Bitcoin mining shadow tenants leave Malaysian landlords with mil

|

Bitcoin mining shadow tenants leave Malaysian landlords with million-dollar electricity nightmares

Landlords across Malaysia are facing massive financial losses after their tenants illegally mined cryptocurrency to rack up electricity bills before leaving property owners to bear the cost.

In one case, a landlord identified as “Jason” was reportedly handed a 1.7 million Malaysian ringgit (about $382,000) penalty by electricity provider Tenaga Nasional Berhad (TNB) after a tenant stole electricity to power their secret crypto mining operations. After four years of legal battles, the fine was reduced to 825,000 ringgit ($185,722).

His ordeal began in July 2020 when he rented out his property to a tenant who claimed to work with computers. Three months later, the entire building suffered power outages due to illegally installed power cables used for crypto mining. When authorities discovered the theft, Jason was held liable, while the tenant had vanished.

Jason attempted to fight the fine in court, arguing that he was not responsible for his tenant’s illegal activities. But after two years of litigation, he lost the case, leaving him to deal with mounting legal fees and a 5% interest rate on the outstanding amount. Now, he is preparing to appeal.

Jason’s case is not isolated. Forty-five homeowners and business operators have reported a combined 8.5 million ringgit ($1.9 million) in fraudulent electricity bills, with tenants using stolen identities to carry out illegal Bitcoin mining. Some only realized the deception after receiving notices from TNB, leaving them financially crippled.

One victim, a 57-year-old landlord who relies on rental income, now faces a 300,000 ringgit ($67,720) bill after his tenant used a fake identity to rent his property. Another victim was blindsided by a 73,000 ringgit ($16,386) bill and has already paid 70,000 ringgit ($15,756).

Malaysia has been grappling with the issue of stolen electricity, with TNB blaming crypto mining for the 441 million ringgit ($100 million) loss it has suffered from electricity theft since 2020.

Chinese programmer burns $6.8M in ETH, claims ‘brain-computer weapons’ control people

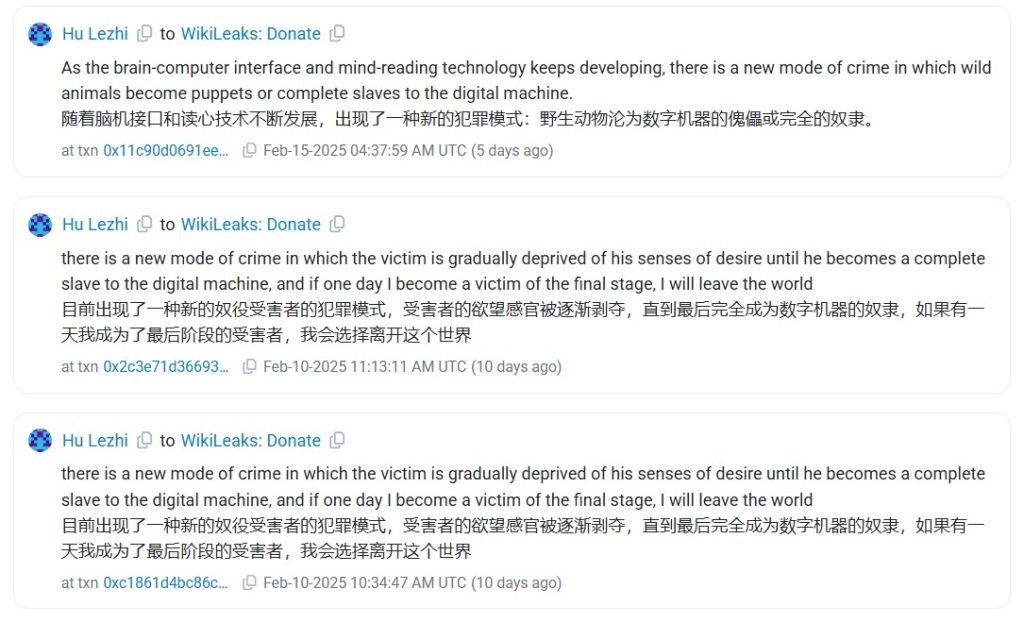

A Chinese programmer self-identified as Hu Lezhi has burned and transferred millions of dollars worth of Ether to publicize his wild claims that Chinese corporations and military forces are using “brain-computer” tech to manipulate and control citizens.

Between Feb. 10 and Feb. 17, Lezhi transferred more than 2,553 ETH (worth $6.8 million at the time) to various addresses, including Ethereum’s burn address and WikiLeaks. His transactions contained onchain messages that state nano-computer chips and radio waves are being used to turn individuals into “puppets or complete slaves to the digital machine.”

Hu’s largest transactions included 500 ETH ($1.35 million) sent to a burn address, effectively removing the funds from circulation. He also donated 711.5 ETH ($2 million) to WikiLeaks across several transactions, claiming in a message that “brain-computer chips have been deployed militarily on a large scale.”

Among his allegations, Hu specifically called out Feng Xin and Xu Yuzhi, hedge fund executives at Kuande Investment, accusing them of using this technology to control employees. He went as far as to claim that the two executives themselves were victims of the same technology.

Hu described himself as a computer programmer who had only recently realized he was being monitored and manipulated his entire life. Their last message claims that they have completely lost their dignity as a human being. Hu’s Ethereum wallet has since remained inactive.

Neither Kuande Investment nor any Chinese authorities have publicly responded to Hu’s claims. Cointelegraph has reached out to Kuande Investment.

Read also

Features

Here’s how to keep your crypto safe

Features

Here’s how Ethereum’s ZK-rollups can become interoperable

Robinhood to enter the Singapore crypto market via Bitstamp

Trading platform Robinhood is reportedly pushing into Singapore’s cryptocurrency market, aiming to roll out trading services through its Bitstamp subsidiary by late 2025.

The company’s $200 million acquisition of Bitstamp, announced in 2024, is still awaiting final…

cointelegraph.com