Investor curiosity in ether choices is stronger than ever, probably as a consequence of pleasure surrounding Ethereum’s long-awaited protocol chang

Investor curiosity in ether choices is stronger than ever, probably as a consequence of pleasure surrounding Ethereum’s long-awaited protocol change, dubbed ETH 2.0.

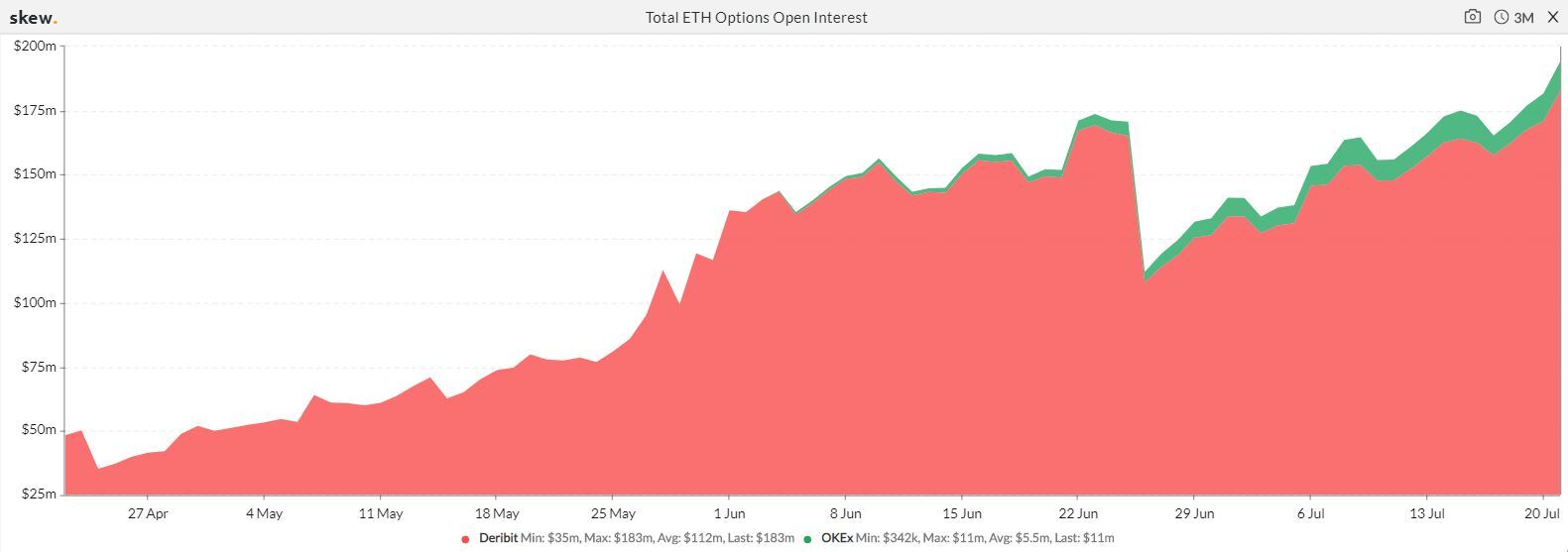

Information from main exchanges – Deribit and OKEx – exhibits that open curiosity in ether choices rose to a brand new lifetime excessive of $194 million on Tuesday, surpassing the earlier document excessive of $173.four million reached on June 23, in line with knowledge provided by the crypto derivatives analysis agency Skew.

Choices are by-product contracts, which give the purchaser the precise however not the duty to purchase or promote the underlying asset at a predetermined worth on or earlier than a selected date. A name choice represents a proper to purchase, whereas a put choice offers a proper to promote.

The Panama-based Deribit trade, the world’s largest choices trade by quantity, accounted for almost 94% of the overall open curiosity of $194 million on Tuesday.

Getting ready for ETH 2.0?

A more in-depth take a look at the distribution of the open curiosity as per expiry exhibits December because the month with probably the most open curiosity.

At press time, there are 240,237 open contracts with a notional worth of $59 million expiring in December. In the meantime, the July expiry open curiosity is 193,919 contracts ($47 million notional), in line with Genesis Volatility, an choices knowledge platform.

“Focus of exercise in December expiry suggests merchants could also be gearing up for ETH 2.0,” stated Greg Magadini, CEO of Genesis Volatility, a by-product knowledge platform.

Learn Extra: Ethereum Turns 5 Subsequent Week and We’re Producing a Particular Collection

Luuk Strijjers, COO of Deribit, informed CoinDesk in a Telegram chat that, “the bullish momentum in open curiosity is predicated on the upcoming ETH 2.Zero staking potential.”

ETH 2.Zero refers to Ethereum’s long-awaited transition from a proof-of-work (PoW) mechanism to proof-of-stake (PoS). The swap to staking mechanism would assist ether holders generate further yield by staking their tokens within the community. The transition, which was initially anticipated within the first quarter, now might not occur till early subsequent 12 months.

Even so, investor curiosity within the cryptocurrency is rising. The variety of addresses holding 32 ETH or extra — the minimal quantity a holder is required to keep up as a steadiness to turn into a validator on Eth 2.0 (and therefore earn staking rewards) — has elevated by over 12% on a year-to-date foundation to 123,530, in line with knowledge supply Glassnode. As well as, ether has gained 90% this 12 months in comparison with bitcoin’s 30% rise.

Some traders could also be expressing their bullish view on the cryptocurrency by shopping for name choices expiring in December, inflicting an increase within the open curiosity. Additionally, the opportunity of traders hedging their lengthy spot positions with lengthy put choices can’t be dominated out. In any case, the transition has already confronted a number of delays and the cryptocurrency’s worth might drop if the improve is once more pushed out past January 2021.

The DeFi harvest

And but, ETH 2.Zero will not be the one purpose for the surge in open curiosity in ether choices. “The current DeFi success and the rising transacted worth in stablecoins might have performed a task,” Strijjers stated.

Certainly, utilizing ether choices as a hedge could also be growing demand. That’s as a result of there are issues that the frenzy surrounding speculative actions comparable to “yield farming” within the DeFi house and interconnected leverage would result in a systemic disaster. Most DeFi initiatives are primarily based on Ethereum and have witnessed phenomenal progress over the previous few months, inflicting an enormous rise within the community exercise and transitions charges.

One might argue that traders, in quest of yield, could also be promoting name and put choices. That appears unlikely, particularly in longer dated choices, given the cryptocurrency’s one-month implied volatility is hovering nicely beneath its lifetime common of 71%. The metric fell to a multi-year low of 46% on July three and has remained largely sidelined ever since in line with knowledge supply Skew.

Learn Extra: DeFi Hype Has Despatched Ethereum Charges Hovering to 2-12 months Excessive: Coin Metrics

Volatility has a optimistic influence on choices’s worth and is imply reverting. In different phrases, there’s a good probability of seeing volatility rising within the close to time period and making choices costlier than what they’re proper now.

As such, seasoned merchants favor to be choice consumers when volatility is low and write choices after they suppose volatility has peaked.

That stated, the opportunity of merchants having offered July expiry choices can’t be dominated out, given the cryptocurrency has spent a greater a part of the final two months buying and selling the slim vary of $225 to $250.

The chief in blockchain information, CoinDesk is a media outlet that strives for the best journalistic requirements and abides by a strict set of editorial insurance policies. CoinDesk is an unbiased working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain…