Terraform Labs has raised $25 million in a brand new spherical from Galaxy Digital, Coinbase Ventures, Pantera Capital and others.The stablecoin fo

Terraform Labs has raised $25 million in a brand new spherical from Galaxy Digital, Coinbase Ventures, Pantera Capital and others.

The stablecoin for e-commerce creator has already confirmed folks will use its volatility free tokens in decentralized finance (DeFi), to purchase artificial shares, and plans to draw blockchain denizens to much more use instances.

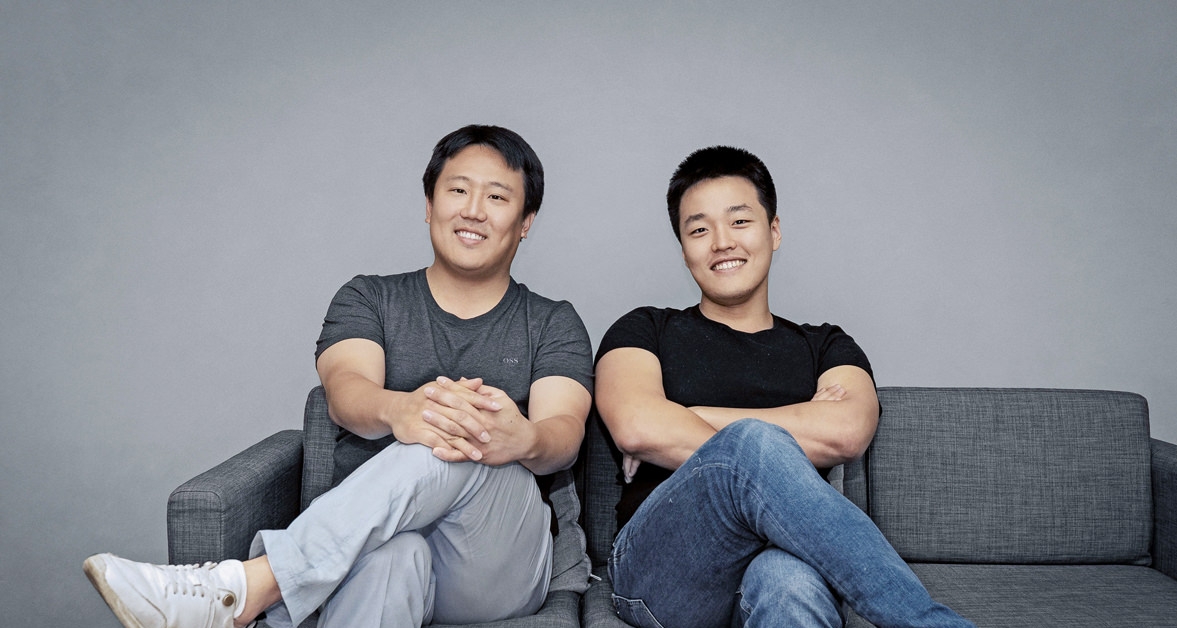

“We sit up for utilizing the funds for constructing key items of infrastructure within the Mirror Protocol for synthetics, Anchor Protocol for financial savings and different killer DeFi purposes to make Terra’s algorithmic stablecoins the centerpiece of the decentralized finance motion,” Terraform’s co-founder Do Kwon stated in a press launch.

Terraform Labs is behind a platform for minting completely different stablecoins for e-commerce that mimic the worth of varied fiat currencies. It’s additionally behind the Chai funds app, an e-commerce pockets that’s extensively utilized in Asia and powered by stablecoins.

“The Terra ecosystem has introduced the advantages of programmable cash to commerce and can do the identical for finance,” Pantera Capital’s Paul Veradittakit stated in a press launch.

Earlier traders Hashed, Arrington XRP and Kenetic Capital additionally participated in what Terraform Labs is asking a “progress fundraising spherical.”

“Terra has already made a profitable fee case for greater than 2 million customers within the Korean market, and can also be quickly rising within the DeFi house,” Simon Kim, CEO of Hashed, stated in a press launch.

Based in 2018, with a co-founder behind one in all Korea’s bigger e-commerce websites, Terra launched with $32 million in backing from Binance and Polychain, amongst others. Every Terra stablecoin (reminiscent of TerraUSD or the one monitoring the South Korean gained, TerraKRW), depends on the system’s LUNA token to keep up its peg.

LUNA is the governance token for the blockchain, because the white paper explains. It’s minted and burned with the intention to implement the peg for any Terra stablecoin, so the governance token absorbs the volatility to defend its stablecoins’ utility.

DeFi catalyst

Most entrepreneurs on Ethereum agree that DeFi Summer season by no means would have occurred had stablecoins not proved they may keep secure.

The Terra stablecoins are notable as a result of they function outdoors the Ethereum ecosystem, the platform most related to DeFi. Terra’s blockchain is Tendermint-based, making it a part of the bigger Cosmos ecosystem.

Terraform says that its blockchain generates $13 million in charges yearly. Its funds system, Chai, has 2 million customers and sees $1.2 billion in transaction quantity utilizing its TerraKRW stablecoin, which tracks the worth of the South Korean gained.

Final summer time, Terraform teased a DeFi financial savings platform known as Anchor, which generates a greater rate of interest for savers by backing proof-of-stake networks. Initially slated for October 2020, it’s presently projected to go stay within the first quarter of 2021.

“On Anchor the protocol work is completed however we’re doing integrations with a well-known companion so we are able to launch collectively. Nearly there,” Kwon advised CoinDesk in a followup e-mail.

Terraform additionally dropped a brand new artificial equities market final month known as Mirror. This permits anybody wherever to purchase tokens that comply with the worth of any fairness within the U.S. inventory market.

The brand new funding will likely be used to broaden these use instances, construct new DeFi tasks that use its tokens and lengthen its interoperability to extra blockchains, Terraform stated.

“We love the increasing use case of the bottom funds product and the unbelievable new demand for LUNA that merchandise like Mirror are creating,” Michael Arrington, founding father of Arrington XRP, advised CoinDesk in a textual content message.