Growth in decentralized finance (DeFi) has driven North America to the world’s second-biggest largest crypto market, new research by crypto intelli

Growth in decentralized finance (DeFi) has driven North America to the world’s second-biggest largest crypto market, new research by crypto intelligence firm Chainalysis said.

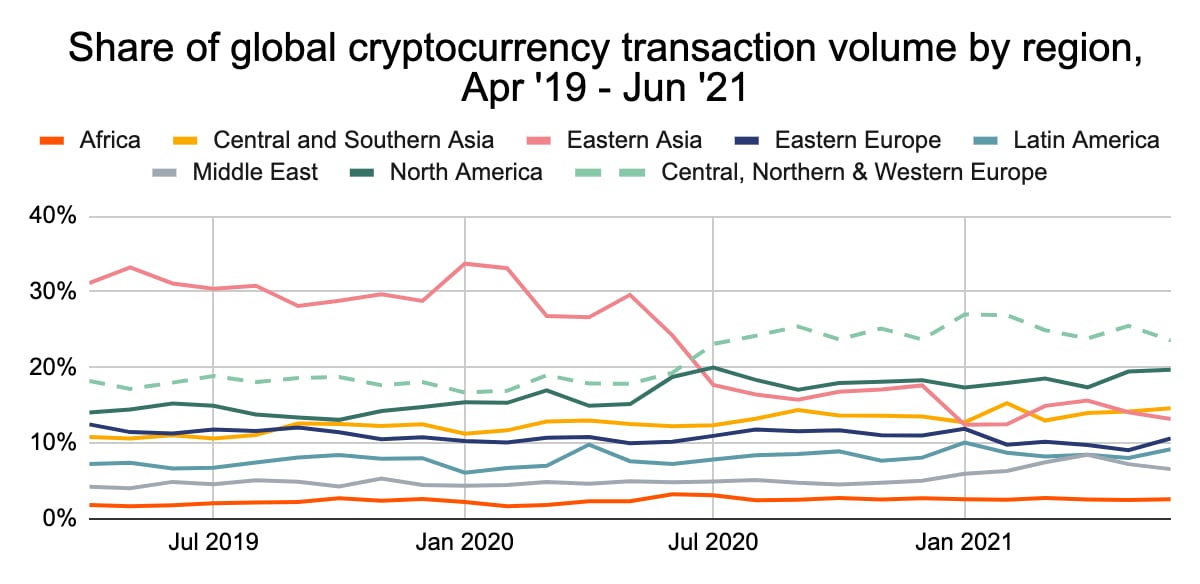

- North American addresses received $750 billion in crypto between July 2020 and June 2021, or 18.4% of global transactions. Central, Northern and Western Europe received $1 trillion in that time period, accounting for 25% of global volume, Chainalysis’s 2021 Geography of Cryptocurrency Report found.

- Monthly transaction volume in North America grew by over 1,000% between July 2020 and May 2021, from $14.4 billion to $164 billion.

- Chainalysis attributed this growth to DeFi, which represented 37% of total transactions in North America between July 2021 and June 2021. The region’s top exchange in that time period is decentralized Uniswap, followed by centralized Coinbase and decentralized dYdX.

- The U.S., the region’s largest market, topped Chainalysis’s DeFi Adoption Index, which measures “grassroots adoption” of DeFi.

- Both North America and East Asia saw a slight dip in total transaction volume in May 2021. The dip in activity in E. Asia is likely explained by Beijing’s new crackdown on crypto, which started with a State Council proclamation in May. China has historically been the world’s biggest bitcoin mining country and a major hub for crypto trading.

East Asia has long lost its edge

Eeast Asia’s share of global crypto transaction volume started dropping in April 2020, long before this year’s crackdown on the industry by Chinese authorities, research by Chainalysis shows.

- Starting April 2019, E. Asia accounted for the lion’s share of crypto transactions globally, until June 2020, when it was overtaken by Central, Northern and Western Europe, as well as North America, the report said.

- China accounted for 47% of these transactions between July 2020 and June 2021, Chainalysis economist Ethan McMahon told CoinDesk in an email interview.

- When asked about the drop in East Asia’s share of global crypto transactions in April 2020, McMahon said that “China has been moving towards an outright crypto ban in favor of its own solutions” for a while, adding that China started testing its own central bank digital currency in that month.

- From July 2020 to June 2021, East Asian countries also fell several places in the Chainalysis Global Crypto Adoption Index; China fell from fourth place to 13th, South Korea from 17th to 40th, Hong Kong from 23rd to 39th, and Japan from 71st to 80th.

- DeFi is also gaining ground in East Asia. Huobi is the region’s most popular exchange, according to the research, followed by decentralized exchanges dydx and Uniswap.

- Hong Kong is the region’s top DeFi adopter, where it accounts for 55% of transactions, followed by China at 49%, Japan at 32%, and South Korea at 15%.

Mining

Since China’s State Council called for a crackdown on crypto mining in May, China’s miners have been moving their facilities overseas, primarily to North America, Central Asia, and South America.

- Between May and June, Binance saw the biggest decline in bitcoin received from mining pools, over $200 million, Chainalysis said. Huobi saw the second biggest net decline, at just over $150 million, followed by FTX at around $100 million.

- This lost liquidity might also account for the overall decline in activity in the region after May, said the intelligence firm.

- North America’s share of the global mining hash rate more than doubled between the end of April and August, research from the Cambridge Center for Alternative Finance shows. By August, China’s hash rate had virtually dropped to zero, according to the the center.

- For mining pools not based in China, proceeds have more than doubled between January and July 2021, Chainalysis said. Those based in China saw their earnings decline by 50%, according to the report.

www.coindesk.com