Galen Moore is a Senior Analysis Analyst at CoinDesk. The next article initially appeared in Institutional Crypto by CoinDesk, a weekly publication

Galen Moore is a Senior Analysis Analyst at CoinDesk. The next article initially appeared in Institutional Crypto by CoinDesk, a weekly publication targeted on institutional funding in crypto belongings. Sign up for free here.

Faux quantity grew to become one among crypto belongings’ main narratives of 2019, as a U.S. regulatory application for an exchange-traded product (ETP) adopted the work of earlier researchers in exhibiting how as a lot as 95 p.c of lit markets’ reported bitcoin buying and selling quantity is perhaps pretend. That is resulted in conservative estimates of bitcoin quantity which might be in all probability far too low, and a situation of uncertainty as to how a lot bitcoin is definitely being traded.

You can consider pretend quantity as a pure function of crypto’s novel market construction, wherein:

- liquidity is split amongst many competing trade venues

- buying and selling charges are excessive relative to different asset classes

- exchanges present knowledge at no cost

In crypto markets, knowledge is a advertising and marketing device as a substitute of a income supply, and a few exchanges have been proven to make use of it that approach, exaggerating volumes with a purpose to improve their perceived liquidity.

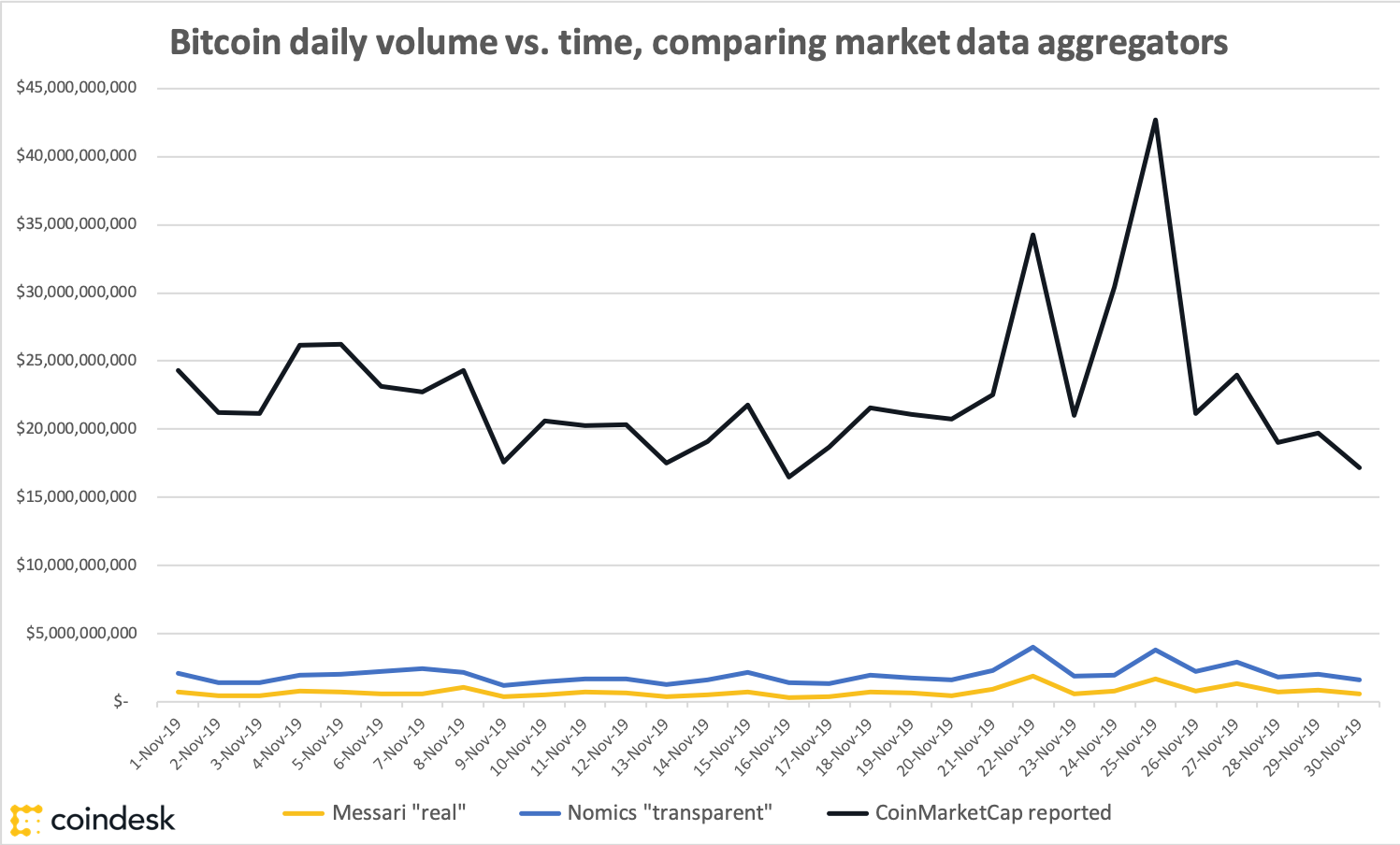

These realities and the information introduced by researchers like BitWise in its March 2019 ETP utility have led market knowledge aggregators to regulate their quantity representations. The chart under compares adjusted each day bitcoin quantity figures for the month of November supplied by two such aggregators, Messari and Nomics, in opposition to the unadjusted reported each day quantity figures supplied by CoinMarketCap, traditionally the best-known market knowledge supplier.

The discrepancy between the 2 examples of adjusted bitcoin quantity proven stems from the checklist of exchanges every knowledge aggregator contains. Messari limits its “actual” bitcoin quantity quantity to the 10 exchanges recognized in BitWise’s ETP utility. Nomics charges 32 exchanges excessive sufficient on its “transparency score” metric to incorporate them in its “clear quantity” mixture.

In its October response to an utility for ETP approval by BitWise, a San Francisco-based fund supervisor, the U.S. Securities and Trade Fee (SEC) famous exchanges that BitWise excluded as pretend are probably supporting some quantity of actual buying and selling exercise, a “grey space” that BitWise conceded in a reply to comments on the applying.

The SEC’s response particularly talked about HitBTC, Huobi, OKEx and a handful of exchanges primarily based in South Korea, which had been excluded as a result of capital controls there. Nomics’ adjusted bitcoin quantity quantity contains HitBTC, however not Huobi, OKEx or any of the bigger South Korean venues.

Anecdotally, merchants say excluding liquid markets wholesale does not make sense – particularly Huobi and OKEx. “I’ve traded on OK since 2013, and it’s executable,” stated Dan Matuszewski, former head of trading at Circle, a Boston-based developer of monetary merchandise in crypto. “That liquidity is there. These markets are actionable. Do I feel the quantity is 100 p.c true? Completely not.”

The chart above reveals that, no less than on Huobi, some bitcoin-base pairs are practically as liquid as they’re on Coinbase, in keeping with order e-book knowledge supplied by Kaiko. Actual each day bitcoin quantity in November was in all probability someplace between the $1.97 billion “clear” quantity that Nomics reported and CoinMarketCap’s unadjusted common each day quantity determine of $22.56 billion – and though Nomics’ quantity excludes some main exchanges, it in all probability will get nearer to the reality than the unfiltered knowledge on CoinMarketCap.

To some extent, it does not matter. Combination bitcoin quantity is a common knowledge level, unlikely to tell a selected funding determination. In crypto’s fragmented markets, quantity at particular venues, chosen for his or her relevance to geographies or classes of investor, could also be higher indicators. For instance:

- Coinbase’s money market volumes as an indicator of latest retail participation

- Exercise on localbitcoins or regionally dominant exchanges

- CME and Bakkt bitcoin futures exercise as an indicator of US fiduciary establishments’ participation

Nevertheless, a dependable determine for bitcoin’s mixture quantity is essential when establishing market infrastructure corresponding to volume-weighted indexes. The crypto asset class’s incapacity up to now to decide on such a quantity is an indicator of its immaturity. When media organizations emerged on the web, their new approaches to income additionally introduced new questions as to which info might be trusted. The identical factor is going on in crypto.

Disclosure Learn Extra

The chief in blockchain information, CoinDesk is a media outlet that strives for the very best journalistic requirements and abides by a strict set of editorial policies. CoinDesk is an impartial working subsidiary of Digital Forex Group, which invests in cryptocurrencies and blockchain startups.