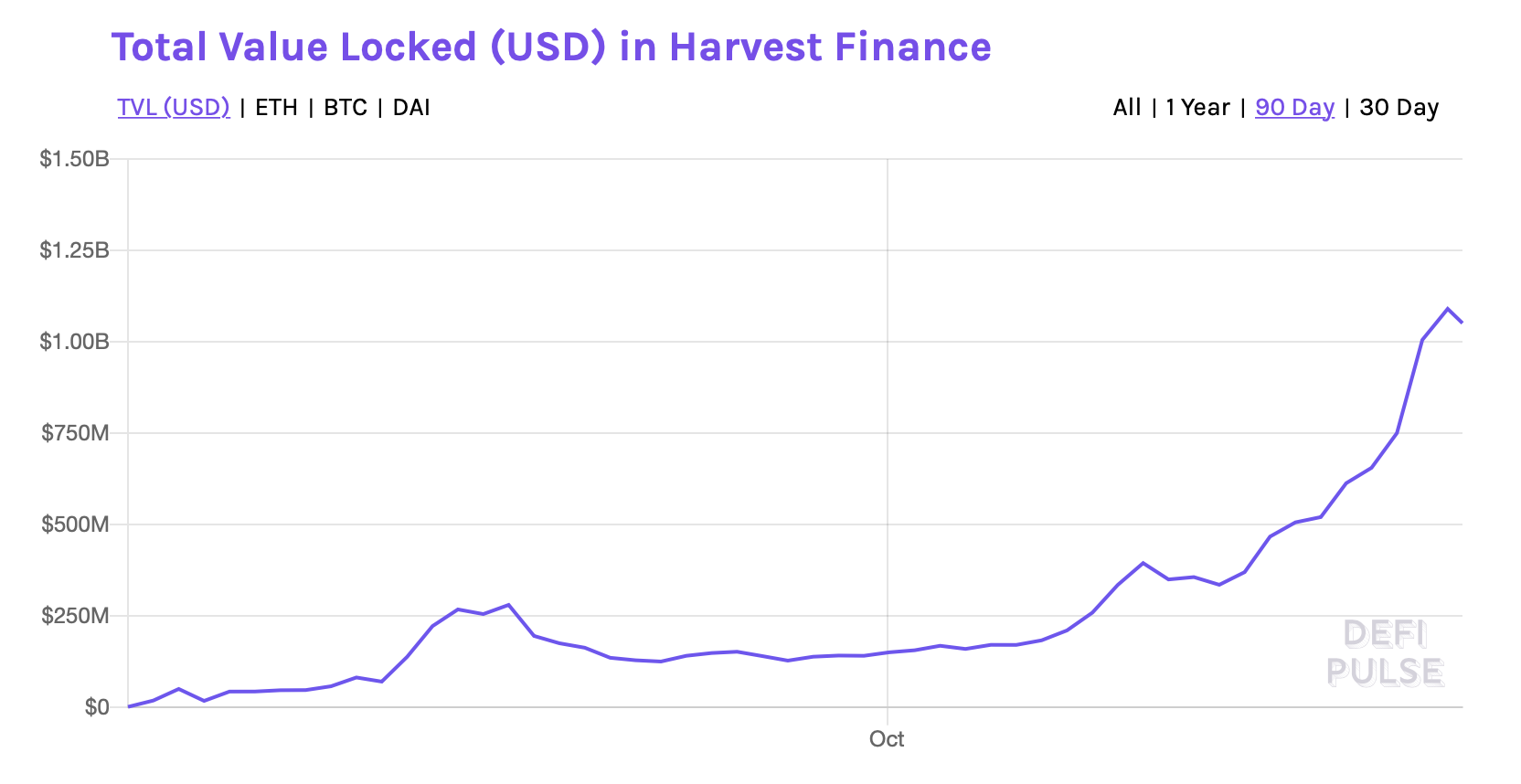

Harvest Finance, a decentralized finance challenge that succeeded in attracting over $1 billion in funds locked has an admin key that offers its ho

Harvest Finance, a decentralized finance challenge that succeeded in attracting over $1 billion in funds locked has an admin key that offers its holders the power to mint tokens at will and steal customers’ funds.

As famous by auditing corporations PeckShield and Haechi, the governance parameters will not be set by a contract with clearly outlined guidelines. An admin key, presumably held by the nameless builders behind the challenge, could possibly be used to arbitrarily mint new FARM tokens.

This energy might enable the governance key holders to create a vast variety of tokens and drain funds within the token’s Uniswap pool, which at present holds $12 million in USDC.

Harvest Finance is an automatic yield administration system, that includes vault-based methods just like Yearn Finance. Haechi highlighted that along with the minting mechanics, the governance key holder has the power to alter the vault performance at will, which could possibly be exploited by submitting a bogus technique that merely sends the funds to an attacker-controlled tackle.

The holders of the governance key would thus have the theoretical risk of stealing the entire $1.05 billion in property dedicated to the protocol, along with the funds within the Uniswap pool.

In response to the audits, the staff launched a 12 hour time lock that ought to give sufficient superior warning to customers if any foul play is detected — however that requires fixed group vigilance.

The challenge is at present operating a classical yield farm just like lots of the “meals cash.” Customers can commit Ether (ETH), Wrapped Bitcoin (BTC) and different property, however the highest FARM yield will be discovered by submitting FARM tokens themselves, with out essentially requiring the extra layer of abstraction of Uniswap pool tokens. Such a round dependency is attribute of many crypto Ponzi schemes.

The staff is totally nameless, although the challenge succeeded in attracting a comparatively sizable group and has been concerned in the neighborhood by doling out grants.

Whereas nothing would recommend malicious intentions for now, the challenge is strongly centralized and potential farmers must be conscious that they’re trusting an nameless group of builders to withstand the temptation to run off with their cash, equally to how the group initially trusted SushiSwap’s founder.