$1 quadrillion. The derivatives market is taken into account the largest market on the earth on a notional foundation, eclipsing even the balloonin

$1 quadrillion. The derivatives market is taken into account the largest market on the earth on a notional foundation, eclipsing even the ballooning world debt market by 4 occasions. Nevertheless, on a gross market worth foundation, the derivatives market is taken into account considerably smaller. The Financial institution of Worldwide Settlements (BIS) estimated it at roughly $12 trillion final 12 months.

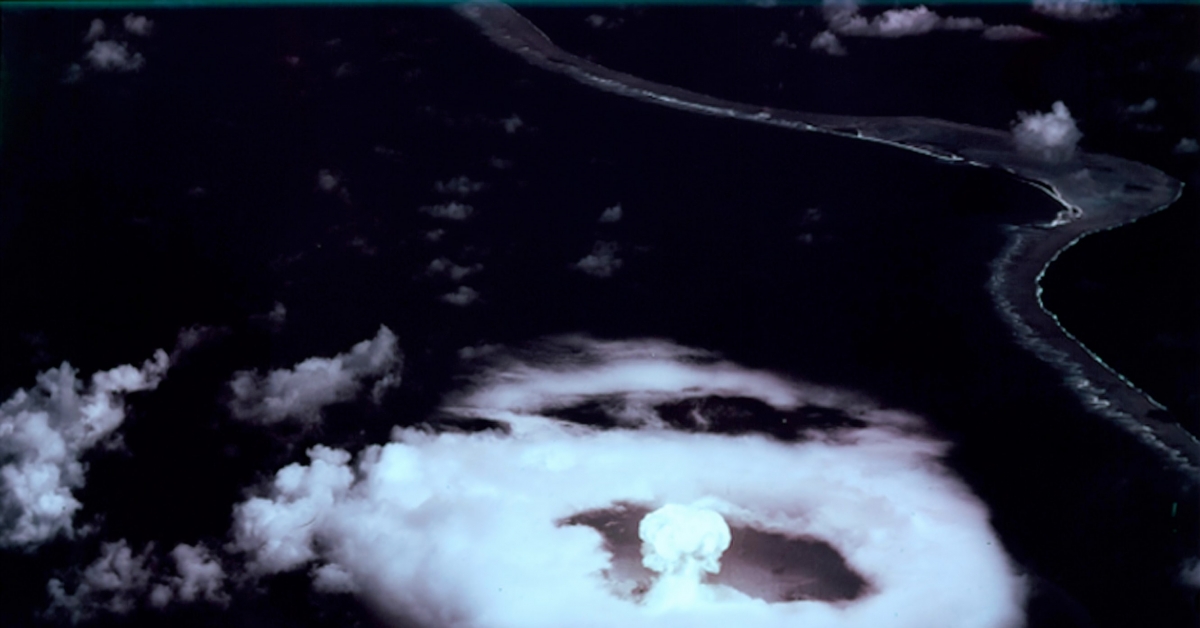

The shortage of readability over the scale of the derivatives market factors to its opaqueness, with little improved real-time danger transparency because the monetary disaster of 2008-09. In a well-known investor letter from 2002, Warren Buffett referred to derivatives as “weapons of economic mass destruction” (not mentioning that Berkshire Hathaway has used inventory choices, a by-product instrument).

Sandra Ro is a former derivatives banker and market infrastructure government and the CEO of the International Blockchain Enterprise Council, a Swiss trade non-profit constructing the following multi-trillion greenback trade by way of partnership, schooling, and advocacy.

The worldwide derivatives market is likely one of the most influential areas of economic companies as a result of it typically drives the underlying costs of different asset lessons, and since it is extremely profitable. Derivatives are additionally thought-about the “black field” of the monetary companies world, particularly over-the-counter (OTC) derivatives, as a result of so few perceive them. (Many crypto markets are open books by comparability.)

Most OTC by-product transactions are personal and bilateral. Subsequently, understanding the precise danger exposures and positions throughout world by-product portfolios at any given time requires monumental systemic danger administration and monitoring. Listed or publicly traded futures and choices contracts have extra knowledge out there for public consumption. Nevertheless, I might argue, they’re nonetheless tough to risk-manage, as most contracts sit throughout lots of, if not hundreds of various exchanges, buying and selling venues, brokers, sell-side and buy-side, in knowledge silos.

See additionally: UK’s Ban on Crypto Derivatives Goes Into Impact At present

Derivatives, at their core, provide hedging and danger administration options for these uncovered to the corresponding asset, whether or not within the type of hedging towards adversarial value actions or an excessive amount of volatility of costs. American farmers began locking in costs of sugar and wheat greater than 100 years in the past as a type of safety towards decrease costs sooner or later (aka ‘futures’ markets).

Nevertheless, within the years since, derivatives have attracted hypothesis and leveraged buying and selling, which might spell catastrophe if regulatory guardrails usually are not clear and enforced. Within the 2000s, “Mrs Watanabe” buyers (a time period coined for usually cautious Japanese housewives) grew to become concerned with notorious JPY carry trades: shifting JPY markets globally, befuddling FX merchants in London and New York, and wiping out the life financial savings of some Japanese households.

Why crypto markets ought to care

The crypto markets are rising and maturing, which implies, inevitably, extra crypto by-product merchandise will likely be out there out there for institutional and retail buyers to commerce. Crypto by-product product builders, regulators, brokers, sellers, merchants, exchanges ought to be taught from the errors of conventional capital markets, particularly the opacity of those markets, and construct higher methods to danger handle exposures, leverage within the type of margin buying and selling, and foster development on this probably profitable market, whereas additionally defending retail buyers and holding out or mitigating injury from dangerous actors.

Moreover, with the tokenization of doubtless all the things and something, we may see actual innovation and breakthroughs for the inexperienced economic system from inexperienced bonds to carbon credit to local weather change indices.

In latest months, we’ve seen regulators take a more in-depth have a look at crypto derivatives, outright banning the retail advertising and marketing of them within the U.Okay., for instance. We additionally see U.S. regulators turning to enforcement actions towards corporations like BitMEX, which has been providing by-product merchandise on its platform for years.

It’s nonetheless very early days of crypto derivatives. What do we have to do now?

See additionally: Crypto Lengthy & Quick: A UK Ban on Crypto Derivatives Will Damage, Not Defend, Traders

There are regulated crypto by-product devices presently buying and selling like CME’s Bitcoin futures, choices on futures, and the lately launched ETN from Van Eck/Deutsche Boerse. Nevertheless, product creation is just one a part of the puzzle. The crypto derivatives group must create real-time danger mitigation and administration instruments for regulators, trade professionals, and, finally, assist all of us all construct extra resilient derivatives markets forward of the following monetary disaster.

There will likely be one other monetary disaster. The query is, will the crypto derivatives market create it, gas it, or assist mitigate the destructive fallout?

In 2021, the trade ought to step up engagement with legislators and regulators on the subject of derivatives, margin buying and selling, and…