In the summer of 2016, Joe Lubin, one of the eight co-founders of Ethereum, was in midtown Manhattan to talk about how blockchain could transform a

In the summer of 2016, Joe Lubin, one of the eight co-founders of Ethereum, was in midtown Manhattan to talk about how blockchain could transform accounting practices. While surely a fascinating topic, most people in the room that day wanted to know Lubin’s opinion in the wake of the theft of $55 million in ether from The DAO, a decentralized autonomous organization.

This post is part of CoinDesk’s Culture Week.

He’d never been a fan of the project – which pooled startup capital to fund Ethereum projects chosen by the DAO members. Only a week or so before, in a still controversial move, Ethereum users voted to change the history of the blockchain to allow the ether stolen from The DAO to be returned.

When asked about it and any lingering effects the so-called hard fork would have on the network he helped create, Lubin said Ethereum was still too young and unsophisticated to handle something like a decentralized private equity fund.

“It was deemed by some of us to be possibly systematically destabilizing,” he told the audience at Microsoft’s office in Times Square. Then, in what could certainly be the most evergreen quote in all crypto, he said, “Naïve people in the cryptocurrency space buy these tokens because they think they’ll get rich.”

While that sentiment hasn’t changed, DAOs sure have.

For years after the DAO hack and hard fork the d-word wasn’t spoken. In 2017, the U.S. Securities and Exchange Commission released a report on the incident where it ruled DAO tokens had been sold as unregistered securities, but chose not to go after anyone. Since then a lot of work has been done on how the terribly named entities are structured and funded, and 2022 may be the year that they make a broad comeback while touching on industries far afield from crypto. Still, a lot of questions are left to be answered and the tools to manage DAOs are in their infancy.

“My starting assumption is DAOs are one of these inventions within crypto that are not going to be un-invented,” said Ryan Selkis, co-founder and chief executive officer of research and analytics firm Messari. “You’re now seeing an explosion of innovation around DAO design.” Messari recently released a suite of DAO governance tools called Governor to help the organizations keep track of voting, member participation and treasury maintenance.

At its essence, a DAO is an organizing principle. It can be applied to a lot of people or a few, but what’s constant is the hierarchy, which is meant to be flat, with every member given a vote in how the DAO’s mission – whatever it may be – is executed. While in many cases DAOs have to start with the vision of one person or a small group of people, the goal is to grow the membership until everyone is engaged in DAO management within an area they find engaging.

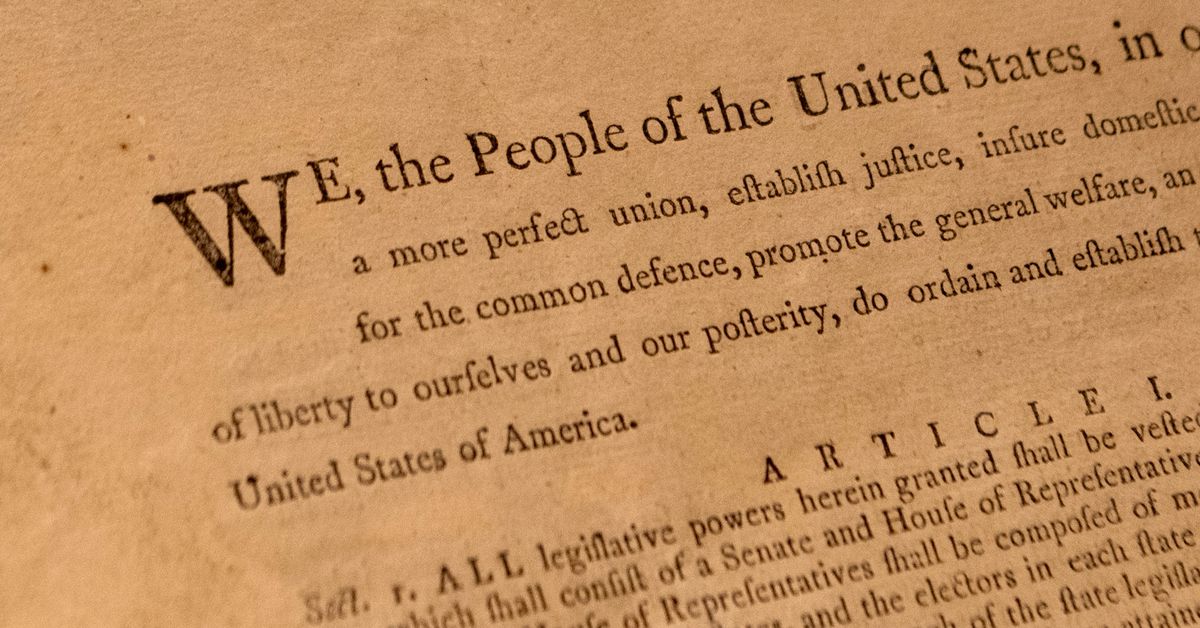

The projects employing that structure are now blooming far outside the crypto world. From a DAO intent on buying an National Basketball Association basketball team, to one that wants to restore ocean health to one dedicated to increasing the wealth of women, or a DAO that wanted to buy a copy of the U.S. Constitution, the range and breadth of how DAOs are being thought of is staggering. The list of DAOs to emerge in 2022 and beyond is far more exhaustive than those examples, yet the connection from the digital world to the real one is a unifying strength most of these projects share.

“Using DAOs to pool capital to make a real-world impact is a big category,” said Aaron Wright, who almost single-handedly brought DAOs back into fashion when he helped create the LAO in 2019 as a co-founder at OpenLaw, a digital contracting system. (The LAO, with some important changes, seeks to serve the same funding function for Ethereum startups that The DAO pioneered.)

Other categories Wright expects to be big in DAOLand include ones that produce creative content, social groups like Friends With Benefits, not-for-profit DAOs and services-oriented groups built on a guild model where software developers, for example, can join to find work opportunities.

“The notion that small groups of people can compete with Silicon Valley is true,” Wright said. “That’s one of the visions of the DAO, that the community can support itself.”

Due to their open and collaborative nature, DAOs may also help diversify crypto culture that mirrors much of the traditional models.

“The face of crypto right now is white and male,” said Alana Podrx, founder of Eve Wealth, a DAO formed to build women’s wealth. She noted 75% of crypto holders are men. “If we’re going to invent the future of the financial system, we need to make sure it looks different and is diverse.”

Get the whole of CoinDesk’s Culture Week.

The tools to pull together a potentially global effort like Eve Wealth in DAO form have been created in just the last six months, Podrx said. “Before this we would have had to develop our own token access tools and create smart contracts,” she said….

www.coindesk.com