Crimson-hot spot markets are primarily fueling bitcoin’s current rally because the main cryptocurrency trades at three-year highs round $15,500, su

Crimson-hot spot markets are primarily fueling bitcoin’s current rally because the main cryptocurrency trades at three-year highs round $15,500, suggesting the bull market might have room to proceed.

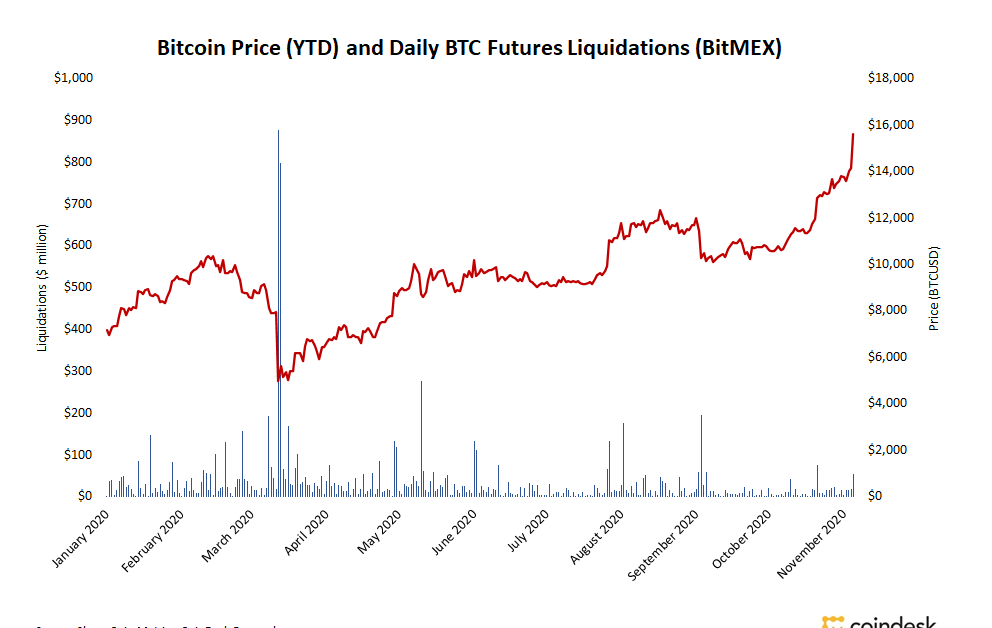

In contrast to beforehand rallies, derivatives markets are enjoying a markedly much less outstanding position, demonstrated by delicate liquidation volumes.

The presence of derivatives in bitcoin’s ongoing rally is “muted compared to earlier run-ups,” mentioned Matt Kaye, managing associate at Santa Monica-based Blockhead Capital. Speaking to CoinDesk, Kaye mentioned, “The market is clearly spot-dominated, and it seems that many of the bidding is popping out of the U.S.,” persevering with a development CoinDesk reported in Might.

On Thursday, BitMEX, a cryptocurrency derivatives change recognized for attracting unorthodox, high-leverage merchants, reported $54 million in liquidated bitcoin futures contracts throughout the newest rally, effectively belowthe nonetheless delicate liquidation quantity of $75 million reported on Oct. 21 when bitcoin reached then new yearly highs, breaking above $13,000, in line with Skew.

Giant liquidations may not occur till the main cryptocurrency breaks above its all-time highs slightly below $20,000, mentioned Kyle Davies, co-founder of Three Arrows Capital, in a direct message with CoinDesk. “Frankly, there’s not a lot leverage available in the market now anyhow,” he mentioned.

Vital value actions usually set off giant scale liquidations in characteristically overleveraged cryptocurrency futures markets. However the delicate liquidations all through bitcoin’s current rally alerts that the usually outstanding derivatives markets has taken a again seat and the spot market has the wheel.

Corroborating the quietness of derivatives markets amid bitcoin’s hovering value motion, is that lower than $500 million in bitcoin futures positions had been liquidated up to now 24 hours, as of 14:35 UTC Friday throughout seven main buying and selling platforms as bitcoin neared $16,000. The most important reported liquidation of $5.97 million occurred on BitMEX, in line with derivatives information aggregator Bybt.

Regulatory troubles weathered by main leveraged buying and selling exchanges like BitMEX, OKEx, and Huobi clarify the subdued affect that derivatives markets play in bitcoin’s present rally, in line with Davies.

That liquidation volumes are low relative to bitcoin’s value actions may very well be an encouraging signal for bitcoin bulls, in line with Aditya Das, cryptocurrency market analyst at Courageous New Coin.

“The quiet funding fee and comparatively low variety of liquidations may very well be learn as a optimistic signal that this rally might have legs and isn’t near overheating due to speculators,” he informed CoinDesk in a direct message.

The market is also signaling that futures merchants merely “missed out on the massive transfer,” Das added.