Digital Currency Group, a crypto-industry holding company, came out in defense of its subsidiary Grayscale’s Grayscale Bitcoin Trust (GBTC) last we

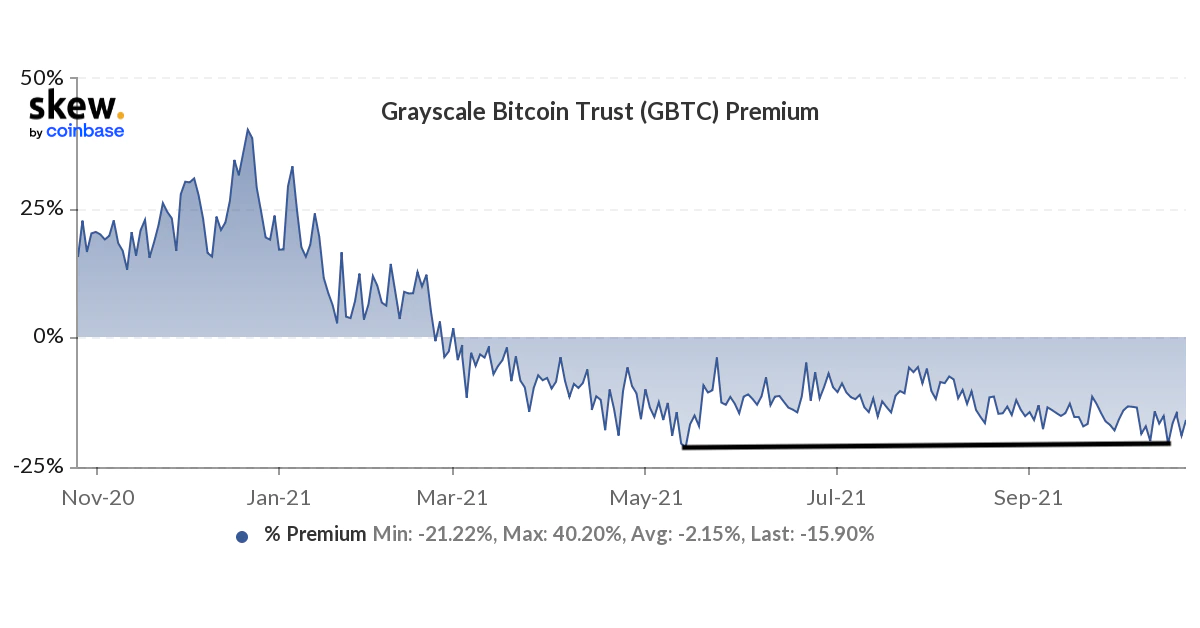

Digital Currency Group, a crypto-industry holding company, came out in defense of its subsidiary Grayscale’s Grayscale Bitcoin Trust (GBTC) last week, when the fund’s shares traded on Monday at a 20.53% discount to its underlying bitcoin holdings – the steepest in five months.

One perspective is that Digital Currency Group’s pledge to buy as much as $1 billion of GBTC shares might represented savvy, opportunistic timing. Another is that the parent company’s announcement was needed as a demonstration of support for the $39.45 billion GBTC, the world’s largest bitcoin fund.

The plot thickened when Grayscale officially filed with the U.S. Securities and Exchange Commission to convert the trust into a spot-based exchange-traded fund (ETF), even though SEC Chair Gary Gensler has signaled his preference for a futures-based ETF. (Several of those have recently won approval.)

On the heels of the developments, the GBTC discount has since narrowed to about 16%, based on data from the crypto derivatives research firm Skew.

Bloomberg commodities analyst Mike McGlone wrote last week that the U.S. Securities and Exchange Commission’s (SEC) recent approval of futures-based bitcoin exchange traded funds (ETFs) might represent a baby step toward an eventual approval of ETFs that buy the actual cryptocurrency, and that the GBTC discount might fully evaporate if the trust converts to an ETF.

“We see increasing pressure for the Securities and Exchange Commission to approve the GBTC ETF,” McGlone said in the market update shared with CoinDesk on Oct. 20. “Grayscale has said it’s committed to converting GBTC to an ETF. We see that as a matter of time, notably with a new digital divide opening vs. China, which may make Bitcoin and crypto success a vested interest of the U.S.”

However, analysts talking to CoinDesk last week said the price discrepancy will likely persist for the foreseeable future.

“Any announcements about purchasing GBTC on the open market, or signaling towards an ETF conversion, are just empty promises in an attempt to bring in arbitrageurs and likely will not have much impact,” Jeff Dorman, CIO at Arca Funds, told CoinDesk in an email. “I don’t think the discount will close any time soon and probably should widen.”

DCG, which also owns CoinDesk as an independent subsidiary, said it would authorize GBTC purchases of as much as $1 billion, up from a prior authorization of $750 million. As of Oct. 19, DCG had already purchased $388 million worth of shares, according to the press release dated Oct. 20. DCG declined to comment on the issue.

Grayscale allows investors to gain exposure to bitcoin through shares in the trust, which currently holds 647,540 BTC, according to bybt.com. That amounts to around 3% of the cryptocurrency’s circulating supply.

GBTC shares are derivatives of bitcoin and, in theory, should closely track the cryptocurrency’s price. So a substantial discount or premium is an opportunity for arbitrageurs – traders exploiting price discrepancies – to make money.

For example, with shares currently trading at a discount of 16% at press time, an arbitrageur expecting the price discrepancy to narrow would buy GBTC shares in the secondary market and simultaneously sell bitcoin in the spot market. The market-neutral position would yield 16% returns if shares in GBTC converge with the spot price. An arbitrageur can also hedge the long GBTC trade with a short position in the futures market, in which case, the return would be higher as futures usually trade at a premium to the spot price and converge with the spot price on expiry.

“The ability to buy GBTC and short futures and get exposure to bitcoin with about a 25% price advantage should continue to attract arbitrage, reduce volatility and narrow spreads,” Bloomberg’s McGlone said on Oct. 20, when the discount was over 20% and the six-month futures contract was drawing a premium of 4%.

Grayscale Investments LLC recently filed the regulatory documents to convert the bitcoin trust into a spot-based ETF. A spot-based ETF would allow for more continual creation and redemption of new shares by market makers, so ostensibly it would track bitcoin’s price more closely than the current trust structure. Thus, it could be a big hit on Wall Street.

“The trust is desperate to return to par value, and I think they will need to in some manner,” Ben Lilly, a crypto economist at Jarvis Labs, said. “At a 17% discount, I find it attractive.”

‘Arb away’

According to Arca’s Dorman, traders may be less inclined to “arb away” the discount solely on the assumption that Grayscale’s plan to convert the trust into an ETF would win approval; that currently appears to be a low-probability event, in his view. Besides, traders can nearly earn double-digit returns via other strategies that appear relatively less risky.

Said Dorman: “Buying GBTC for that 17% discount is the equivalent of buying a 0% coupon, 2-year bond at 83 cents…

www.coindesk.com