“What’s the time worth of cash?”

That’s the age-old query Allan Niemerg, former funding head at DRW and founding father of newly launched Paradigm-incubated Yield Protocol, is making an attempt to reply along with his new programmatic cash market.

Launched publicly Oct. 19, Yield is jostling to affix a $2.6 billion decentralized lending business dominated by established gamers reminiscent of Compound by offering a benchmark product others haven’t: a DeFi yield curve.

And whereas cash markets aren’t all the time a head-turning subject, they do carry out a helpful operate by permitting buyers to plan for the longer term. In that sense, Yield as an summary product may be seen as a cornerstone to long-term, blockchain-based cash markets.

Steady versus variable

DeFi predominantly provides variable charges. Those who provide mounted charges reminiscent of Aave cost a premium as a result of younger market’s volatility. Yield, however, gives steady long-term borrowing and lending choices. Model one has six completely different contracts extending by way of December 2021.

It’s all made potential by mashing collectively a number of current initiatives plus some novel arithmetic, Niemerg mentioned in a telephone interview.

“We took the instance of Uniswap and some others that exist,” Niemerg mentioned. “We generalize the way you truly assemble markets like this. What you’re doing is ranging from some precept. This market ought to keep some property and if it maintains that property we are able to put boundaries on how a lot it might lose.”

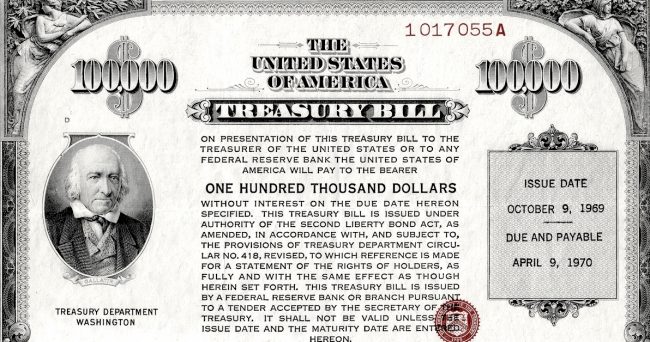

Niemerg mentioned his product is akin to a Treasury invoice (T-bill). The venture’s white paper describes Yield loans as a “zero-coupon bond” (a monetary instrument that trades at a reduction if rates of interest are optimistic till it pays off at face worth at expiry).

To do that, Yield employs the automated market maker (AMM) scheme that got here into vogue with Uniswap this summer time. Costs in Uniswap and different related markets are parameterized, which means costs are a operate of asset reserves (a bonding curve in DeFi communicate, often known as your run-of-the-mill algebraic equation). For instance, Uniswap’s curve is X * Y = Okay, the place X and Y are pooled asset reserves and Okay is the value.

“The important thing factor is to establish properties then code them within the math so the markets mirror these properties and may commerce at affordable costs,” Niemerg mentioned.

Yield house

However as a substitute of the Yield AMM making a worth solely by way of the balancing of reserves, it creates an rate of interest by together with a brand new variable: time.

“We need to construct a liquidity provision components that works in ‘yield house’ slightly than ‘worth’ house. Particularly, we would like the rate of interest – not the value – to be a pure operate of reserves,” the Yield white paper states.

In observe, this appears like many different DeFi lending schemes: You deposit ether (ETH) as collateral in change for the protocol’s token, fixed-yield dai (fyDai). (Deposits are positioned in a MakerDAO vault.) That token can then be swapped for dai into one of many six borrowing contracts with completely different expiry dates and steady charges.

Very like how a conventional T-bill trades, the distinction between dai and fyDai throughout that interval is an implicit rate of interest. The maths behind fyDai ought to make the token commerce at a reduction to dai till the borrowing interval closes and the 2 tokens attain parity.

In case you purchase a typical T-bill earlier than expiry, you’ll be able to anticipate a set return when the contract comes due. Likewise, should you purchase fyTokens with dai (lending), you’ll be able to anticipate a set return when the contract expires. The bigger distinction right here being, in fact, is the danger profile: authorities bonds are backed finally by the complete religion and credit score of the federal authorities, whereas fyDai is backed by software program.

Is DeFi prepared for a yield curve?

The product market match for steady rates of interest in DeFi is an unexplored query, DeFi market UMA co-founder and former Goldman Sachs bond dealer Hart Lambur advised CoinDesk in a telephone interview. (Lambur maintains relationships with each Paradigm and Yield, however does have a competing venture, the Yield Greenback, he mentioned).

Lambur mentioned Yield is “actually elegant in principle” however he’s uncertain if DeFi buyers are asking for a steady rate of interest product proper now. Yield could also be in search of a future market occasion for it to make sense, he mentioned (although he famous that any venture has traction if buyers are prepared to purchase and promote on Yield at given costs).

But, steady rates of interest are in demand in some locations. The contract has a nudge over $750,000 in complete worth locked (TLV) as of Oct. 22, Niemerg mentioned, and Yield could reduce into the lending market by providing extra enticing charges.

For instance, Aave founder Stani Kulechov advised CoinDesk in an e mail that “many of the borrowings from Aave Protocol are in variable rates of interest.” He…