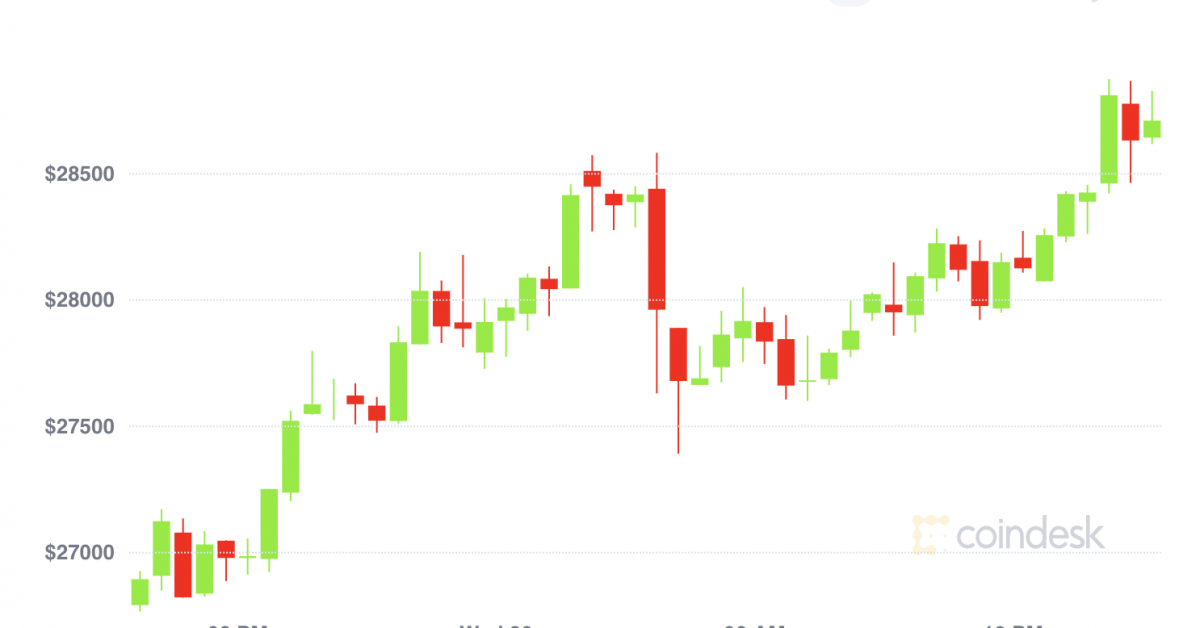

Bitcoin (BTC) buying and selling round $28,775 as of 21:00 UTC (Four p.m. ET). Gaining 7.3% over the earlier 24 hours.Bitcoin’s 24-hour vary: $26,7

- Bitcoin (BTC) buying and selling round $28,775 as of 21:00 UTC (Four p.m. ET). Gaining 7.3% over the earlier 24 hours.

- Bitcoin’s 24-hour vary: $26,796.90 to $28,969.90 (CoinDesk 20)

- BTC above its 10-hour and 50-hour transferring averages, a bullish sign for market technicians.

One other day, one other all-time excessive in bitcoin because the cryptocurrency modified fingers as excessive as $28,969.90, in accordance with information compiled by the CoinDesk 20.

Bitcoin’s worth started its upswing at round 17:00 UTC (12:00 p.m. ET) Tuesday and barely let up, taking off from $26,400 to the brink of $29,00Zero in simply 26 hours.

Based on analyst Alex Krüger, motion within the bond market spurred beneficial properties in cryptocurrencies. “Charges got here off within the 48 hours resulting in yesterday’s [Tuesday’s] pump,” he advised CoinDesk. On Monday, the U.S. 10-year bond yielded 0.950%. By Wednesday afternoon, it was 0.926%.

Calling Wednesday’s motion a “robust market,” Chris Thomas, head of digital asset at Swissquote, mentioned bitcoin’s worth was “being pushed greater by retail flows. Now we have seen a couple of [institutional investors] however not too many,” including that “most are on vacation till subsequent Monday.”

And whereas Thomas mentioned he had anticipated the market to commerce sideway this week, “the truth that it has moved greater to me suggests we might even see a short-term pullback,” he mentioned.

Learn extra: Bitcoin Costs in 2020: Right here’s What Occurred

“Bitcoin is extending its parabolic uptrend after gapping up firstly of the vacation week,” mentioned technical analyst Katie Stockton, managing companion at Fairlead Methods. “The rally has no new indicators of exhaustion from an overbought/oversold perspective, and there’s no resistance left to carry again bitcoin.”

Just like Swissquote’s Thomas, Stockton warns a pullback is feasible and, ought to it occur, “the hole from Monday is more likely to be stuffed in an abrupt reversal.”

In the meantime, a string of dangerous information hit XRP as extra exchanges introduced halts in buying and selling the cryptocurrency U.S. regulators declare is a safety. Genesis, owned by CoinDesk dad or mum firm DCG, introduced it was suspending buying and selling and lending in XRP. Cryptocurrency change Binance can be suspending XRP buying and selling for its clients, efficient Jan. 13. The token was down 3.5% within the 24 hours main as much as publication time.

Dealer eyes $5,00Zero ETH by September

Ether, the second-largest cryptocurrency by market capitalization, was up sharply Friday and buying and selling round $750. That marks a 3.5% acquire in 24 hours as of 21:00 UTC (4:00 p.m. ET).

Regardless of hitting a multi-year excessive, buying and selling on ether was lighter than common Wednesday. Simply $618 million price of ether was traded on the eight exchanges tracked within the CoinDesk 20 in comparison with the earlier seven-day common of $726 million.

But, not less than one dealer has sights set on an astounding rally within the months forward. On Deribit, the biggest crypto choices change, somebody purchased 153 contracts of September 2021 calls with a strike of $5,00Zero for a premium of round $25 every. Which means the dealer guess roughly $3,825 that ether will rally sevenfold over the course of the subsequent 9 months. Calls give the proprietor the fitting, however not obligation, to purchase the underlying asset (on this case, ether) at a set worth on a set date.

Costs needn’t come near $5,00Zero for the dealer to make a revenue; a mere spike in volatility or perhaps a comparatively modest rally may improve the now-low chance of the choices being within the cash, albeit by a really small share. Nonetheless, that may very well be simply sufficient for the guess to repay. As of now, although, it has the identical threat profile of a lottery scratch-off sport.

Different markets

Digital belongings on the CoinDesk 20 had been blended Monday.

Notable winners as of 21:00 UTC (4:00 p.m. ET):

- orchid (OXT) +2%

- bitcoin money (BCH) +2%

- litecoin (LTC) +2%

- chainlink (LINK) -2.2%

- eos (EOS) – 3%

- stellar (XLM) – 3%

- Japan: Nikkei 225: 27,444.17 (-123.98 or -0.45%)

- U.Okay.: FTSE 100: 6,555.82 (-46.83 or -0.71%)

- U.S.: S&P 500: 3,732.04 (+5.00 or +0.13%)

- Oil was up 0.6%. Worth per barrel of West Texas Intermediate crude: $48.29

- Gold was within the inexperienced, up 0.7% and at $1,896.40 as of press time.

- The 10-year U.S. Treasury bond yield fell Monday to 0.926%.