Rumored Shenzhen celeb memecoin factory A mysterious memecoin

|

Rumored Shenzhen celeb memecoin factory

A mysterious memecoin factory in Shenzhen is rumored to be behind a wave of memecoin scams, allegedly launching over a dozen tokens a month. Brazilian football legend Ronaldinho Gaúcho has been swept into the controversy on Chinese social media.

On March 3, Ronaldinho announced the launch of his own memecoin on BNB Chain. Within hours, it skyrocketed to a peak market cap of $30 million, only to come crashing down to around $3.7 million, according to CoinGecko data.

A now-banned X user, @R10coin_, claimed to have struck a $6 million deal with Ronaldinho to promote their token, paying him $3 million upfront. However, the X user then claimed Ronaldinho had allegedly signed another token deal and that the footballer’s X account had been sold to a Shenzhen-based firm.

The unnamed Shenzhen firm is rumored to operate like a full-scale scam operation, aggressively marketing celebrity-backed tokens to lure investors, pumping the price, and then cashing out before disappearing. These unverified accusations, while speculative, have ignited discussions across Chinese crypto communities about the presence of organized memecoin factories designed solely to rug unsuspecting investors.

A legal expert from Man Kun Law Firm weighed in on the matter through a WeChat post on March 4. The lawyer stated that if such “token factories” truly exist, they would constitute outright fraud and a textbook example of a rug pull. According to the lawyer, the marketing is based entirely on deception — using famous names to create hype, playing into people’s fantasies of overnight wealth, and ultimately profiting off artificial price manipulation rather than developing a genuine blockchain project.

Despite all these allegations, the project itself has not been abandoned, though its value has mostly evaporated. On March 6, the Ronaldinho memecoin team announced that the token would be expanding to the Solana blockchain, doubling down on its future plans rather than distancing itself from the token. Meanwhile, the X account that raised accusations against Ronaldinho and the supposed Shenzhen factory, @R10coin_, has been banned from the platform for violating site policies.

Not all HK-listed Bitcoin buyers are hodling

Another Hong Kong-listed company has been buying Bitcoin — but don’t get too excited. Yuxing Infotech Investment Holdings (HKEX: 8005) quietly accumulated millions in BTC in the second half of 2024, only to begin selling just months later.

According to disclosures filed with the Hong Kong Stock Exchange, Yuxing purchased 78.2 Bitcoin between July 25, 2024, and Dec. 31, 2024, at an average price of $80,960 per BTC, amounting to a total of $6.3 million. But by early 2025, the firm had already started reducing its holdings. Between Jan. 22 and March 5, Yuxing sold 50 BTC at an average price of $89,194 per coin, generating $4.5 million. The company also offloaded 3.3 million USDT for $3.3 million.

Yuxing has not outlined a long-term strategy regarding Bitcoin. While the firm allocated capital into BTC in 2024, it opted to reduce its holdings within months, suggesting it may view Bitcoin as a short-term investment rather than a treasury asset. The sales at $89,194 per BTC indicate Yuxing may have turned a profit, though the company did not provide details.

Yuxing is not an outlier among Asian firms. In December 2024, Chinese selfie app Meitu liquidated its entire Bitcoin and Ethereum holdings, securing approximately $80 million in profits after three years of accumulation.

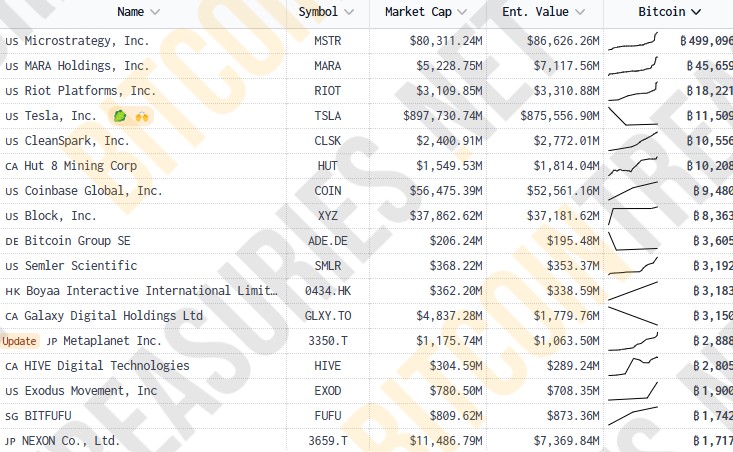

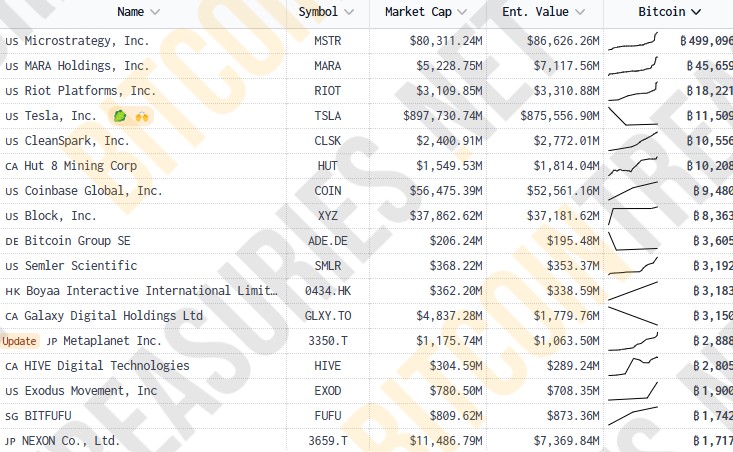

Meitu was once called the “MicroStrategy of Asia”, being one of the first firms to adopt the aggressive Bitcoin accumulation strategy popularized by Strategy and its CEO Michael Saylor. That title has since shifted to Japanese investment firm Metaplanet, which is now closing in on Hong Kong-listed Boyaa Interactive, Asia’s largest public Bitcoin holder with 3,183 BTC.

On March 5, 2025, Metaplanet increased its holdings to 2,888 BTC after purchasing another 497 Bitcoin.

Read also

Features

US enforcement agencies are turning up the heat on crypto-related crime

Features

Airdrops: Building communities or building problems?

Telegram in…

cointelegraph.com