Ripple has emerged (mostly) victorious from its long-running bat

|

Ripple has emerged (mostly) victorious from its long-running battle with the Securities and Exchange Commission (SEC), but for legal experts, the case’s conclusion feels like a missed opportunity.

Since the case didn’t advance to a higher court, Judge Analisa Torres’ original district court decision — which famously differentiated between XRP sales to institutional investors and those on exchanges — has not established a binding precedent.

For the wider industry, the case’s murky status leaves companies struggling with unanswered questions: How should token offerings be structured? What legal weight does Torres’ decision really carry? And what happens now that the SEC seems to be pivoting away from enforcement-heavy tactics?

Add to this the broader context of evolving frameworks overseas, including the EU’s MiCA regulation and Hong Kong’s move to position itself as a global Web3 hub, and it becomes clear that the Ripple case is just one part of a rapidly shifting legal landscape.

To understand the true impact of the case’s resolution, Magazine brought together legal experts from across the globe: Charly Ho of Rikka from the US, Yuriy Brisov from Digital & Analogue Partners in Europe, and co-chair of Hong Kong Web3 Association Joshua Chu. Together, they unpack what Ripple’s “win” really means for crypto law, and whether the industry is any closer to clarity than it was four years ago. This discussion has been edited for clarity and length.

Magazine: What implications does the end of the long running case have for other crypto firms?

Ho: There were lots of hopes about increased clarification. It was a partial win for the SEC, a partial win for Ripple; and then the SEC was going to appeal the decision that was not favorable for it, and then Ripple was going to appeal the decision for the portion of the decision that was not favorable for Ripple.

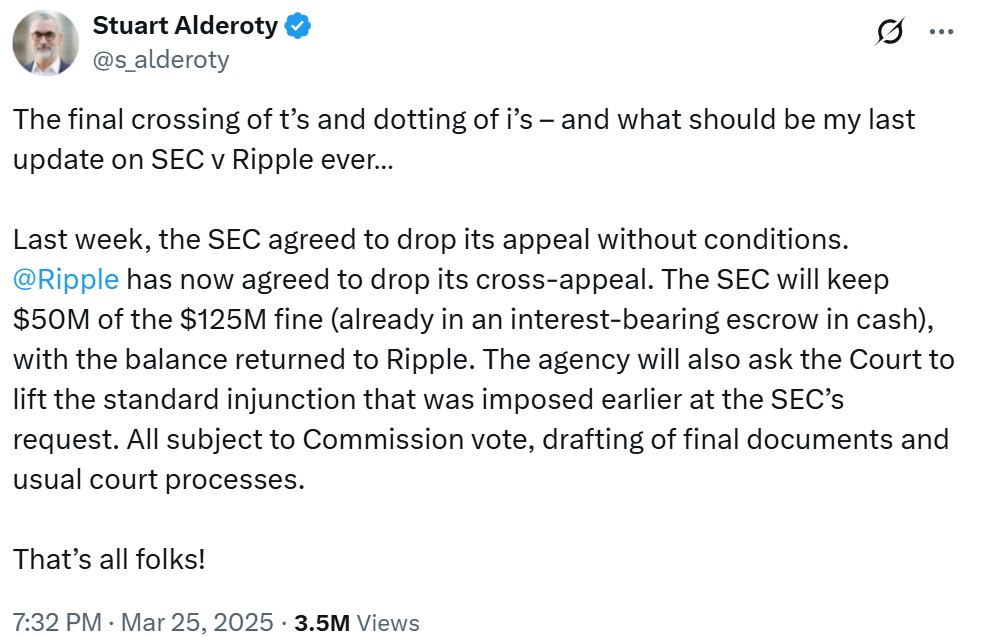

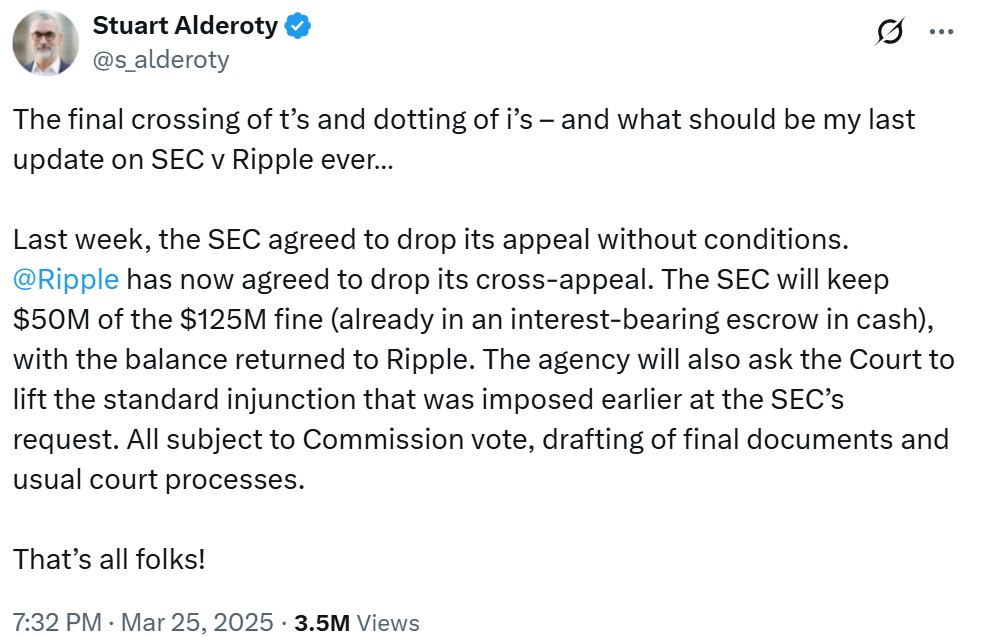

But because the SEC has now dropped the complaint and the claims against Ripple, part of the settlement discussions was Ripple agreeing to drop its appeal as well.

The challenge is that settlements are often confidential. So we may not get that clarity the industry seeks.

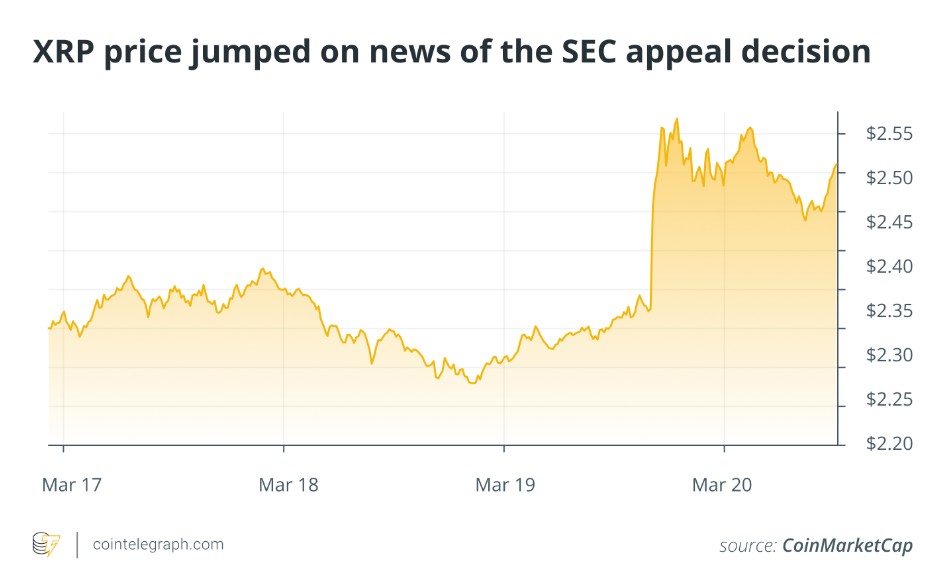

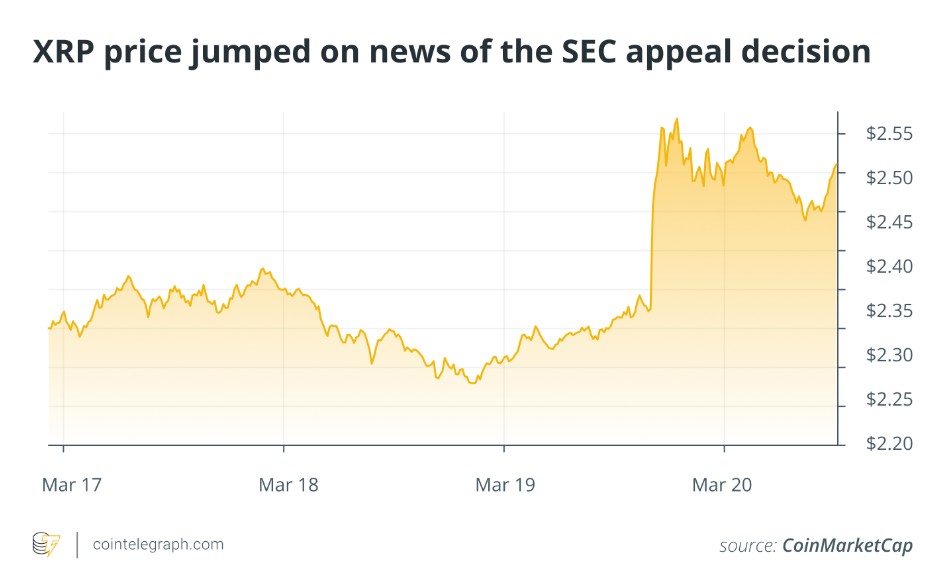

Brisov: This is probably good for Ripple as we saw with XRP price reacting. They still have to pay a fine but they won’t have to fight any longer. For the whole industry, it just means that the precedent that everyone was really expecting for over four years also would not happen. If you want your case to become a precedent in a circuit, it must reach the circuit level. This case didn’t.

But in SEC versus Coinbase and all the other crypto litigations at the moment, they’re already citing this decision. However, it’s just a persuasive authority. It’s like the court decision from another jurisdiction, or the opinion of an expert or a scholar. It didn’t create a binding legal precedent, but I think that future handbooks and university programs will definitely cite this case to teach the new generation of digital lawyers.

Magazine: Does that mean this case can’t be used as a precedent?

Ho: The district court decision is still legal precedent. The judge still gave a ruling. I think it’s not fair to say it’s not legal precedent in any sense of the meaning of the word, but it is not as clear as we would have liked, because Judge Torres is one judge. There were other judges actually in the same court that ruled differently, like in cases like the Terraform Labs case.

Chu: It’s actually a missed opportunity insofar as legal development is concerned.

Magazine: Ripple was hit with a “bad actor disqualification” under Rule 506 of Regulation D. What does that mean and is this restriction still in place?

Brisov: Crypto projects usually use Reg D, which means offering securities to other institutional investors in the US. It’s not a public offering but rather a private offering.

When you’re considered a bad actor, it means that you violated the rules of Reg D in violation of the securities laws. This means that you’re banned from using this regulation for five years.

This decision stays. So Ripple won’t be able to offer any more institutional deals with VCs for their tokens.

Read also

Features

Australia’s world-leading crypto laws are at the crossroads: The inside story

Features

Crypto Is Alive and Well, Though Skeptics Say It’s ‘Not Money’

…

cointelegraph.com