Bitcoin costs tumbled 6.2% Thursday, falling beneath $11,000 for the primary time in a month. The value drop trimmed the most important cryptocurr

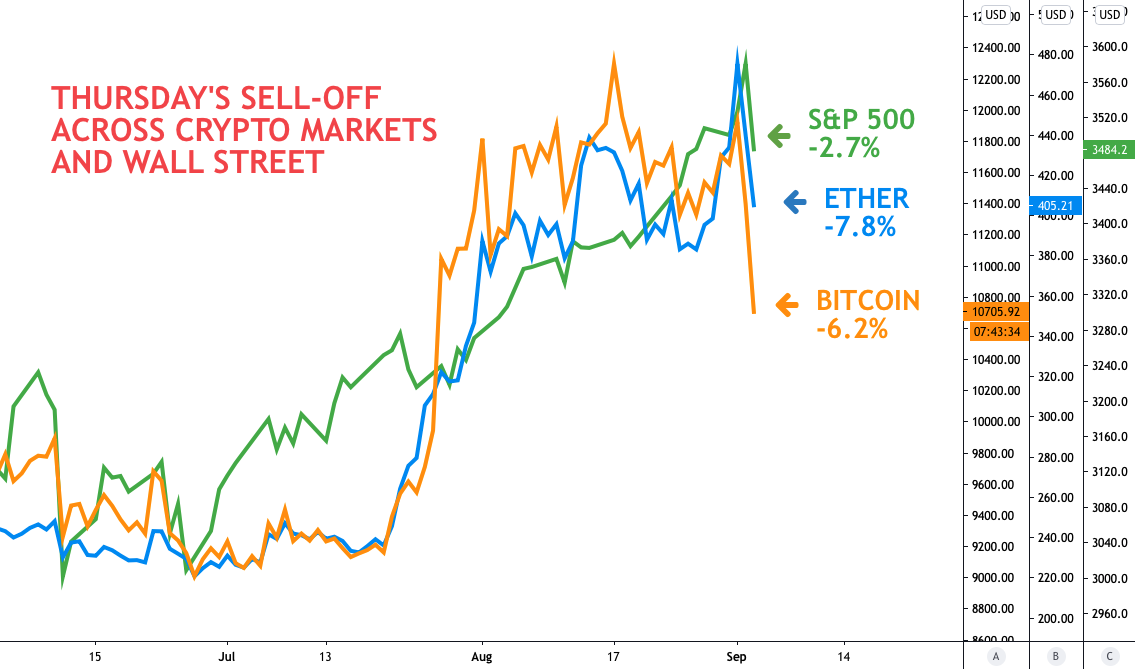

Bitcoin costs tumbled 6.2% Thursday, falling beneath $11,000 for the primary time in a month.

The value drop trimmed the most important cryptocurrency’s 2020 rally to 50% and despatched digital-asset market merchants and analysts scrambling to elucidate the sell-off.

Listed here are three causes cited by analysts:

1. Bitcoin slid in sync with conventional markets

The Customary & Poor’s 500 Index of enormous U.S. shares retreated Thursday after climbing to a brand new file excessive earlier within the week. A report displaying new U.S. jobless claims at 881,000 within the closing week of August was higher than feared – and the bottom for the reason that pandemic hit earlier this yr – however nonetheless properly above the 665,000 degree that marked the excessive level of the final recession in early 2009. Pantheon Macroeconomics referred to as the determine “nonetheless grim,” whereas Navy Federal Credit score Union economist Robert Frick mentioned the labor market was “persevering with to wrestle, and never displaying enchancment regardless of COVID-19 ranges that declined in August.

John Todaro, director of institutional analysis on the cryptocurrency evaluation agency TradeBlock, mentioned:

“There may very well be an overlap between fairness sellers and digital foreign money sellers. The biggest fairness market decliners this morning are tech shares, together with retail buying and selling darlings, Tesla and the FAANG names [Facebook, Amazon, Apple, Netflix and Alphabet, once Google]. It’s unclear if this may push right into a continued broader crash in fairness markets, which may put extra stress on digital currencies, or whether it is only a short-term correction.”

2. Bitcoin bought pulled down due to DeFi unwinding

Merchants have been getting out of the latest speculative fervor in decentralized finance, or DeFi, a lot of which takes place on Ethereum, the second-largest blockchain. Costs for ether, the native foreign money of the Ethereum blockchain, tumbled 8.3% on Thursday after a 7.6% drop the prior day. But these value drops adopted beneficial properties of 54% in July and 25% in August amid reviews of eye-popping greenback quantities flowing into DeFi – particularly with recently-launched initiatives like Compound, Yearn.Finance and SushiSwap – attracting consideration from merchants to the fast-growing and lucrative-but-risky pursuit of “yield farming.” Complete worth locked in DeFi greater than doubled in August to $9.5 billion, however up to now few days the quantity has shrunk to $9.1 billion, in accordance with the web site DeFi Pulse.

Denis Vinokourov, head of analysis on the crypto prime dealer BeQuant, informed CoinDesk in an e-mail: “The explosive progress that decentralized exchanges (DEXs) and all issues DeFi has lastly reached ranges that start to impression on the sentiment throughout its centralized alternate (CEX) counterparts, with the sell-off triggered by a mixture of stratospheric Ethereum charges. Additionally, an aggressive unwind of the very crowded commerce throughout Uniswap token associated positions within the wake of a variety of tokens, specifically PIZZA and HOTDOG, dramatically collapsed from $6,000 to $1 in a mere few hours. That is probably as a result of the identical property (bitcoin, ether and others) are used aggressively to construction collateralized positions. Equally to a different DeFi heartthrob SushiSwap, these choices had been additionally Uniswap clones. DEX and DeFi buying and selling is now not a hobbyist exercise and a variety of companies that dominated CEX house have lately ventured out into DeFi to generate alpha. As such the Chinese language wall that after separated markets is now not in place and sentiment from one market will stream into one other, and vice versa.”

3. Miners offered a few of their bitcoin

Bitcoin miners and presumably merchants determined to take threat off the desk by buying and selling in a few of their cryptocurrency, which they obtain as rewards for serving to to keep up the safety of the blockchain community. CoinDesk reported previous to Thursday’s sell-off that blockchain information had been displaying elevated transfers of bitcoin to alternate wallets, usually seen as a precursor of heightened promoting stress. In keeping with CryptoQuant, a blockchain-data evaluation agency, monitoring of main bitcoin-mining swimming pools confirmed a rise in bitcoin being transferred out – ostensibly additionally to exchanges for a potential sale.

Ki Younger Yu, founding father of CryptoQuant, informed CoinDesk in a Telegram chat: “Miners are good merchants. I feel they’re simply on the lookout for promoting alternatives, not capitulation. I feel it’s going to be the warfare of miners between those that desire a bitcoin value rally and people who don’t. Some Chinese language miners already understand their mining profitability (ROI), and they may not need new mining opponents becoming a member of the business due to the bull market.”