Top Stories of The Week SEC dismisses lawsuit against crypto

|

Top Stories of The Week

SEC dismisses lawsuit against crypto exchange Coinbase

The US Securities and Exchange Commission has dismissed its lawsuit with crypto exchange Coinbase on Feb. 27, filings show, ending the case permanently.

The SEC agreed to voluntarily dismiss all litigation tied to Coinbase and Coinbase Global with prejudice, which included withdrawing from its initial June 2023 lawsuit and its request for an interlocutory appeal with the US Court of Appeals, a Feb. 27 court filing shows.

It comes after the two parties announced an agreement to end the legal dispute on Feb. 21.

Bitcoin sheds nearly all Trump election gains in plummet under $80K

Bitcoin has fallen under $80,000 for the first time since November amid mounting macroeconomic uncertainty over US President Donald Trump’s proposed tariffs.

On Feb. 27, Bitcoin plummeted to $79,752, according to TradingView data. The 2.65% price decline over the past hour led to $100.01 million in long positions liquidated, per CoinGlass data.

Bitcoin last traded at this level on Nov. 11, just days after Trump was elected US president, amid optimism that his pro-crypto policies would lead a Bitcoin rally in 2025.

Over the past couple of days, most crypto traders eyed $82,000 as a potential bottom for Bitcoin, but many are now bracing for a move toward $70,000.

US judge tosses SEC fraud suit against Hex founder Richard Heart

A district court judge has dismissed the US securities regulator’s lawsuit accusing Hex founder Richard Heart of raising over $1 billion through unregistered crypto offerings and defrauding investors of $12.1 million.

Heart, whose real name is Richard Schueler, was also accused of spending those allegedly stolen funds on luxury items — including the world’s largest black diamond.

However, Judge Carol Bagley Amon said those alleged deceptive acts couldn’t be decided on as the US Securities and Exchange Commission failed to establish that the US had jurisdiction over Heart’s crypto activities — which she said were global in scope and not specifically targeted at US investors.

SEC again delays Ether ETF options on Cboe

The US Securities and Exchange Commission has once again extended its deadline for deciding whether or not to permit Cboe Exchange to list options tied to Ether exchange-traded funds (ETFs).

The agency has given itself until May to make a final decision to approve or disapprove of Ether ETF options trading on the US exchange, according to a Feb. 28 regulatory filing.

Cboe initially requested to list Ether ETF options in August 2024, but the SEC sought extra time to reach a decision in October.

The exchange is seeking to list options on the Fidelity Ethereum Fund. The fund is among the more popular Ether ETFs, with around $1.3 billion in net assets, according to data from VettaFi.

FBI asks node operators, exchanges to block transactions tied to Bybit hackers

The US Federal Bureau of Investigation has urged crypto node operators, exchanges and the private sector to block transactions from addresses used to launder funds from the $1.4 billion Bybit hack.

The FBI confirmed the results of an earlier industry investigation, stating that North Korea was responsible for the hack, which the US law enforcement agency dubbed “TraderTraitor” in a Feb. 26 public service announcement.

The FBI noted in an April 2022 statement that TraderTraitor is commonly referred to in the industry as the Lazarus Group, APT38, BlueNoroff and Stardust Chollima.

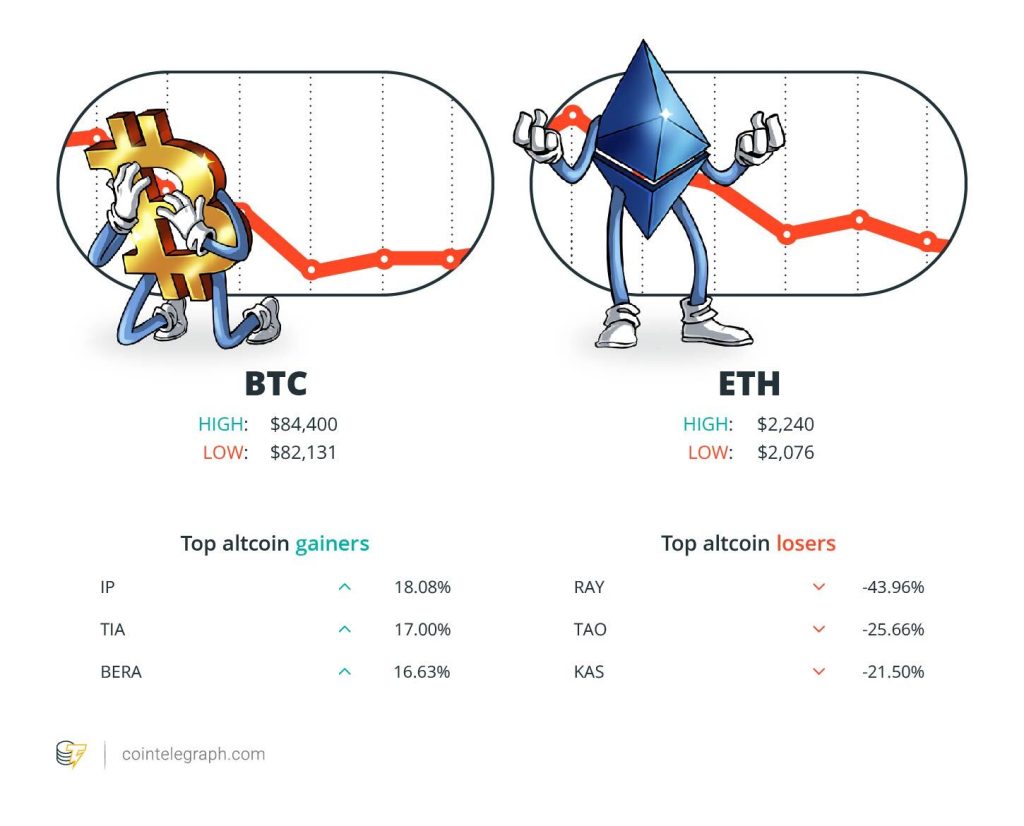

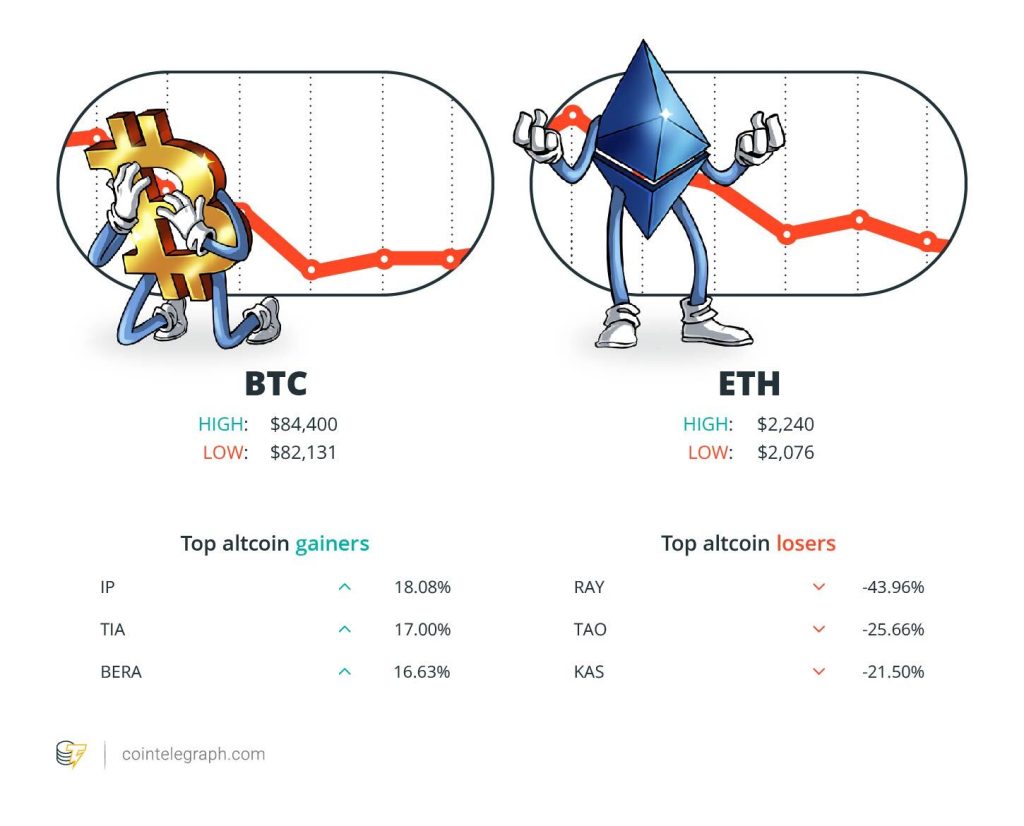

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $84,400 Ether (ETH) at $2,240 and XRP at $2.15. The total market cap is at $2.81 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Story (IP) at 18.08%, Celestia (TIA) at 17.00% and Berachain (BERA) at 16.63%.

The top three altcoin losers of the week are Raydium (RAY) at 43.96%, Bittensor (TAO) at 25.66% and Kaspa (KAS) at 21.50%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“It’s time for the Commission to rectify its approach and develop crypto policy in a more transparent manner.”

Mark Uyeda, acting chair of the US Securities and Exchange Commission

“If GameStop embarks on the LBE (Leveraged Bitcoin Equity) strategy… It will bake the noodles of so many TradFi investors and commentators who think both GME and Bitcoin are a joke.”

John Haar, managing director of Swan Bitcoin

“The magnitude of skullduggery that is happening in Washington D.C. is really incredible. […] And it’s not over yet.”

Caitlin Long, founder and CEO of Custodia Bank

“We have quite a lot of bearish ‘sentiment’ confluence. Which historically has been a good marker for a…

cointelegraph.com