Everyone seems to think that AI agents trading crypto for you wi

|

Everyone seems to think that AI agents trading crypto for you will be the Next Big Thing. The benefits of a smart agent trading 24/7 to make you wealthy while you sleep are obvious — but so are the dangers.

One hallucination could see your portfolio wiped out, or a scammer might jailbreak the agent to hand over your funds.

But since it was founded in 2021, Olas (previously Autonolas) has quietly built up the largest autonomous AI agent network. Almost 500 active agents trade on its Predict platform daily, with a total of 3.8 million transactions to date. Those agents are responsible for around 50% of all lifetime SAFE wallet transactions on Gnosis.

It’s now moving into DeFi and social with an onchain AI agent app store called Pearl. Users can download and run AI influencers using Agents.fun, or use one of its “Baby Degen” agents.

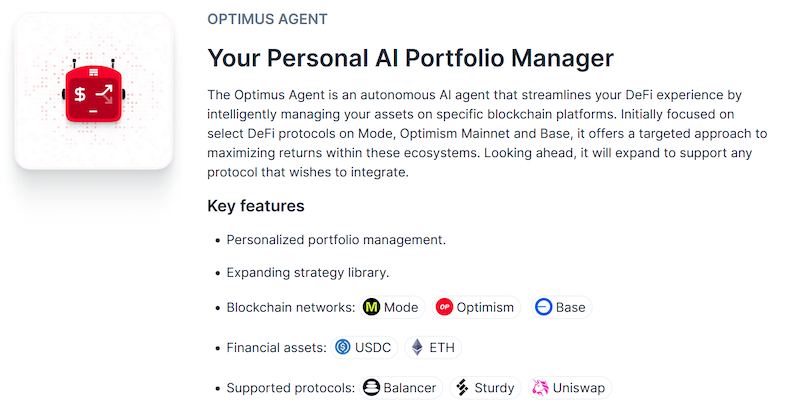

The first agent to be released is called Modius, which can trade DeFi protocols Balancer and Sturdy on the Mode mainnet. A companion AI portfolio manager called Optimus just dropped and can trade those two protocols along with Uniswap, on Mode, Base and Optimism. Both agents gather market data, select trading algorithms and execute strategies while you are sleeping or just shitposting on X.

“I delegate my wallet to the agent and then the agent fully autonomously executes a strategy that I have previously approved,” explains Minarsch, founder and CEO of Valory, one of the core contributors to the Olas DAO.

“Users tend to do things like, ‘Okay, I want to invest in yield-bearing LP positions. Find me the best ones, and do not use such-and-such protocol because I don’t like it.’”

The first catch is there’s a $1,000 limit initially as the bugs are ironed out, and this cautious approach extends to the rollout of Baby Degen memecoin agents. It’s not being released just yet because “most users lose with memecoins, and when you’re losing yourself, it’s different than when your agent loses.

’You don’t want to have the initial user experience being that the agent loses money.”

The other catch is that users also have to agree to a legal waiver that Olas is just the software provider and isn’t at fault if your agent sucks at trading.

“If you run it, it’s your agent, so you’re responsible.”

Train AI agents in a prediction market

Most of the transactions to date have been on Olas Predict, where autonomous agents attempt to predict the outcome of news events in a prediction market tailored to the needs of AI. About 2 million of the transactions are agent-to-agent — with the AIs roping in other models with different strengths and abilities to help with predictions.

It’s not a serious rival to Polymarket or Kalshi at this stage, as the average user-run agent is only funded with $10 to $100, with the $1,000 limit in place. The aim is to get AI agents training in live markets every day so they learn to make better predictions.

“The markets aren’t really a primary product for end-users right now. It’s more like that the agents [predict] the news against these markets so that they can get better. You can think of it as a data improvement flywheel.”

As users also aren’t getting rich from their predictions at this point, the exercise is being subsidized via “Proof of Active Agent,” which is a fancy way of saying users running agents get OLAS token rewards. Minarsch says the yield is currently over 100%, which makes up for duff predictions made by the agents.

“By having created a token economy around it with the Olas token, we can basically scale that more than running it on the server farm ourselves,” says Minarsch. “We incentivize people to run their agent.”

He adds, “It’s still like a mixture of an art and a science” and requires constant experimentation and trial and error to refine the agents’ predictive abilities.

Users can run a provided agent using Pearl’s desktop app locally, while more professional operators can run it in the cloud and tend to modify the agent to get an edge on the competition.

How good are AI agents at making predictions?

So, how good are these agents at predicting the future? Minarsh says we’ll need to wait for an independent study to get hard data. However, anecdotal evidence suggests they are better at dispassionately assessing evidence and making predictions than humans.

“What we do have is kind of internal benchmarks, where we ask team members to answer markets, and we compare it with the agents, and it tends to be the case that the agents are better,” he says.

However, he notes agents don’t perform well in markets that depend on…

cointelegraph.com