The Takeaway:

Bitcoin almost triples its value in 2020 and ends the 12 months near $29,000 however ether gained 450%.

- Bitcoin (BTC) buying and selling round $28,963 as of 21:00 UTC (Four p.m. ET), gaining 1.5% over the earlier 24 hours.

- Bitcoin’s 24-hour vary: $27,916.63 – $29,280.05 (CoinDesk 20)

Bitcoin printed a brand new report excessive above $29,000 early Thursday earlier than charting a fast pullback to $27,900 throughout U.S. buying and selling hours, in accordance with information compiled by the CoinDesk 20.

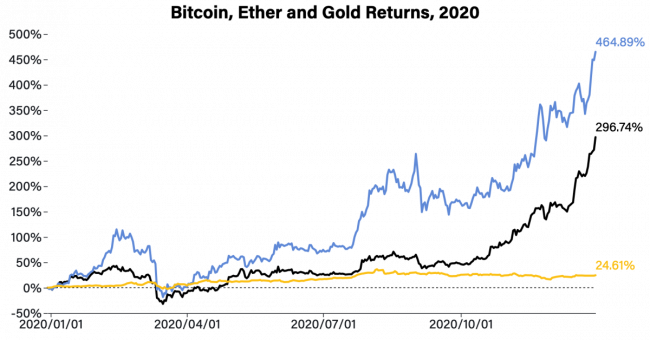

Regardless of the minor drop, the primary cryptocurrency by market worth is eyeing its third consecutive month-to-month achieve, a feat final achieved within the second quarter of 2019. The cryptocurrency has rallied by over 45% this month alone and is on monitor to finish 2020 with at the least a 290% achieve.

The worth rally places bitcoin far forward of conventional belongings resembling gold and shares. The yellow metallic has gained 25% this 12 months, and the S&P 500, Wall Road’s benchmark index, has added 15%.

The 12 months 2020 will go down in historical past because the interval of bitcoin maturing as a macro asset, with distinguished publicly-listed corporations resembling MicroStrategy diversifying their money reserves into the cryptocurrency.

Most observers anticipate a continued rally in 2021. “The longer-term financial impacts of COVID are unknown. Nevertheless, as we’re nonetheless within the midst of main financial disruptions and historic volatility, I imagine bitcoin/crypto will proceed to rise and be on the pinnacle of constructive change,” Changpeng “CZ” Zhao, CEO of cryptocurrency change Binance, mentioned in a New 12 months’s message.

Analysts on the funding banking large JPMorgan foresee bitcoin’s rising mainstream adoption hurting gold’s value.

Nevertheless, a correction could possibly be seen within the quick run if the spot influx from institutional buyers slows down, in accordance with Ki Younger Ju, CEO of cryptocurrency information supplier CryptoQuant.

“We haven’t had important Coinbase outflows since $23,000,” Ju informed CoinDesk. “Tokens transferred are reducing and the fund circulate ratio for all exchanges is rising. Grayscale BTC holdings are 607,000 since Dec. 25,”

From a technical evaluation standpoint, $27,300 is vital help which, if breached, would open the doorways to $25,300, in accordance with crypto change EQUOS’ every day bitcoin evaluation e-mail.

Ether outperforms bitcoin

- Ether (ETH) buying and selling round $742.19 as of 21:00 UTC (Four p.m. ET), down 0.8% over the earlier 24 hours.

- Ether’s 24-hour vary: $723.18 – $755.56 (CoinDesk 20)

Ether, the second-largest cryptocurrency by market worth, has gained over 450% this 12 months versus bitcoin’s 300% rally. The cryptocurrency rose to a 31-month excessive of $757 on Wednesday and was final seen buying and selling at $730.

Ether obtained a lift from the decentralized finance’s explosive progress in 2020, and stronger beneficial properties could possibly be within the offing subsequent 12 months.

Based on Ryan Watkins, an analyst at crypto information supplier Messari, the CME’s current announcement to launch ether futures in February is an indication of rising institutional curiosity within the cryptocurrency.

Bitcoin charted a powerful rally within the run as much as futures itemizing on CME three years in the past. The change introduced bitcoin futures on Oct. 31, 2017, when the cryptocurrency was buying and selling close to $6,300, and traded the primary contract on Dec. 27. By then, costs had neared $20,000.

Different markets

Digital belongings on the CoinDesk 20 are principally down Monday.

Notable winners on the day as of 19:00 UTC (2:00 p.m. ET):

- cosmos (ATOM): +11.5%

- chainlink (LINK): +1.7%

- OMG community (OMG): +1.6%

- orchid (OXT): -5.0%

- stellar (XLM): -4.5%

- bitcoin money (BCH): -4.0%

- Japan: Nikkei 225: 27,444.17 (-123.98 or -0.45%)

- UK: FTSE 100: 6,460.52 (-95.30 or -1.45%)

- U.S.: S&P 500: 3,756.07 (+24.03 or +0.64%)

- Oil was down 0.22%. Worth per barrel of West Texas Intermediate crude: $48.18.

- Gold was within the inexperienced 0.3% and at $1,900 as of press time.

- The 10-year U.S. Treasury bond yield fell Thursday to 0.917%.