The United States Securities and Exchange Commission is rapidly

|

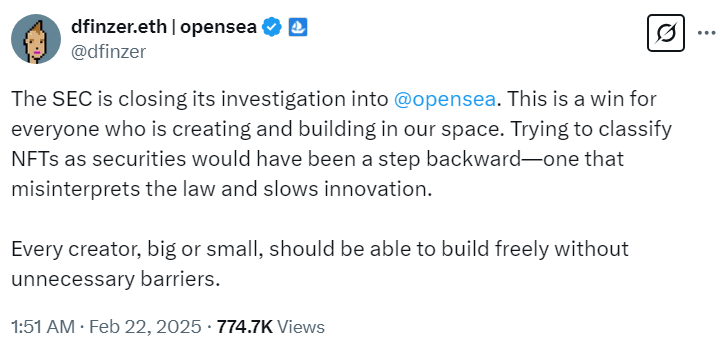

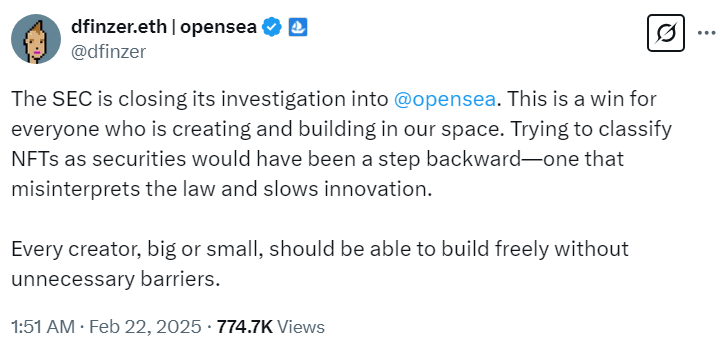

The United States Securities and Exchange Commission is rapidly shifting its stance on cryptocurrency, dropping cases and investigations against major companies like Coinbase, OpenSea, Uniswap and Robinhood, among others.

President Donald Trump has further cemented the legitimacy of the industry with his announcements about a strategic Bitcoin and/or crypto reserve.

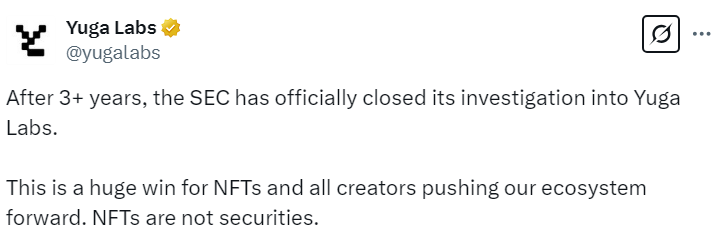

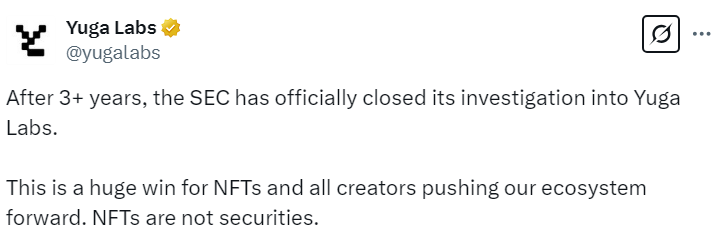

While the industry is celebrating these developments, there are plenty of unresolved questions. Does the SEC dropping its investigations into OpenSea and YugaLabs really mean that NFTs are not securities? Yuriy Brisov of Digital & Analogue Partners says it’s not that clear cut, pointing to the Ripple case as an example of how an asset’s classification depends on how it is sold.

Magazine spoke with a panel of legal experts to find out more about the ramifications of these moves: Brisov in Europe, co-chair of the Hong Kong Web3 Association Joshua Chu from Asia and Charly Ho of Rikka from US. This discussion has been edited for clarity and length.

Does the SEC’s withdrawal of charges and investigations against crypto firms set a precedent for crypto laws for the future?

Ho: Because the SEC is the plaintiffs suing the defendants, which would be the Ripples, the Coinbases, the OpenSeas of the world, they can certainly drop those cases — though from the Ripple case, Judge [Analisa] Torres wanted to be specifically involved so that one might be a little bit more complicated to just drop.

Whether that leaves the industry in a bit of a vacuum, in some respects, yes. But it’s also kind of what the industry asked for. The industry asked not to be regulated by enforcement action that was somewhat — in their words, using the formerly existing Chevron deference— arbitrary and capricious. So a lot of the responses from the Coinbases, the Ripples and OpenSeas of the world have similar language asserting that the SEC was extending beyond its legal jurisdiction and that it was basically acting in an arbitrary and capricious manner in violation of the Administrative Procedure Act.

It opens up: “Where do we go from here?” What the industry has asked for is moreclear regulatory guidancein the form of either a law passed by Congress or regulation and rules from the agency itself. So with the creation of the new crypto task force, I believe that their mission is specifically to fill that void. So case law is not the only way to get clarity.

Brisov: The good outcome of these investigations isn’t always a lawsuit. It could also result in an SEC report clarifying regulatory classifications — just as Ripple’s utility tokens were deemed securities in certain sales, the SEC might assert that NFTs and memecoins can also be securities under certain conditions, while DeFi platforms may be considered brokers or dealers under the Exchange Act of 1934.

Now, they just dropped charges and the crypto community is saying that NFTs cannot be securities. And the Uniswap case suggests that all DeFi platforms cannot be an exchange or broker dealer under the Exchange Act.

It’s the wrong message that the market receives: that they can do whatever. I don’t support this approach. It’s probably a good thing to let the new, innovative companies grow. But someone must, from time to time, investigate them and ask some questions, issue reports, and make recommendations.

Under Gary Gensler, the SEC was overdoing it. For instance, with Coinbase, they were strictly following all the KYC procedures. Coinbase actually invests a lot into following all the laws. So this battle with Coinbase, for me, was meaningless from the very beginning. But with OpenSea, with Uniswap, I wouldn’t say that it was meaningless but the results of these investigations, I cannot call them satisfactory at this point.

Given that US crypto laws influence other countries, are jurisdictions like Hong Kong, Singapore, and Dubai likely to see similar abrupt changes?

Chu: In places like Hong Kong, Singapore, and Dubai, such drastic regulatory U-turns are less likely. These jurisdictions have taken a more measured and structured approach to crypto regulation.

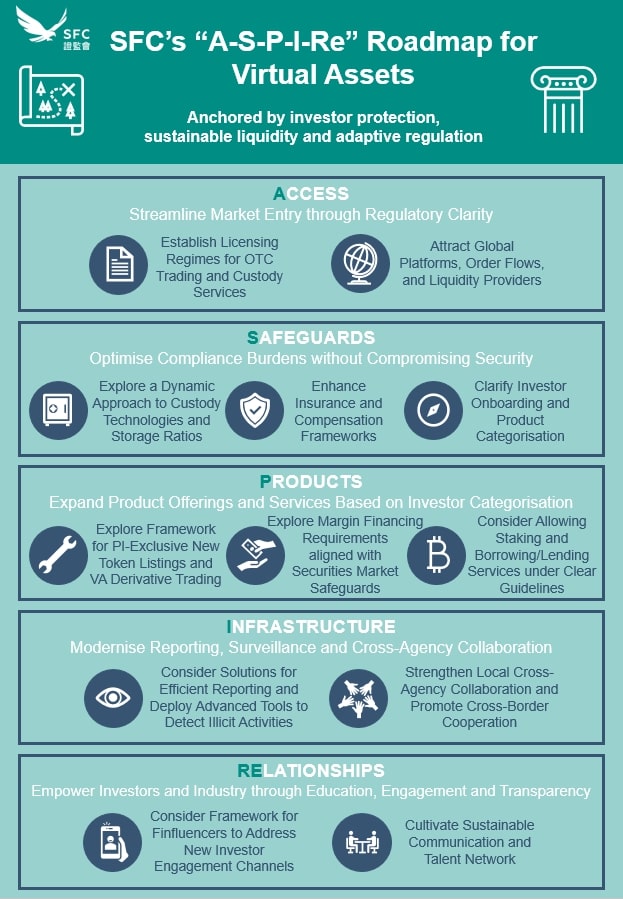

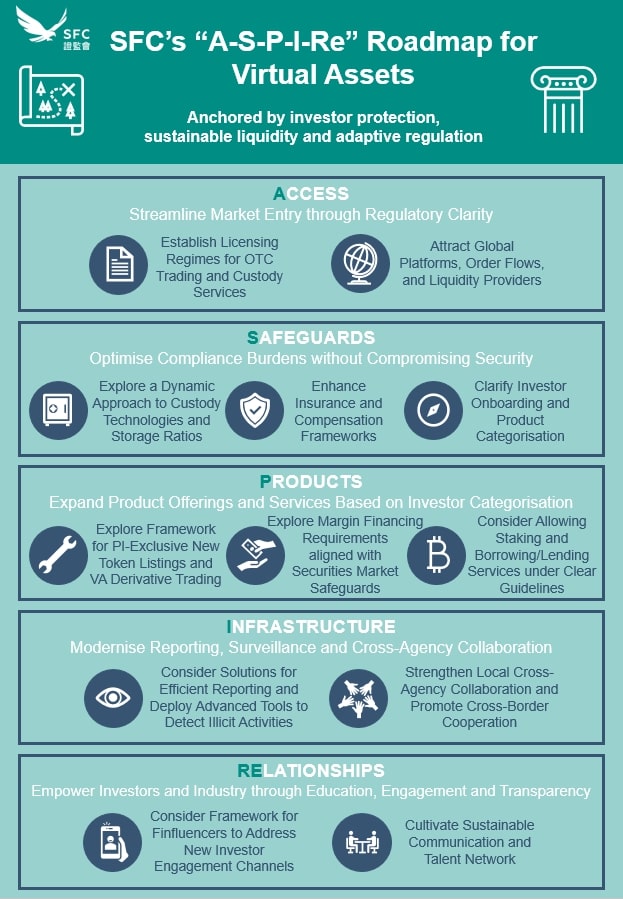

For example, Hong Kong’s Securities and Futures Commission has been methodical in its approach. When the SFC first introduced its crypto regulatory framework, it excluded riskier products like options trading. Only after the initial framework had been in place for some time did the SFC announce it would explore allowing options and leveraged trading. This phased approach ensures that riskier aspects of the ecosystem are introduced only after participants have been vetted and deemed sufficiently sophisticated.

This steady, incremental approach contrasts sharply with the SEC’s abrupt shifts….

cointelegraph.com