Whereas the Small Enterprise Administration, which runs the PPP, has seen enhancements in funds reaching smaller companies, administration officer

Whereas the Small Enterprise Administration, which runs the PPP, has seen enhancements in funds reaching smaller companies, administration officers instructed reporters Sunday night time that they had been limiting entry to this system to push lenders to do much more to work with the smallest employers. 98 % of small companies have fewer than 20 staff, in response to the Biden administration.

“Throughout that two-week interval we would like lenders to be actually centered on serving present purchasers which are within the under-20-employee class after which going out proactively to seek out new small companies with below 20 staff to assist,” one administration official stated.

The announcement marks the newest twist within the operation of the PPP, which has made obtainable greater than $648 billion to companies since its creation final March. This system has been vastly in style however has confronted a sequence of controversies associated to loans that originally went to massive corporations, unclear guidelines for lenders in addition to important fraud.

Most not too long ago, the SBA confronted complaints that anti-fraud measures it imposed within the newest iteration of this system in response to criticism final yr had been too stringent, forcing it to rethink its safeguards towards scammers so reputable companies did not face delays in receiving help.

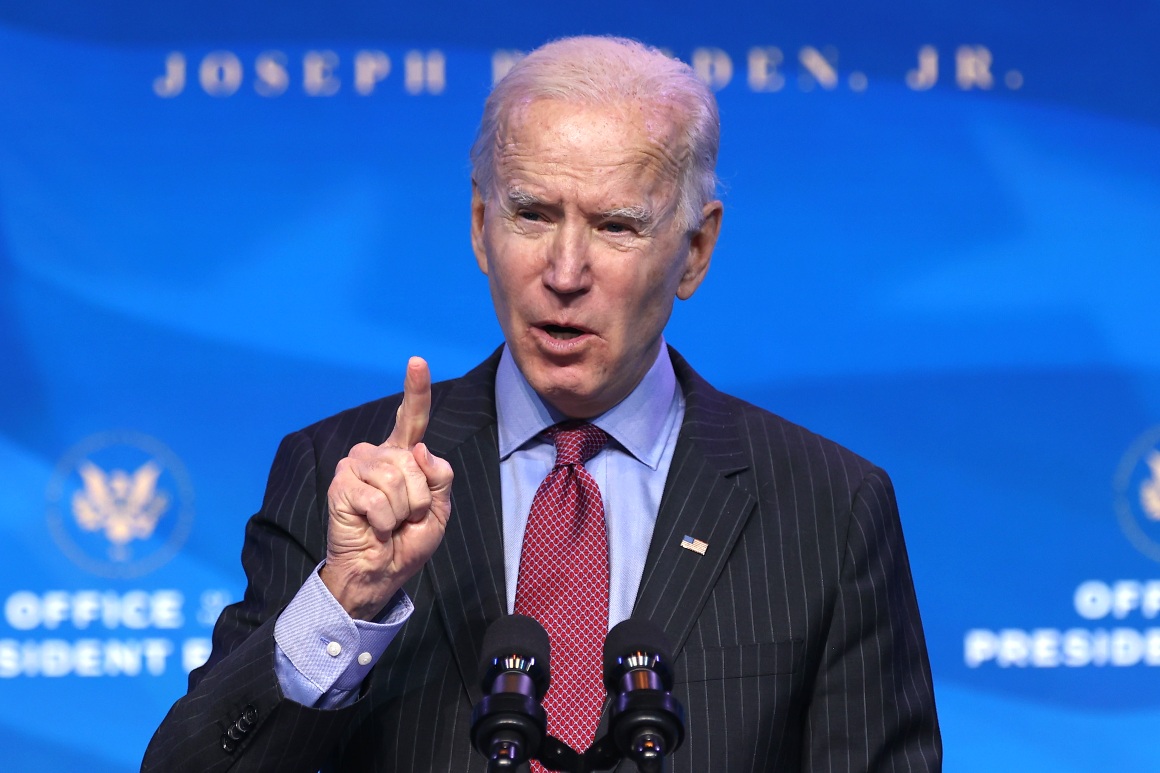

Monday’s announcement will mark President Joe Biden’s first main transfer to place his stamp on this system. It displays his pledge to make financial fairness a prime precedence. The administration plans to temporary lenders on the plan right now.

Along with the window for small companies to use, the administration will take different steps to increase PPP entry to underserved companies.

The upcoming PPP adjustments embody altering eligibility calculations in order that sole proprietors, impartial contractors and self-employed people obtain extra funds. The administration stated it additionally deliberate to put aside $1 billion for companies which are in that class and are positioned in low-and-moderate-income areas.

As well as, the SBA will eradicate restrictions on enterprise house owners with non-fraud felony convictions and people delinquent on their federal pupil loans. The company will even make clear that enterprise house owners who’re non-citizen, U.S. residents can use Particular person Taxpayer Identification Numbers to use for aid.

Whereas many companies will likely be prohibited from making use of throughout the two-week window deliberate by the SBA, administration officers stated they anticipated bigger employers to have loads of time to use for PPP loans earlier than lending authority expires on March 31. Additionally they stated purposes submitted by bigger companies earlier than Wednesday would proceed to be processed and wouldn’t face a delay.

The $1.9 trillion financial help invoice that Biden is searching for would offer one other $7 billion to PPP nevertheless it doesn’t lengthen the lifetime of this system. An administration official instructed reporters Sunday that if Congress needed to pursue an extension, “we’ll think about it then.”