Bitcoin costs surged 5% on Wednesday, outpacing shares and gold amid requires extra authorities stimulus, because the financial toll of the coronavirus mounts.

The oldest and largest cryptocurrency rose to $11,755. The value is now approaching $12,000 for the second time in per week, a stage that bitcoin hasn’t sustainably traded above for greater than a 12 months.

You’re studying First Mover, CoinDesk’s each day markets e-newsletter. Assembled by the CoinDesk Markets Crew, First Mover begins your day with essentially the most up-to-date sentiment round crypto markets, which in fact by no means shut, placing in context each wild swing in bitcoin and extra. We observe the cash so that you don’t must. You’ll be able to subscribe right here.

Bloomberg Information went as far as to declare in an article Wednesday that “bitcoin mania seems to be virtually again in full bloom.”

Bitcoin is seen by many digital-asset traders as a hedge in opposition to inflation, and the bets are rising that governments and central banks should pump trillions of {dollars} extra into the monetary system to stimulate the economic system out of the worst recession for the reason that 1930s.

Gold, traditionally seen as a dependable inflation hedge, surged this week to a brand new report above $2,000.

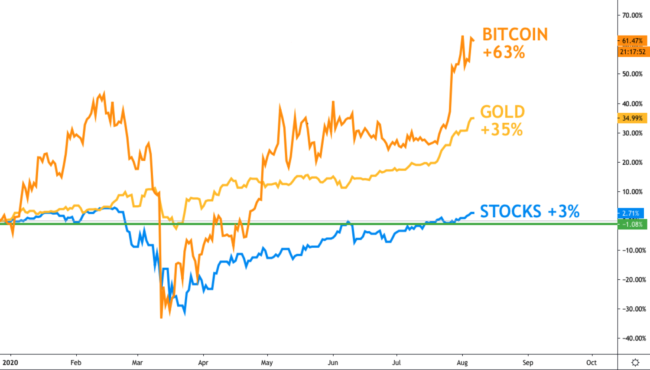

But even gold’s 35% acquire this 12 months isn’t any match for bitcoin’s 63% value enhance. The Commonplace & Poor’s 500 Index is now up 3% on the 12 months, with some conventional traders arguing that shares have develop into indifferent from actuality, merely propped up by the roughly $Three trillion of freshly created cash that the Federal Reserve has pumped into the worldwide monetary system this 12 months.

“Bitcoin and the crypto markets are as soon as once more in a position to declare independence from the standard markets,” Mati Greenspan, co-founder of the foreign-exchange and cryptocurrency evaluation agency Quantum Economics, wrote Wednesday in a e-newsletter.

The U.S. authorities’s funds deficit this fiscal 12 months is projected to soar to $3.7 trillion, far surpassing the earlier report of $1.four trillion in 2009, in response to the Related Press.

An additional $600-per-week federal profit for laid-off staff lapsed final week, threatening the financial restoration, and U.S. lawmakers are wrangling over the small print of a brand new spending measure that would vary from $1 trillion to greater than $Three trillion.

“Bitcoin’s long-term worth proposition as a hedge in opposition to fiat forex debasement solely grows stronger,” Anil Lulla, of cryptocurrency analysis agency Delphi Digital, famous Wednesday in an op-ed for CoinDesk.

The Worldwide Financial Fund warned this week in a weblog submit that “one other bout of world monetary stress may set off extra capital circulation reversals, forex pressures and additional increase the chance of an exterior disaster for economies with preexisting vulnerabilities, equivalent to giant present account deficits.”

All that simply performs to bitcoin’s strengths, as extra traders begin to extrapolate the probably stimulus wanted to get better from a protracted financial downturn. In accordance Bloomberg Information, analysts for the U.S. financial institution JPMorgan Chase wrote Tuesday that whereas older traders are shopping for gold, youthful traders are shopping for bitcoin.

The evaluation agency Coin Metrics famous that bitcoin over the previous week had averaged over 1 million each day lively addresses for the primary time since January 2018. That was within the wake of the cryptocurrency hitting an all-time excessive round $20,000 in 2017.

And Norwegian cryptocurrency-analysis agency Arcane Analysis famous in a report this week that bitcoin each day buying and selling volumes have been “rising strongly,” with a number of days topping $2 billion. The variety of open bitcoin futures contracts on the CME alternate has jumped to a brand new report round $850 million.

“The sturdy momentum out there continues,” Arcane wrote. “The sharp rise in open curiosity at CME is a transparent indication of elevated institutional demand for bitcoin.”

Chris Thomas, head of digital property for dealer Swissquote, informed CoinDesk’s Daniel Cawrey on Wednesday that bitcoin may break previous $12,000 by Friday.

The indicators actually look like pointing in that path.

Tweet of the day

Bitcoin watch

BTC: Value: $11,700 (BPI) | 24-Hr Excessive: $11,807 | 24-Hr Low: $11,380

Development: Bitcoin is wanting north after twin bullish cues have been activated by a 5% rally Wednesday.

Firstly, with the UTC shut at $11,755, bitcoin marked an upside break of a narrowing value vary witnessed Monday and Tuesday.

As well as, Wednesday’s UTC shut established a robust foothold above $11,400. The bulls had repeatedly didn’t hold features above that stage on Monday and Tuesday.

The mix of vary breakout and convincing transfer above a key hurdle has opened the doorways for a re-test of current highs above $12,100.

Nonetheless, the case for a rally to current highs would solely weaken if…