Jill Carlson, a CoinDesk columnist, is co-founder of the Open Cash Initiative, a non-profit analysis group working to ensure the best to a free and

Jill Carlson, a CoinDesk columnist, is co-founder of the Open Cash Initiative, a non-profit analysis group working to ensure the best to a free and open monetary system. She can be an investor in early-stage startups with Gradual Ventures.

We Individuals like to complain in regards to the economic system, about policymakers, about bailouts, in regards to the Fed. However each time I journey overseas, I’m struck by the immense privilege of getting the US greenback as my native foreign money. I’ve but to discover a cabbie, a lodge clerk, or certainly a banker in any a part of the world who won’t gladly settle for the buck as a type of cost. In international locations from Argentina to Zambia, I’ve discovered demand for {dollars} money when I’ve come up quick on the native foreign money.

The demand for {dollars} was by no means extra evident to me than in the middle of the analysis on Venezuela that I performed with my colleagues on the Open Cash Initiative. We went into the analysis hoping to find out how instruments and applied sciences like bitcoin have been being utilized by Venezuelans going through the collapse of their very own currencies. What we discovered time and again was, as an alternative, rampant demand for just one weapon within the face of hyperinflation: the U.S. greenback.

See additionally: Jill Carlson – Don’t Apply 2008 Pondering to At this time’s Disaster

We spoke to younger entrepreneurs who leverage convoluted networks of buddies and family to achieve somebody with a US checking account via whom they’ll maintain a few of their wealth in bucks. We spoke with a few of these account holders, de facto casual bankers for total communities, who’ve to take care of paper information detailing that their nephew’s girlfriend has $200 held of their account and that their ex-wife has $50 with them. We spoke with cash changers in Venezuela who work tirelessly to satisfy demand for US {dollars}, even smuggling hordes of money throughout the border.

This demand for U.S. {dollars} is just not solely current in excessive circumstances, as in Venezuela, nor solely on the degree of the person. It’s most notable on the nation state degree. Since World Warfare II, the U.S. has loved the position of supplying the world’s reserve foreign money. This meant one thing totally different in 1944 than it does as we speak, however the result’s what issues right here: the U.S. greenback is the usual unit of account for currencies and commodities globally. When central banks world wide search to handle the power of their native currencies, they achieve this relative to the greenback, shopping for or promoting USD. When India imports oil from Iraq, that oil is priced in U.S. {dollars}. {Dollars} are in every single place.

Thanks to those dynamics, many international locations and worldwide establishments additionally borrow in {dollars}. When Brazil or Indonesia or Ukraine borrows cash from buyers and collectors, they typically achieve this in {dollars} versus reais or rupiahs or hryvnias. This typically permits international locations to borrow at a decrease rate of interest than they might in any other case be capable to entry.

The pictures of deflation are fewer and fewer more likely to strike concern into our hearts, however they need to.

This additionally means, nevertheless, that these international locations have a structural and ongoing demand for {dollars} as that’s the foreign money they must use to repay the curiosity and the principal on this debt. Nations and international companies issuing dollar-denominated debt are uncovered to foreign money threat: if the U.S. greenback appreciates materially relative to their native currencies (which represents the vast majority of the money inflows), then these debtors can discover themselves in hassle. For that reason, most international locations keep greenback reserves. However these should not all the time adequate to cowl all of their dollar-denominated obligations, spurring additional greenback demand.

Final month, as the worldwide implications of the COVID-19 pandemic turned more and more clear, the worth of the greenback spiked. Hedge funds, retail buyers, worldwide debtors, and everybody in between made a touch for money. Because the world hurried to liquidate shares and promote credit score, it sought to liquidate these property for one factor: US {dollars}. In buying and selling, a sale is rarely only a sale. It is usually the acquisition of one thing else. On this case, everybody was promoting all the pieces for {dollars}. In a world that already has excessive demand for {dollars}, on account of each psychological and structural forces, the implications of sturdy greenback appreciation are monumental.

See additionally: Cash Reimagined: Demand for USD Stablecoins Foreshadows Monetary Disruption

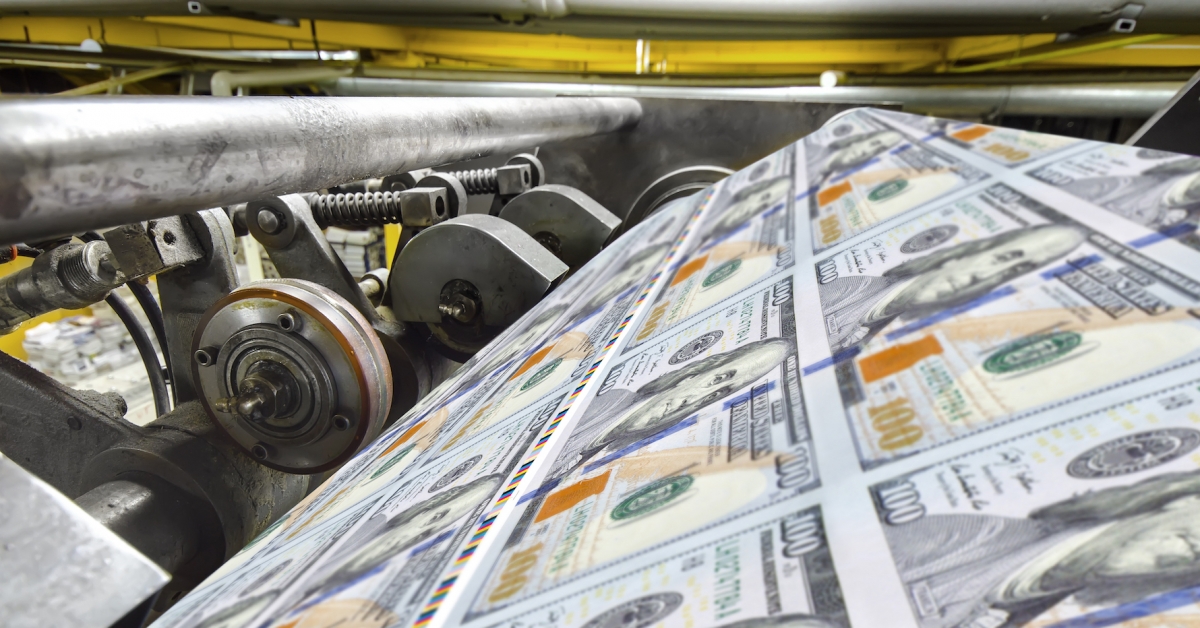

The Federal Reserve, which is tasked with managing the provision of {dollars} on this planet, did the one factor it might do within the face of this: activate the faucets. Over the course of only a few weeks, the U.S. central financial institution minimize its goal rate of interest to zero, pledged limitless asset purchases, and carried out a slew of different measures that have been completely unprecedented, even relative to the measures it took within the wake of the 2008 disaster. These actions have been memorialized, and criticized, within the type of the favored meme: cash printer go brrr.

The thought behind the criticism is that the U.S….