Whilst bitcoin costs languish under $10,000, North American cryptocurrency mining corporations are tapping right into a flurry of contemporary fina

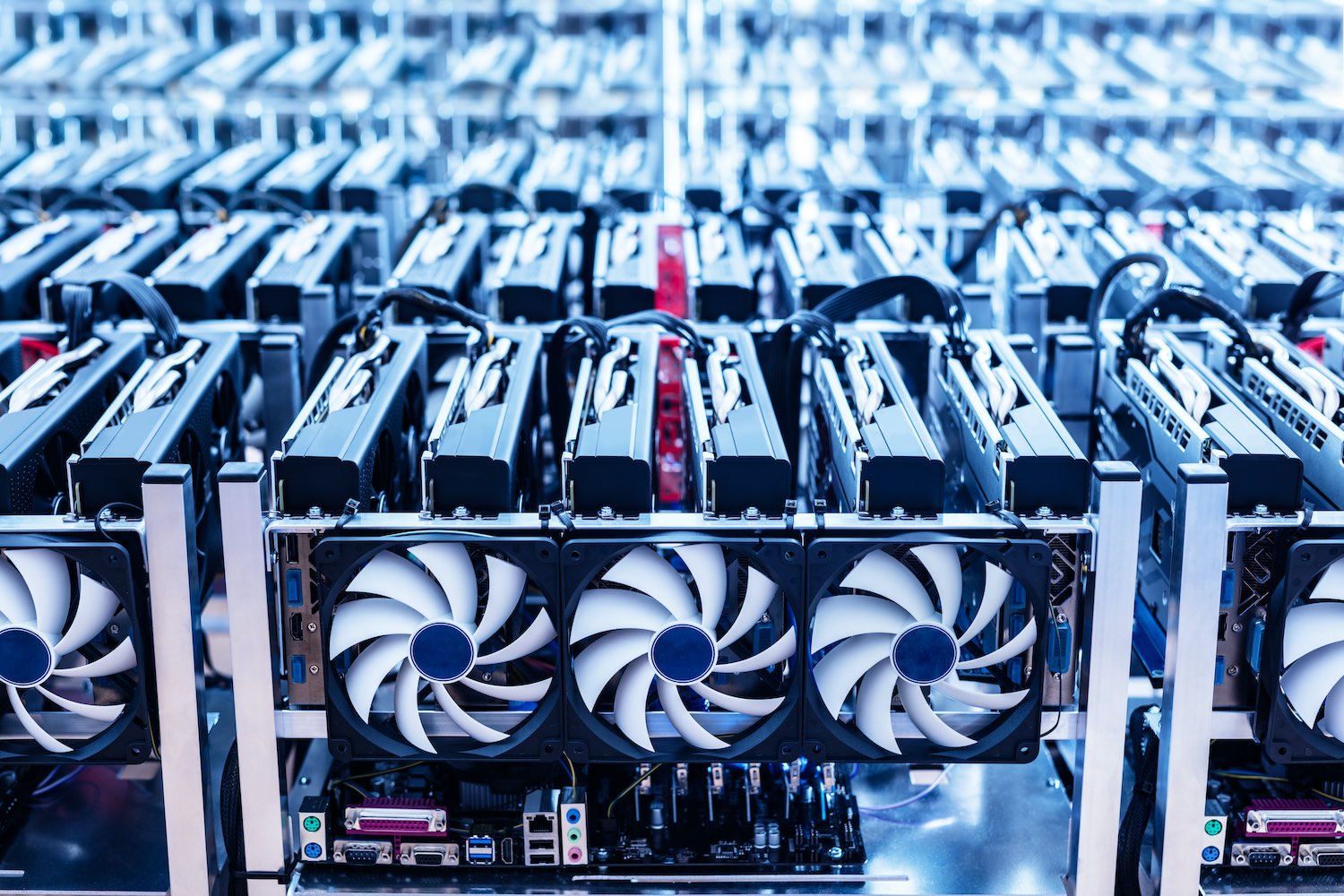

Whilst bitcoin costs languish under $10,000, North American cryptocurrency mining corporations are tapping right into a flurry of contemporary financing from traders to pay for brand spanking new gear upgrades, bolstering the blockchain community’s resilience and lowering its reliance on Chinese language operators.

Greater than $1 billion of latest bitcoin-mining computer systems can be bought for North American bitcoin mining within the subsequent two years, a number of folks conversant in the trade advised CoinDesk. That’s about 5 instances the publicly traded mining-equipment maker Canaan’s income for all of 2019.

You’re studying First Mover, CoinDesk’s every day markets publication. Assembled by the CoinDesk Markets Staff, First Mover begins your day with probably the most up-to-date sentiment round crypto markets, which in fact by no means shut, placing in context each wild swing in bitcoin and extra. We comply with the cash so that you don’t need to. You possibly can subscribe right here.

“North America isn’t going to fully take over mining, however there’s going to be progress,” Trevor Smyth, managing accomplice of San Francisco-based Arctos Capital, mentioned in a cellphone interview. In April, Arctos funded a $1 million sale-and-leaseback transaction for Blockware Mining, a bitcoin mining and rig-hosting firm, in response to a press launch on the time.

The pattern reveals that entrepreneurs and traders are undaunted by the latest doldrums within the bitcoin market, the place for the previous month costs have remained caught – nearly uncannily quiet for the traditionally risky cryptocurrency – in a spread between roughly $9,000 and $10,000. It’s been an enormous disappointment for a lot of bitcoin bulls, after a slew of predictions earlier this yr that the Might’s once-every-four-years “halving” would possibly ship costs to $90,000 or increased.

However the availability of financing for upgrades might put stress on trade gamers to maintain investing in new gear, perpetuating the {hardware} arms race even with out contemporary value indicators. It’s kind of like buying a brand new smartphone yearly simply to keep away from falling behind the innovative.

Dave Perrill, CEO of Compute North, a Minnesota-based information heart operator that gives internet hosting providers for bitcoin miners, estimates that no less than 2 million new-generation mining rigs can be produced in the course of the present {hardware} cycle, with no less than 400,000 models touchdown in North America.

“We imagine that upwards of 20% of the brand new gear can be operated there,” Perrill mentioned.

Blockfills, a Chicago-based cryptocurrency market maker, says it can present gear financing for North American bitcoin miners who can get hold of power-purchase agreements and safe base amenities within the U.S. or Canada.

“We anticipate to fund roughly $250 million ourselves within the subsequent 12 months,” Neil Van Huis, director of gross sales and institutional buying and selling at Blockfills, advised First Mover in a cellphone interview.

Smyth, of Arctos Capital, mentioned his agency is financing North American bitcoin mining gear purchases within the vary of $1 million to $2 million per deal.

Buyers trying to achieve a yield in a low-interest financial setting are investing in bitcoin mining – extra so than ever earlier than, Smyth mentioned. Lenders can earn a pretty return from the curiosity charged within the offers, often called industrial leasing, he mentioned.

“We elevate capital by a number of sources,” Smyth mentioned. “Finally they discover our enterprise is ready to generate engaging risk-adjusted yields that may assist diversify their funding portfolios.”

The funding proposition has change into much more attractive because the coronavirus-induced financial disaster led to a collapse in yields on all the pieces from U.S. Treasury bonds to mortgages. Smyth says his traders are seeing “non-correlated, regular returns.”

Arctos will get debt capital from establishments like banks and securitization companions. There’s additionally a personal Regulation D fund, which has exemption from SEC registration for small companies like Arctos to boost capital, he mentioned.

The funding push might additionally give North America an even bigger share of the bitcoin mining trade, traditionally dominated by Chinese language operators, lots of them with prepared entry to low cost electrical energy from hydropower vegetation. Presently, China has 65% of the geographical mining market share.

Smyth pointed to the entry into the bitcoin market of high-profile traders like Paul Tudor Jones III as an indication that extra institutional capital is coming to crypto, regardless of the shortage of value motion.

The debt financing offers could also be simpler for a lot of traders to know than, say, taking a flyer on bitcoin perpetual derivatives on a Seychelles-based trade.

“There’s definitely going to be hedge funds coming in and instantly holding bitcoin,” he mentioned. “However I truly see extra alternative for the bitcoin trade to draw institutional traders by structured debt merchandise resembling lease financing.”

Smyth says he sees a…