Larger spot volumes Wednesday – and file volumes for the previous month – are serving to push bitcoin greater. In the meantime, ether choices for D

Larger spot volumes Wednesday – and file volumes for the previous month – are serving to push bitcoin greater. In the meantime, ether choices for December go 550,00Zero ETH.

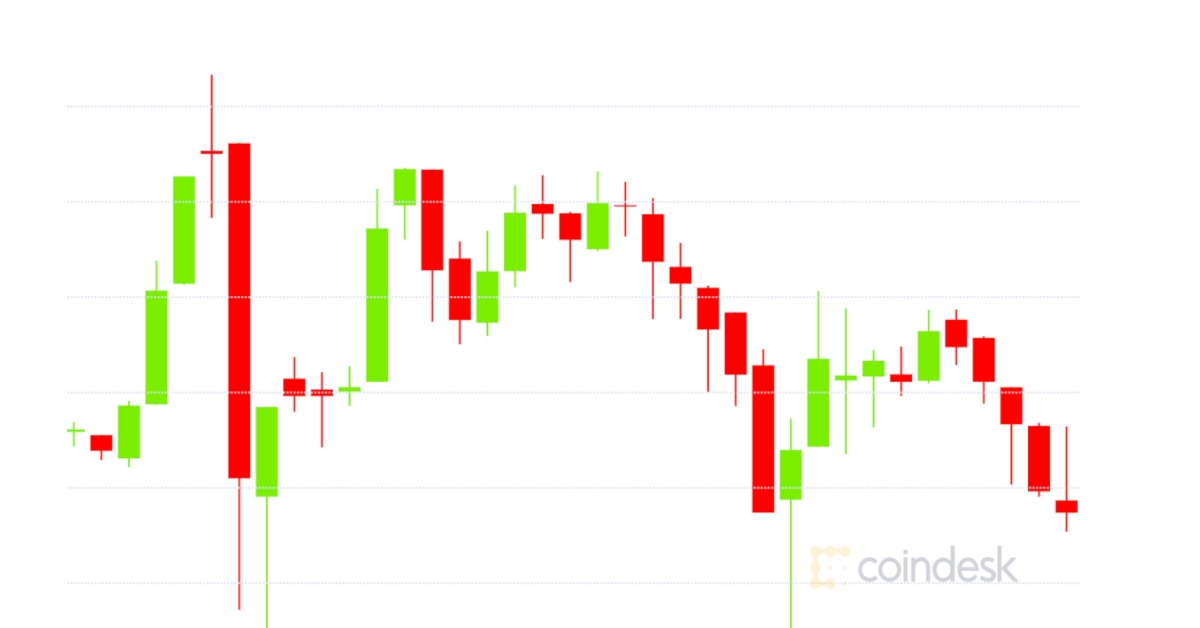

- Bitcoin (BTC) buying and selling round $17,688 as of 21:00 UTC (Four p.m. ET). Gaining 0.17% over the earlier 24 hours.

- Bitcoin’s 24-hour vary: $17,571-$18,474 (CoinDesk 20)

- BTC under its 10-day transferring common however above the 50-day, a sideways sign for market technicians.

Bitcoin made features for the third straight day this week, going as excessive as $18,474 in accordance with CoinDesk 20 knowledge. The worth slipped, nevertheless, to $17,688 as of press time.

Learn Extra: Bitcoin Indicator Suggests Bull Market Is Nonetheless in Early Part

The final time bitcoin was on this vary occurred method again in December 2017. “Generally, the market sentiment remains to be very bullish,” stated Andrew Tu, an govt at quant agency Environment friendly Frontier. “It’s doable that we vary between $17,500 and $18,300 for a bit. Nevertheless, it appears possible within the coming days that we break the $18,300 resistance.”

Constantin Kogan, a companion at Wave Monetary, factors to a $18,690-$18,950 “resistance” space the place alternate books have quite a lot of promote orders piled up, although he expects bitcoin to push above that quickly. “I’m bullish, personally,” he informed CoinDesk.

Volumes have been a lot greater than regular Wednesday, with main spot USD/BTC over $1.6 billion as of press time, surpassing this previous month’s Nov. 5 excessive.

“We’ve had a powerful run up from $13,200, which was solely a few weeks in the past, and I believe it’s now gunning for the all time excessive,” famous Rupert Douglas, head of institutional gross sales for crypto brokerage Koine. Nevertheless, Douglas’ outlook mirrors Sir Isaac Newton’s well-known dictum that what goes up should come again down. “At some stage we’re going to see a flush all the way down to $13,000. The pattern is up nevertheless it received’t be with out volatility,” stated Douglas.

The bitcoin derivatives market, which was nascent within the final main bull run, continues to see open curiosity rise. Bitcoin choices on main venues, for instance, are at over $Four billion as of press time, the very best they’ve ever been and an indication some sensible cash is seeking to hedge away any dangers volatility might – or might not – convey.

“At present’s lively choices market – which was nonexistent again in 2017 – is protecting any meteoric rises in test,” stated Micah Erstling, a dealer at agency GSR.

However, Erstling sees more cash piling in due to crypto’s eye-popping efficiency thus far in 2020. “Seasoned traders are discovering it more and more onerous to argue with bitcoin’s efficiency – over 133% year-to-date, and up 100% over the past yr.”

Ether choices merchants guess on 2.0

The second-largest cryptocurrency by market capitalization, ether (ETH), was down Wednesday, buying and selling round $472 and slipping 2% in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Learn Extra: Ethereum Basic Will get DeFi Therapy With Wrapped ETC

The quantity of open ether choices for December expiration has surpassed 550,00Zero ETH, price greater than $260 million as of press time.

Merchants are possible taking bets about the way forward for Ethereum’s technical roadmap to “2.0”, an formidable effort to insert staking and better effectivity whereas porting over its native asset, ether.

“Our concept is that this open curiosity sample in ETH was strictly on account of merchants positioning themselves for an ETH 2.Zero part Zero launch, or yet one more delay,” stated Greg Magadini, chief govt officer of choices knowledge aggregator Genesis Volatility. “Even whereas BTC choices had open concentrated in numerous expiration months, ETH persistently had open curiosity concentrated in December.”

Different markets

Digital property on the CoinDesk 20 are combined Wednesday, principally purple. Notable winners as of 21:00 UTC (4:00 p.m. ET):

Learn Extra: Zcash Undergoes First Halving as Main Improve Drops ‘Founders Reward’

- Oil was up 0.69%. Value per barrel of West Texas Intermediate crude: $41.64.

- Gold was within the purple 0.51% and at $1,869 as of press time.

- The 10-year U.S. Treasury bond yield climbed Wednesday leaping to 0.870 and within the inexperienced 1.5%.