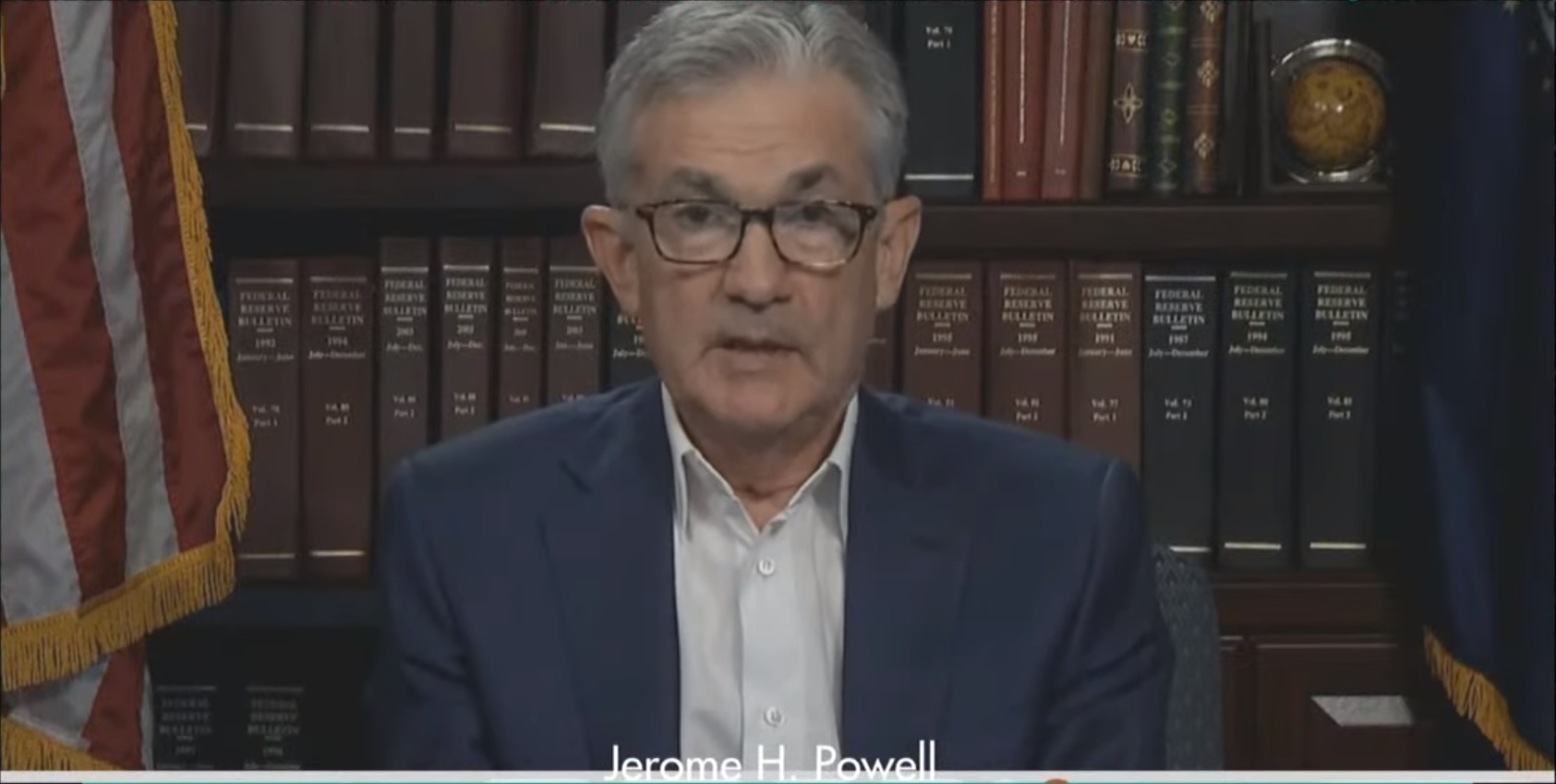

Federal Reserve Chair Jerome Powell didn't increase many eyebrows Thursday morning when he introduced the U.S. central financial institution would

Federal Reserve Chair Jerome Powell didn’t increase many eyebrows Thursday morning when he introduced the U.S. central financial institution would encourage some durations of inflation above its 2% goal in sure circumstances to spice up the long-term financial system.

In remarks earlier than a digital model of the annual Jackson Gap symposium, Powell mentioned the Fed was seeking to bolster the labor market, although that is largely a difficulty Congress must cope with amid the continuing COVID-19 pandemic. The present recession differs from most earlier monetary downturns due to its underlying trigger, specifically, lockdowns slightly than the after-effects of an overheated financial system, he mentioned.

“If inflation runs beneath 2% following financial downturns however by no means strikes above 2% even when the financial system is powerful, then, over time, inflation will common lower than 2%,” he mentioned. “Households and companies will come to count on this outcome, which means that inflation expectations would have a tendency to maneuver beneath our inflation purpose and pull realized inflation down.”

“To stop this end result and the antagonistic dynamics that would ensue, our new assertion signifies that we’ll search to attain inflation that averages 2% over time. Due to this fact, following durations when inflation has been operating beneath 2%, applicable financial coverage will doubtless purpose to attain inflation reasonably above 2% for a while.”

Thursday’s new method to financial coverage comes after a year-long assessment of the Fed’s earlier technique, Powell mentioned.

Learn extra: Commentary: Fed Chair Jerome Powell Particulars Inflation Goal Adjustments

Ben Emons, managing director at macro analysis agency Medley International Advisors, advised CoinDesk the speech and the Fed’s new framework “mainly matched market expectations.”

“For a while now the dialogue has been shifting to a extra versatile framework concentrating on inflation,” he mentioned.

Market stability

Each conventional monetary devices and hedge belongings ended Thursday’s buying and selling classes typically steady, regardless of some value fluctuation earlier.

Whereas Bitcoin noticed a value spike in the course of the first half of Powell’s feedback, it returned to the low $11,000s by its conclusion, and was buying and selling round $11,300 as of press time, down lower than 2% over the previous 24 hours.

Bitcoin’s value rose to the mid-$11,000s on Friday, up simply barely over a 24-hour interval.

Conventional monetary markets additionally skilled some slight volatility, however closed their buying and selling classes lower than 1% away from their beginning factors.

Employment considerations

Powell famous that Congress must goal the unemployment charge, Emons mentioned.

“So the message right here as we speak is admittedly that if the financial system recovers we’re going to see extra inflation, and if employment improves we’re going to permit this to proceed so long as attainable,” he mentioned. “The Fed’s not going to lean in opposition to it.”

Throughout his speech, Powell mentioned the labor market could be “strongly influenced by non-monetary components,” resembling the trail of the coronavirus and any lasting modifications within the enterprise panorama.

For crypto merchants, the massive query shall be how inflation impacts the costs of cryptocurrencies like bitcoin and ether. Ought to the greenback weaken, the worth of those cryptocurrencies ought to climb.

Nonetheless, Powell additionally addressed belief in main centralized establishments like central banks.

“Public religion in giant establishments around the globe is beneath stress,” he mentioned. “I believe establishments just like the Fed should aggressively search transparency and accountability to protect our democratic legitimacy.”