Shareholders of publicly traded bitcoin mining firms loved report month-to-month beneficial properties because the main cryptocurrency reached a br

Shareholders of publicly traded bitcoin mining firms loved report month-to-month beneficial properties because the main cryptocurrency reached a brand new all-time excessive Monday morning.

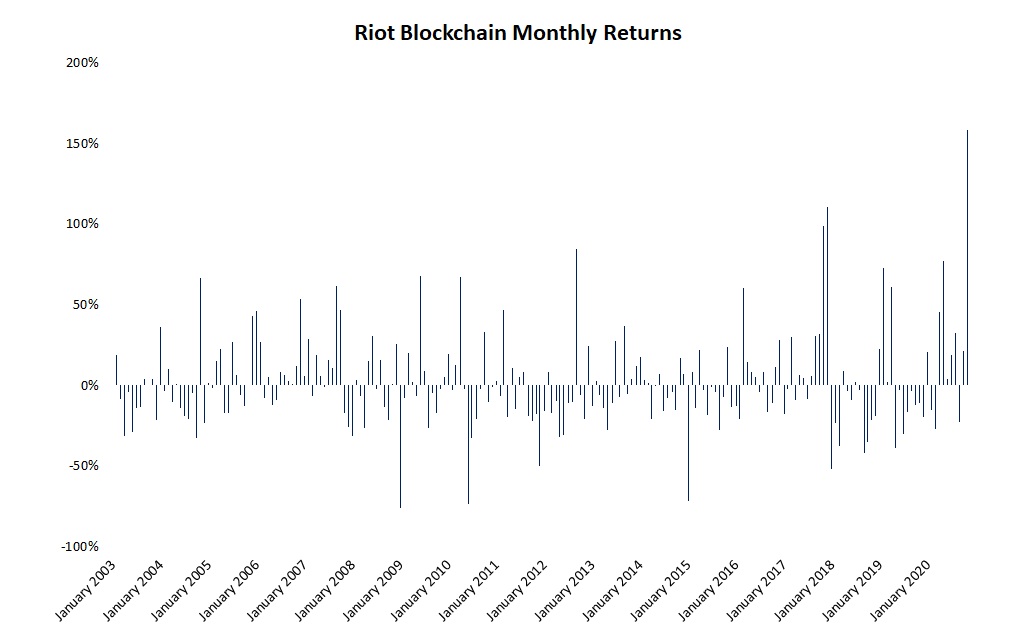

Fortress Rock, Colo.-based mining agency Riot Blockchain ended November with a 160% acquire buying and selling at $8.45 per share. Las Vegas-based Marathon Patent Group additionally soared over 190% in November, the agency’s largest month-to-month proportion acquire, up over 600% 12 months so far.

Miner producer Canaan Artistic ended November with a report month-to-month acquire of almost 140% with shares buying and selling at $4.99 by Monday shut.

Riot’s beneficial properties come amidst its accumulation of hundreds of the trade’s main mining machines, in response to Thomas Heller, chief working officer at mining software program firm HASHR8.

“Riot expects to have a complete of 22,640 miners deployed by June 2021, and nearly all of them are S19 Professional miners,” Heller stated. “Together with the M30S++, the S19 Professional is essentially the most highly effective and environment friendly miner in the marketplace, and instructions the very best market value.”

Riot additionally almost tripled the greenback worth of bitcoin holdings, per the corporate’s Q3 earnings, reaching $9 million, up from $3.1 million throughout the identical interval in 2019. Marathon additionally reported a triple-digit proportion enhance in its bitcoin holdings after a record-setting quarter of mining income in Q3.

Canaan’s beneficial properties come as a aid to shareholders who suffered a 85% drawdown on the finish of Q3 from its preliminary checklist value in November 2019. So far in This autumn, Canaan shares are nonetheless down 18 p.c.

Robust demand for brand spanking new machines by miners holds promise for Canaan, which reported a $12 million Q3 loss Monday. Heller informed CoinDesk, “Present orders with Canaan gained’t ship till April because of the excessive demand for ASIC miners.”

Shares of different public mining firms additionally noticed triple-digit proportion beneficial properties in November. For instance, Vancouver-based Hive Blockchain gained greater than 160% within the month with shares buying and selling fingers at $1.23 by market shut Monday.

“Mining shares are a really engaging means for traders to get upside publicity to Bitcoin value whereas being restricted on the draw back because of the infrastructure nature of the enterprise,” stated Ethan Vera, co-founder of mining firm Luxor Know-how, in a direct message with CoinDesk.

“One of the best mining firms can ship earnings in bear markets and have outsized returns in bull runs,” Vera stated.