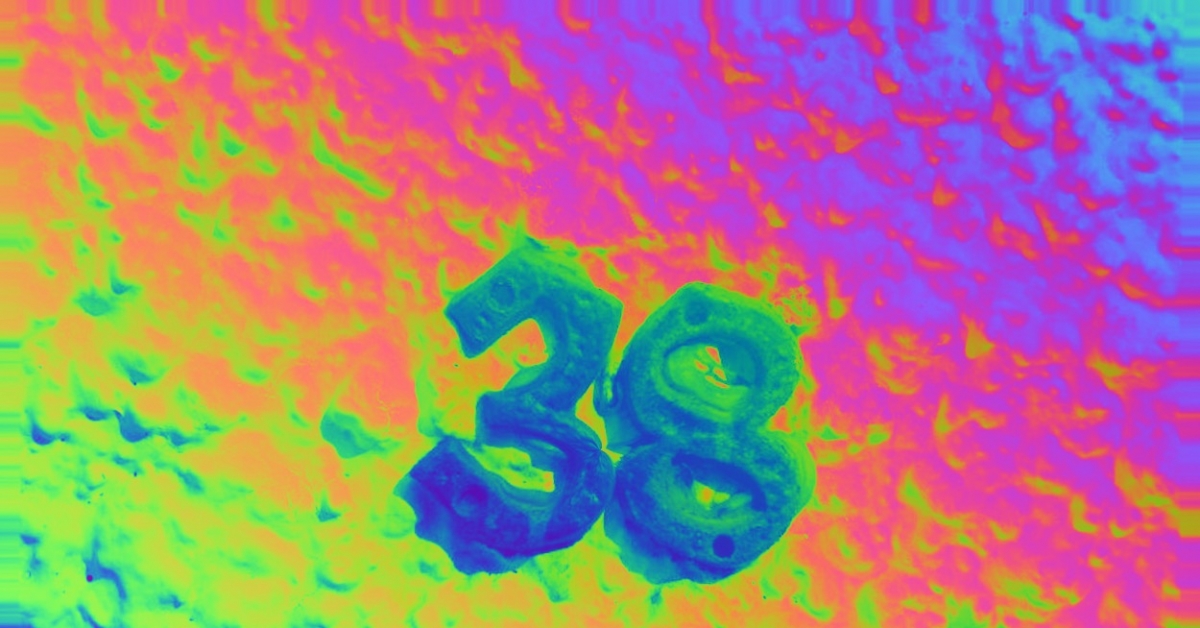

Bitcoin (BTC) rose for a 3rd straight day, pushing early Thursday to a brand new all-time excessive value above $38,000 and setting bullish merchan

Bitcoin (BTC) rose for a 3rd straight day, pushing early Thursday to a brand new all-time excessive value above $38,000 and setting bullish merchants’ sights on $40,000.

“Momentum has been constructing over time, and it’s anybody’s guess the place or after we may ultimately prime out,” Mati Greenspan, founding father of the foreign-exchange and cryptocurrency evaluation agency Quantum Economics, informed purchasers in a publication.

The positive aspects got here after a day of turmoil in Washington, D.C., throughout which supporters of U.S. President Donald Trump stormed the Capitol constructing and disrupted a congressional vote to formalize challenger Joe Biden’s victory in final November’s presidential election. The surprising photographs prompted world leaders from the U.Okay., European Union and Canada to sentence what they characterised as an unacceptable assault on democracy. U.S. lawmakers later reconvened and authorized the election outcome early Thursday.

The upshot, in accordance with Bloomberg Information, is that world buyers at the moment are specializing in the probability {that a} Biden White Home, backed by a legislature managed by his Democratic Social gathering in each chambers, might extra simply move new U.S. stimulus measures. Bitcoin costs quadrupled in 2020 as a rising variety of huge Wall Avenue buyers stated the cryptocurrency might function a hedge towards the potential detrimental impression on the greenback’s worth from trillions of {dollars} of fiscal and financial stimulus.

In conventional markets, European and Asian shares rose on Thursday and U.S. inventory futures pointed to a better open. Gold weakened 0.1% to $1,916 an oz.

Market strikes

Earlier this week, First Mover flagged the chance that the overall market capitalization of all cryptocurrencies mixed might surpass $1 trillion inside a number of months.

Seems it solely took a number of days. The overall market worth of bitcoin and all the opposite digital tokens and stablecoins pushed into the trillion-dollar zone late Wednesday for the primary time. As reported by CoinDesk’s Zack Voell, the business had topped out at $760 billion over the last huge bull run in late 2017.

The milestone might show one other catalyst for giant Wall Avenue funds to look extra significantly at cryptocurrencies for a possible portfolio allocation. It’s getting tougher and tougher to argue, because the huge financial institution and brokerage agency Goldman Sachs did final Could, that cryptocurrencies are “not an asset class.” The sums are getting too huge to disregard.

“Is it frothy? Slightly bit within the brief time period,” Qiao Wang, co-founder of decentralized finance (DeFi) accelerator agency DeFi Alliance, informed Voell. However is it ridiculous? “Nope.”

One of many greatest tales in finance over the last decade was the fast (and regarding) progress in so-called leveraged loans, that are huge loans which might be organized by Wall Avenue corporations on behalf of junk-grade and even unrated firms after which usually apportioned to different banks, bought off to buyers and even remodeled into new triple-A rated bonds by way of the alchemy of structured finance.

Headlines abounded when the excellent quantity of U.S. leveraged loans grew to about $500 billion in late 2010 after which doubled to $1 trillion by early 2018.

Cryptocurrencies have now traversed that chasm in just some months.

“The $1 trillion mark cements cryptocurrency as an investable asset class that now not sits on the fringes of conventional finance as a toy for retail buyers,” Jack Purdy, of the crypto-market evaluation agency Messari, informed Voell. “It demonstrates that this asset class is giant sufficient to soak up giant orders like we’ve seen not too long ago with the slew of establishments coming into over the previous couple of months.”

Bitcoin, the unique cryptocurrency and the most important by far, represents about 70% of the business’s complete market capitalization. So the push towards the $1 trillion milestone got here largely on the heels of bitcoin’s rally over the previous yr.

Bitcoin now has a market capitalization of about $700 billion, up from about $130 billion initially of 2020. In accordance with the web site fiatmarketcap.com, bitcoin’s excellent worth would rank it because the 16th greatest world foreign money, simply forward of the Mexican peso and one rung under the Russian ruble.

And if bitcoin had been a publicly traded firm, it might rank because the world’s eighth-largest, in accordance with one other web site, AssetDash, nicely behind Apple’s $2.1 trillion valuation, Amazon’s $1.6 trillion and Fb’s $751 billion valuation, however far in extra of the large U.S. monetary establishments like Visa ($468 billion), JPMorgan Chase ($401 billion) and Citigroup ($135 billion).

If the latest pattern is any indication, bitcoin might maintain climbing these ranks.

Bitcoin watch

Choices merchants are signaling a looming change in digital-asset markets – from a deal with bitcoin…