J.P. Koning, a CoinDesk columnist, labored as an fairness researcher at a Canadian brokerage agency and was a monetary author at a big Canadian fin

J.P. Koning, a CoinDesk columnist, labored as an fairness researcher at a Canadian brokerage agency and was a monetary author at a big Canadian financial institution. He runs the favored Moneyness weblog.

Cryptocurrency remains to be a brand new endeavor. Individuals who use it aren’t too shocked when issues go incorrect. Ethereum Basic has suffered from three 51% assaults in a single month. It prices $6 simply to make a transaction on the Ethereum blockchain.

However all of those malfunctions pale compared to the breadth of the system error that has hit one of many oldest financial tasks within the U.S., the nation’s coin system. As we converse, the U.S. is experiencing a country-wide scarcity of cents, nickels, dimes and quarters.

Since mid-June, anybody handing over a $5 or $10 invoice to purchase $4.92 or $9.79 price of products has not been receiving the 8¢ or 21¢ in change that is because of them. Retail employees behind the until simply don’t have sufficient cash to offer out.

See additionally: JP Koning – What Bitcoin Can Be taught From Gold About Staying ‘Clear’

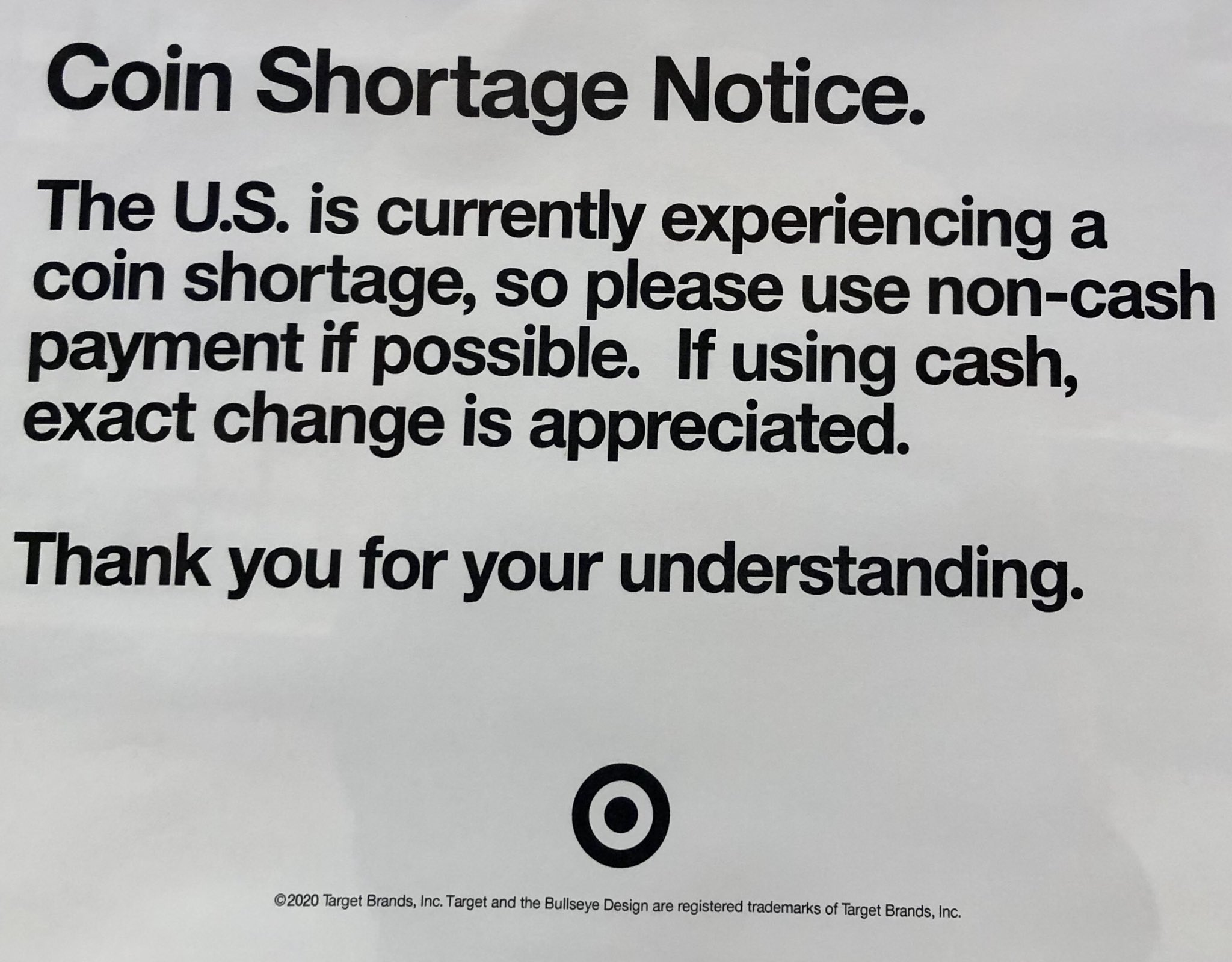

Indicators have sprung up in shops all throughout the U.S. asking customers to both pay with the correct quantity of change or use a card. Grocery big Kroger requests its prospects to contemplate rounding up their invoice and paying the proceeds to Zero Starvation Zero Waste, its non-profit charity, or to place the steadiness due on a present card. The grocery chain blames the Federal Reserve, which is “presently experiencing a coin scarcity.” Comparable indicators have sprung up at McDonald’s, Dairy Queen, Lowes, Walmart and extra.

Companies which can be depending on cash are particularly hard-pressed. Residents of condo buildings with coin-operated laundry machines, determined for change, have been raiding native laundromats for quarters. Laundromat homeowners are begging non-customers to remain away, some going as far as to put in safety cameras and rent attendants 24/7.

CoinDesk readers may be excused for failing to note the coin scarcity. Money utilization has been steadily falling over the past decade. In line with the Federal Reserve’s 2019 Diary of Shopper Fee Alternative, about one in six Individuals don’t maintain any money in any respect.

However hundreds of thousands of Individuals nonetheless use banknotes and cash to make each day funds. The Federal Reserve’s examine on fee selection finds that 26% of all funds are nonetheless made with the stuff. Below-25s and the aged are usually probably the most intensive money customers. In line with one other Federal Reserve report, the 2019 Survey of Shopper Fee Alternative, low-income Individuals are probably the most cash-dependent demographic.

There can by no means be shortages of digital variations of the greenback as a result of tokens movement quickly over the web, not slowly by way of hand.

It appears odd that a sophisticated nation such because the U.S. might be experiencing a scarcity of change. Coin shortages had been widespread within the medieval ages, particularly shortages of low denomination copper cash, which weren’t worthwhile for mints to provide. “Moneyers most popular to strike excessive denominations to low ones… and had been apt to go away the general public desperately wanting small change,” wrote historian Peter Spufford.

But it surely’s 2020, not 1620. We’re purported to have this down pat.

I’d argue that the U.S. coin scarcity will not be really a scarcity. The U.S. has all of the cash it wants. The issue is that the cash are positioned within the incorrect place.

In line with the Federal Reserve, the U.S.’s central financial institution, there are round $47.Eight billion price of cash in circulation. (About the identical market capitalization of Ethereum.) That’s $140 in cash per American. The U.S. Mint solely produces round $750 million price of cash annually, which is a tiny movement in comparison with the billions of {dollars} in cash already on the market.

There’s a life cycle to a coin. A retailer like Kroger orders 5 cent cash from its financial institution. It pays out a nickel as change to Jack. Jack retains the nickel in a change jar for per week or a month, finally bringing his stash to deposit in his checking account. Or he could drop it into an area Coinstar machine, Coinstar transport his 5 cent piece to its financial institution. At which level Kroger can ask its financial institution for extra change and get the nickel again.

In line with the Georgia Bankers Affiliation, about 82% of the banking system’s coin provide in any given month comes from recirculating coinage – people like Jack. Solely 18% of coin provide is freshly-made by the U.S. Mint.

The arrival of COVID-19 and ensuing shutdowns has brought about a larger-than-normal share of the nation’s cash to be frozen up in individuals’s houses, vehicles, and pockets somewhat than making its manner again into the distribution system. Why? I believe this dislocation may be blamed on the mixture of worry about catching the virus and the final slowness of counting out cash.

There may be an asymmetry within the money person expertise. It’s nearly all the time quicker to pay with paper cash and get change than to rely out and pay with the correct quantity of notes and cash. We’ve all skilled this as we wait within the verify…