Secondary markets for bitcoin mining machines are pink sizzling as a surge in demand from miners has brought about extreme delays so as achievement

Secondary markets for bitcoin mining machines are pink sizzling as a surge in demand from miners has brought about extreme delays so as achievement from producers.

Two of the mining trade’s largest producers, Bitmain and MicroBT, are bought out of recent machines till Could 2021 as demand has overrun present manufacturing capability. Scrambling for much more machines, miners are turning to secondary markets for no matter they will discover.

Bitmain’s worldwide advertising director, Nathaniel Yu, confirmed that the corporate is bought out of stock till Could 2021 in an e-mail to CoinDesk. Bitcoin’s 166% year-to-date rally is a “key driver” of surging demand for brand spanking new machines, particularly for Bitmain’s 19 Sequence, Yu stated.

Vincent Zhang, vp of gross sales for Bitmain’s main competitor MicroBT, declined to touch upon his agency’s present stock however famous that demand for environment friendly mining machines is excessive.

“When the value ran up, everybody wolfed up orders,” stated Kevin Zhang, vp of enterprise improvement for New York-based mining firm Foundry, referring to bitcoin’s robust restoration off of a 50% intraday value crash in March.

Producing sufficient new machines to satisfy demand is very difficult due to the competitors for mining chips, Zhang stated.

The identical 7 and eight nanometer chips that miner producers want are additionally in excessive demand by different know-how giants like Apple and Nvidia. When competing for provide towards these companies, bitcoin mining corporations are usually a decrease precedence buyer.

Unable to obtain new machines from producers battling supplyline issues, miners are swarming to secondary markets.

Buying and selling exercise on these in any other case a lot quieter secondary markets is at and even above pre-halving ranges, based on information approximations from Guzmán Pintos, co-founder of mining software program firm Luxor Applied sciences. Earlier than the third bitcoin halving occasion in Could, the mining subsidy was twice as giant, permitting for a bigger pool of worthwhile market individuals.

A good starker imbalance between provide and demand was drawn by Thomas Heller, chief operations officer at mining software program firm HASHR8, in a direct message with CoinDesk. Heller stated secondary markets mining {hardware} are the most well liked they’ve been since late 2017 or early 2018 through the cryptocurrency market’s final peak.

“No person needs to promote. Everybody needs to purchase,” Pintos advised CoinDesk.

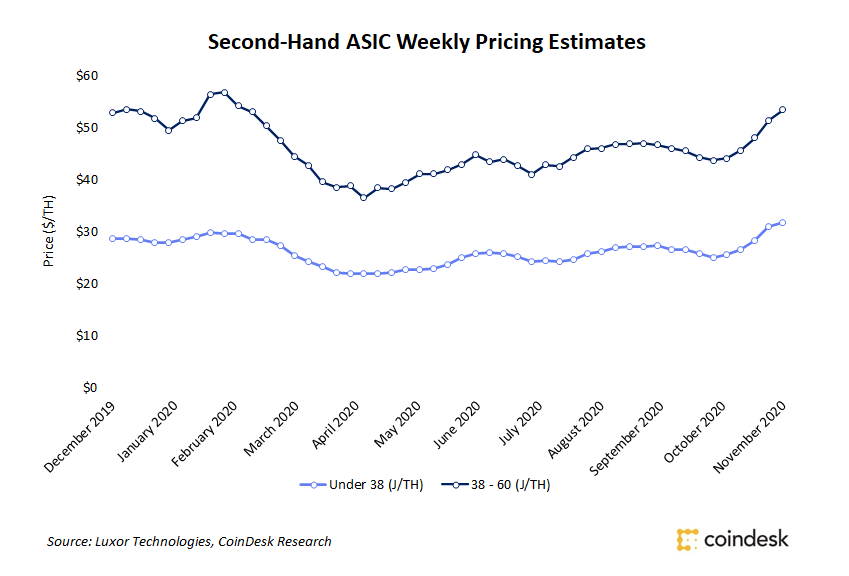

Sturdy demand for any out there machines is mirrored within the excessive volatility and premiums of ASIC costs. For some machines, the per-unit value can “simply change 10-20% on a weekly foundation,” Pintos stated.

It’s not unusual for the upward volatility of second-hand mining machines to usually exceed bitcoin’s volatility, Heller added.

In latest months, costs for second-hand, decrease era mining machines have elevated upwards of 40%-50%, based on Mason Jappa, CEO of Blockware Options, one of many main mining {hardware} and repair suppliers. Newer machines just like the S19 Professional have seen extra gentle value will increase of round 25% on secondary markets.

With Bitmain and MicroBT bought out via Could 2021, Jappa stated, the mining {hardware} market has been reworked into “really a vendor’s market at this level.”

Blockware expects the present pattern of robust demand and restricted provide to accentuate with increasingly miners “scrambling to buy machines on the secondary market with as fast as a timeline for supply as potential,” Jappa stated.

Mining situations—to not point out the bitcoin value itself—are “very bullish in the mean time,” he advised CoinDesk. In line with Jappa, timelines for future batches of machines from Bitmain and MicroBT will proceed to be prolonged, and costs on secondary markets will proceed to understand.