MicroStrategy’s headline-grabbing bitcoin wager was a rational response to a macroeconomy in chaos, stated Chief Govt Michael Saylor.Showing Tuesda

MicroStrategy’s headline-grabbing bitcoin wager was a rational response to a macroeconomy in chaos, stated Chief Govt Michael Saylor.

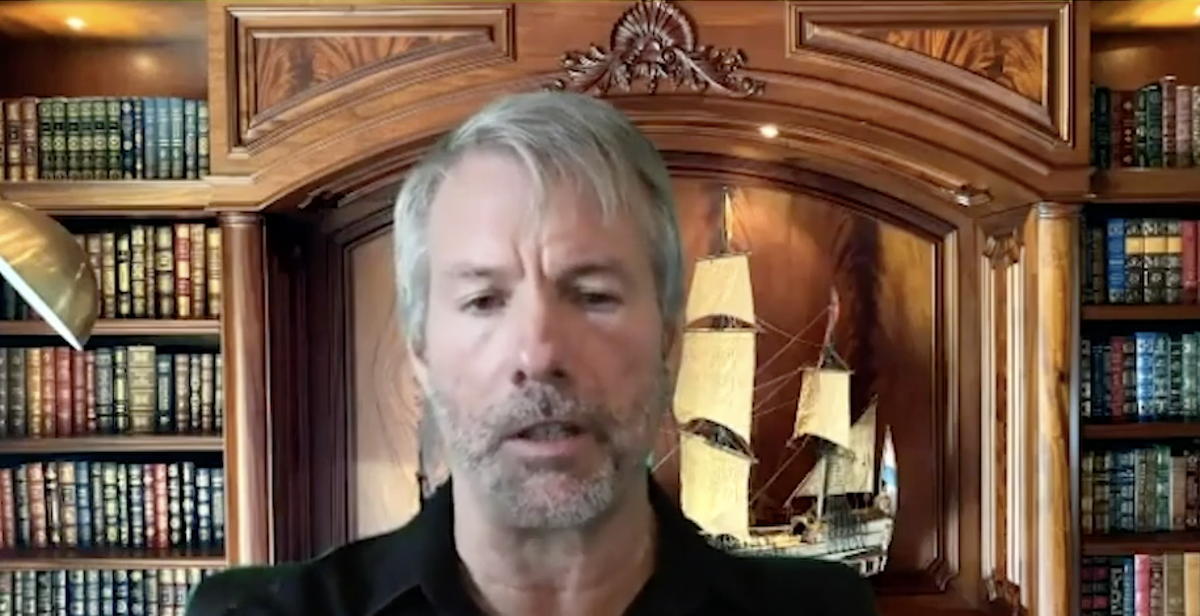

Showing Tuesday at CoinDesk’s Bitcoin for Advisors digital convention, Saylor shed new gentle on one in all this 12 months’s greatest cryptocurrency tales: his software program firm’s latest purchases of $425 million in bitcoin.

That shock September transfer by Nasdaq-listed MicroStrategy marked one of many first – and largest – embraces of bitcoin by a mainstream company.

In a prerecorded fireplace chat with CoinDesk Chief Content material Officer Michael Casey, Saylor unpacked MicroStrategy’s bitcoin thought course of, why it determined to eschew money as a treasury reserve and whether or not gold can reclaim its spot because the marquee retailer of worth in an more and more digital world.

Saylor’s brief reply: Gold can’t. He thinks bitcoin has seized the lead.

Hoarding gold is “an antiquated method to storing worth,” he stated. Bitcoin is “1,000,000 instances higher.”

Printer go brr

In Saylor’s telling, MicroStrategy’s bitcoin journey started with the belief its $500 million money pile was being eaten alive by authorities cash printers. With latest emergency stimulus inflating the U.S. cash provide sooner than a Thanksgiving parade balloon, firm executives felt compelled to maneuver the treasury reserves away from the greenback.

“What we’re attempting to do is protect our treasury,” he stated. “The buying energy of the money is debasing quickly.”

Learn extra: ‘I Didn’t Purchase It to Promote It. Ever.’ MicroStrategy’s Michael Saylor on His $425M Bitcoin Guess

For the final decade or so, the M2 cash provide – the sum of bodily money, checking and financial savings accounts, certificates of deposit and cash market funds – grew a modest 5.5%, Saylor famous. “A rational view of enterprise treasury technique can be, you needed to get greater than 5 and a half p.c as your price of capital so as to maintain your buying energy from 2011 to 2020,” he stated.

However when COVID-19 hit this 12 months, tanking the financial system, the measures taken to include the injury swelled M2 by 20%, elevating the hurdles for company treasurers to protect that buying energy. “The price of capital of each money treasury or each treasury on the planet is now 20%,” Saylor stated.

To make certain, U.S. inflation, as measured by the core Client Value Index (which excludes meals and vitality) declined briefly in 2020. However to Saylor, that measure is “irrelevant.”

“If inflation solely means a market basket of issues with no meals and vitality in them, then virtually by definition I’ve outlined a metric which can by no means go up,” he stated.

He pointed to money holders in inflation-prone international locations like Argentina, Brazil and Venezuela. They know all too properly their buying energy takes successful when cash provide expands.

“What in the event you reside in Europe and america? It wasn’t apparent. However it must turn out to be apparent,” Saylor stated. “I believe folks will determine it out.”

Bitcoin pivot

Satisfied the greenback was no place for MicroStrategy’s extra capital, Saylor stated he and his executives started trawling round for a “tangible” asset various. “We needed to cycle by way of actual property, bonds, fairness, valuable metallic, derivatives or crypto,” Saylor stated.

Of that group, valuable metals, notably gold, has lengthy stood as an attractive retailer of worth, a scarce, safe-haven asset acknowledged around the globe. To not Saylor. For starters, he balked on the notion that gold is scarce. “Gold is the least considerable of the commodities, however you’ll be able to nonetheless produce gold,” he stated.

However he’s additionally acutely involved with what he describes because the clashing pursuits of gold miners and gold bugs. One is attempting to capitalize available on the market by mining replenishable provide whereas the opposite is hoping that entry stays scarce, pushing costs up.

Learn extra: Sq. Places 1% of Whole Property in Bitcoin in Shock $50M Funding

“The gold miners are the enemies of the gold holders,” stated Saylor. “The gold miners try to destroy your worth, proper? They’re not attempting that can assist you.”

He predicts a good greater drawback with the gold market: Traders fleeing to bitcoin. Even when they don’t understand it but, Saylor thinks gold buyers will eagerly dump the commodity for what he calls a superior retailer of worth. It’s not an if. It’s a when.

“Not wager to wager in opposition to ingenuity and assume that individuals will likely be lazy and ignorant for the subsequent decade, as a result of it’s not going,” Saylor stated.

Debasing fiat

Citing one analyst’s prediction that Federal Reserve motion will preserve equities shifting upward whatever the latest election’s final result, Saylor stated the “most aggressive financial growth” might be forward.

Traders will due to this fact seemingly proceed treating blue-chip juggernauts from Apple to Amazon as a brand new sort of protected haven. “They’re desperately greedy at straws,” Saylor stated. All these belongings are reliant on the fiat foreign money he sees…