Argentina finalizes rules for virtual asset providers Argenti

|

Argentina finalizes rules for virtual asset providers

Argentina’s securities regulator has finalized rules for virtual asset service providers (VASPs), which cover general codes of conduct and custody requirements for cryptocurrency exchanges and other platforms facilitating digital asset transactions.

The regulations were published on March 13 by the National Securities Commission, also known as the CNV, under General Resolution No. 1058.

According to a translated version of the announcement, the regulations impose “obligations regarding registration, cybersecurity, asset custody, money laundering prevention, and risk disclosure” on VASPs operating in the country.

The stated goal of the rules is to guarantee “transparency, stability, and user protection in the crypto ecosystem,” the announcement said.

Argentine tax lawyer Diego Fraga said the final guidelines include mandatory separation of company and client funds, annual audits and monthly reporting with the CNV.

US Rep. Byron Donalds to introduce bill codifying Trump’s Bitcoin reserve

A new bill set to be introduced in Congress aims to formalize President Donald Trump’s executive order establishing a US Strategic Bitcoin Reserve, a move that could further integrate Bitcoin into the nation’s financial strategy.

Trump signed an executive order on March 7 to use Bitcoin seized in government criminal cases to establish a national reserve.

The legislation, introduced by US Representative Byron Donalds, seeks to ensure the Bitcoin reserve becomes a permanent fixture, preventing future administrations from dismantling it through executive action.

“For years, the Democrats waged war on crypto,” Donalds, a Florida Republican, said in a statement to Bloomberg. “Now is the time for Congressional Republicans to decisively end this war.”

FTX liquidated $1.5B in 3AC assets 2 weeks before hedge fund’s collapse

Newly revealed court documents show that FTX secretly liquidated $1.53 billion in Three Arrows Capital (3AC) assets just two weeks before the hedge fund collapsed in 2022. The disclosure challenged previous narratives that 3AC’s downfall was solely market-driven.

Once valued at over $10 billion, 3AC collapsed in mid-2022 after a series of leveraged directional trades turned sour. The hedge fund had borrowed from over 20 large institutions before the May 2022 crypto crash, which saw Bitcoin fall to $16,000.

However, recently discovered evidence shows that the FTX exchange liquidated $1.53 billion worth of 3AC’s assets just two weeks ahead of the hedge fund’s collapse.

3AC “asked a bankruptcy court to let it increase its claim against FTX from $120 million to $1.53 billion,” according to Mbottjer, the pseudonymous co-founder of FTX Creditor, a group FTX creditors and bankruptcy claim buyers.

SEC delays decision on XRP, Solana, Litecoin, Dogecoin ETFs

The US Securities and Exchange Commission has delayed its decision to approve several XRP, Solana, Litecoin and Dogecoin exchange-traded funds.

In a slew of filings on March 11, the agency said it has “designated a longer period”to decide on the proposed rule changes that would allow the ETFs to proceed.

Among the affected ETFs are Grayscale’s XRP and Cboe BZX Exchange’s spot Solana ETF filings, with the decisions on them pushed until May.

Russia using Bitcoin, USDt for oil trades with China and India: Report

Russian companies have been using cryptocurrencies like Bitcoin and USDt to facilitate trade with China and India amid international sanctions, according to a Reuters report.

Russian oil companies have used crypto assets including Bitcoin and Tether’s USDt for international trade, Reuters reported on March 14, citing four sources with direct knowledge of the matter.

One Russian oil trader reportedly conducts tens of millions of dollars worth of monthly transactions using digital assets, according to a source who spoke on condition of anonymity due to a non-disclosure agreement.

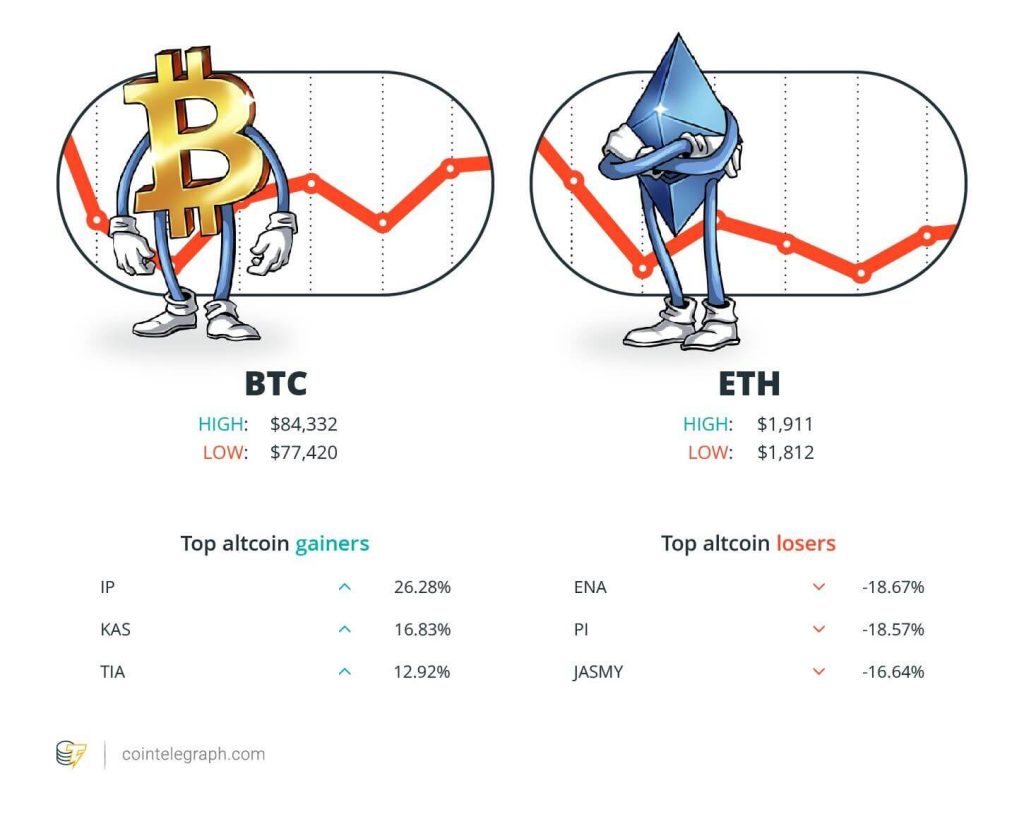

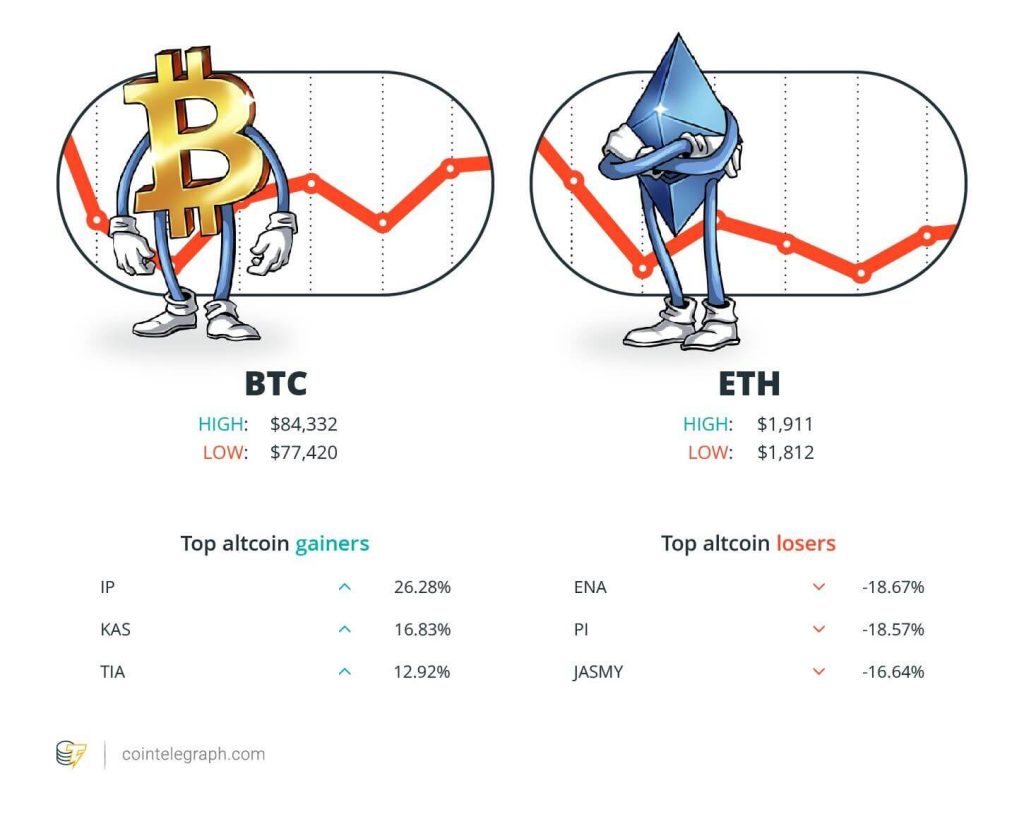

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $84,322, Ether (ETH) at $1,911 and XRP at $2.39. The total market cap is at $2.74 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Story (IP) at 26.28%, Kaspa (KAS) at 16.83% and Celestia (TIA) at 12.92%.

The top three altcoin losers of the week are Ethena (ENA) at 18.67%, Pi (PI) at 18.57% and JasmyCoin (JASMY) at 16.64%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Most Memorable Quotations

“As a long time Solana builder, the reason I stepped down is because I am far too trusting for how parasitic the memecoin space is.”

Ben Chow, co-founder of Meteora

“No felon would mind a pardon, especially being the only one…

cointelegraph.com