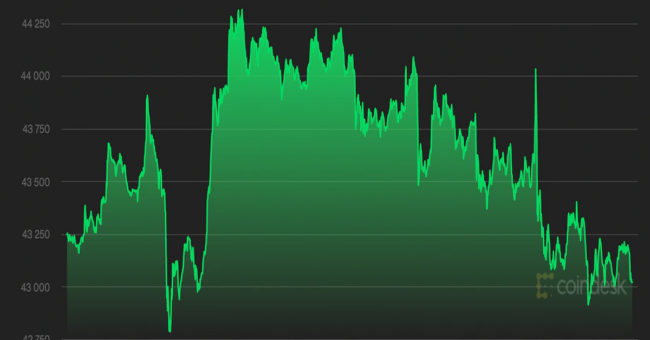

Bitcoin was slightly lower on Monday as traders remained cautious about regulatory crackdowns from China and elsewhere.

The cryptocurrency was trading at about $43,000 at press time and is roughly flat over the past 24 hours. Analysts are monitoring blockchain data for signs of buyer accumulation, although it may be too early to tell if sellers have fully capitulated.

For now, it appears that some buyers have shifted their focus away from bitcoin and moved into decentralized finance (DeFi) tokens in the wake of China’s crackdown on cryptocurrency activities. For example, Messari data shows the PERP token initially spiked about 55% toward $17 on Monday, although the price settled at about $15 at press time. PERP is the utility token facilitating and incentivizing the decentralized governance of the Perpetual Protocol.

Analysts expect China’s crypto industry to phase out given the recent ban.

“I think OTC platforms that are operated from the big exchanges will close down,” said Bobby Lee, founder and CEO of the Ballet wallet service and former head of BTCC, once one of the biggest bitcoin exchanges in China in an interview with CoinDesk. “OTC” refers to over-the-counter trading, or off-exchange.

And on Monday, Ethereum mining pool SparkPool said it plans to suspend services for all its users by Sept. 30.

Latest Prices

- Bitcoin (BTC), $43,075, -0.4%

- Ether (ETH), $2,999, -1.8%

- S&P 500: -0.3%

- Gold: $1,751, +0.0%

- 10-year Treasury yield closed at 1.487%

Bitcoin fund inflows

Investors pumped $95 million into digital asset products last week, more than double the prior week’s pace, according to a CoinShares weekly report.

With the headwinds that digital assets have faced recently, such as China’s ban, the inflows suggest that price declines may have been seen as buying opportunities, CoinDesk’s Lyllah Ledesma reported.

Flows into all crypto funds during the week ended Sept. 24 were the most since the $98 million in the week through Sept. 3, and brought total inflows over the last six weeks to $320 million.

Bitcoin saw the largest inflows of any crypto investment product with a total of $50 million, also the most in three weeks.

Test of buyer conviction

Analysts are questioning whether bitcoin holders can sustain enough buying power to support further price increases into the fourth quarter. Prices are now back near the cost basis for most short-term holders, similar to September 2020, which preceded a price rally.

This time, however, “the 50%+ correction in May resulted in a flushing out of many retail traders and investors, and thus interest in the [Bitcoin] protocol has waned since early 2021,” Glassnode wrote in a blog post.

About 58% of short-term holders are already experiencing losses (current BTC price below the acquired price), according to Glassnode data. The holders who entered over the past two months could decide to sell their BTC at a loss, which could drive prices lower, or accumulate more BTC in hopes of turning a profit.

The chart below shows the market-value-to-realized-value (MVRV) ratio, which measures BTC’s market capitalization relative to its realized market value. The current MVRV suggests that BTC is trading at roughly its fair value after the May sell-off.

Altcoin roundup

- DeFi tokens PERP, DYDX lead crypto market higher: Native tokens of decentralized trading platforms such as Perpetual Protocol and dYdx are surging as China’s crypto crackdown saw centralized exchanges scramble to comply with new regulations. Perpetual Protocol’s PERP token surged 55% in the past 24 hours, reaching $17 a token, CoinDesk’s Omar Godble reported. Derivatives DEX dYdx registered a trading volume of more than $4.3 billion in the past 24 hours, surpassing the Nasdaq-listed centralized crypto exchange Coinbase’s $3.7 billion.

- Immutable X token sales raise over $12.5 million in under an hour: Ethereum scaling product Immutable X’s token sale on CoinList sold out in less than one hour and raised $12.5 million for the project, CoinDesk’s Jamie Crawley reported. Of the 720,000 accounts that registered to participate in the sale, only about 25,000 (3.6%) were able to make purchases due to the high demand, Immutable announced Monday. The company said it is aiming for the IMX token to be Ethereum’s “Stripe for NFTs,” offering gas-free non-fungible token minting and trading, referring to payments company Stripe.

- Cardano’s commercial arm to invest $100 million in DeFi, NFTs and blockchain education: Emurgo, the commercial and venture arm of Cardano, is investing $100 million to “accelerate the development of the Cardano ecosystem,” Emurgo CEO Ken Kodama announced at the Cardano Summit 2021 on Sunday. Emurgo also said it would be pouring additional funding into African artificial intelligence, blockchain and smart technologies firm Adanian Labs. Cardano founder Charles Hoskinson also recently donated $10 million to establish the Hoskinson Center for Formal Mathematics at Carnegie Mellon…

www.coindesk.com