Greater than $1 billion price of Bitcoin (BTC) has now been tokenized to entry decentralized finance (DeFi) protocols on the Ethereum (ETH) communi

Greater than $1 billion price of Bitcoin (BTC) has now been tokenized to entry decentralized finance (DeFi) protocols on the Ethereum (ETH) community. That’s equal to the complete complete worth locked (TVL) in DeFi lower than 4 months in the past.

In response to DeFi Pulse, roughly 98,300 BTC, price $1.05 billion, has been tokenized utilizing protocols aside from Blockstream’s Lightning Community — equating to greater than 12% of the DeFi’s sector’s $8.57 billion mixed capitalization.

The milestone illustrates the rising recognition of ETH-based protocols for producing passive returns amongst Bitcoin hodlers, with the complete DeFi sector having been valued at simply $1.05 billion TVL as of the beginning of June — of which $47.5 million or 4.7% was Bitcoin, indicating that the share of DeFi’s capitalization represented by BTC has elevated by 150% over three and a half months.

Against this, the Lightning Community has solely attracted 1,100 Bitcoin price $11.5 million since launching throughout March 2018.

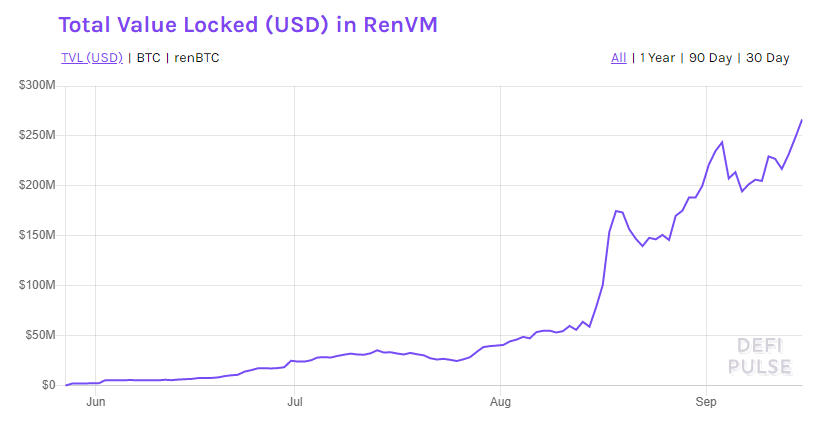

In June, the overwhelming majority of BTC within the DeFi sector took the type of Wrapped Bitcoin (WBTC), Nonetheless, the launch of Ren’s extra decentralized Digital Machine (VM) and RenBTC along with grassroots tokenization protocols like PieDAO’s BTC++ this 12 months have boosted Bitcoin’s enlargement into DeFi.

Bitcoin tokenization protocols let customers lock up their Bitcoin and mint an corresponding ERC-20 token — permitting the worth represented by a person’s Bitcoin holding to work together with good contracts on the Ethereum community.

Whereas WBTC continues to be the top-ranked tokenization protocol by complete BTC locked after attracting 56,800 Bitcoin price practically $605.5 million since late-November 2018, Ren’s VM has tokenized 21,500 Bitcoin price $230 million since launching in Might of this 12 months.

Whereas each protocols have greater than doubled within the variety of locked Bitcoin over 30 days, WBTC continues to draw a bigger quantity of BTC than Ren — with WBTC rising from roughly 28,360 BTC to 56,850 BTC, and RenBTC increasing from 10,000 BTC to 21,510 over one month.

Over the previous 90 days, each tasks have grown by greater than 850%. On June 19 WBTC represented solely 5,839 BTC and Ren had tokenized simply 155 BTC.

Curve Finance is the top-ranked yield producing protocol by tokenized BTC with 27,600 Bitcoins price 295 million, adopted by Aave with 17,800 BTC price $190.5 million, and Balancer with 9,500 BTC price 101.6 million. Collectively, the three protocols have attracted greater than half of all tokenized Bitcoin.

Nonetheless, with solely 0.47% of Bitcoin’s provide tokenized, there’s nonetheless vital worth that may seemingly migrate from Bitcoin into DeFi over the approaching months and years.