur subsequent: CeFi gamers will proceed to decrease the limitations to entry for DeFi and DeFi-like initiatives, permitting their consumer base to pattern the advantages of DeFi, whereas retaining the liquidity, safety, and stability that the customers are accustomed to with CeFi choices. As soon as these proof-of-concept initiatives are “verified” by the market, and the DeFi mannequin proves to achieve success, then market demand will comply with.

See additionally: Binance’s CZ Views ‘CeDeFi’ as a Complement, Not a Competitor, to DeFi

As we speak, Binance customers can entry DeFi-inspired merchandise like staking, lending, and pooling companies. As well as, we’re committing a $100 million accelerator fund for DeFi initiatives on Binance Good Chain (BSC), a smart-contracts enabled blockchain that permits builders to construct decentralized apps and digital belongings. Among the many wave of inaugural DeFi initiatives that debut on BSC, there’s an opportunity that considered one of them will turn into the subsequent “killer” utility.

It appears we’ve already reached “the turning level” relating to DeFi adoption. In any case, the enduring attraction of economic self-custody and decentralization is…