“Three and a half years of rollbacks dealing with severe litigation ensures a number of issues are ‘to-be-decided,’” mentioned Wayne D’Angelo, an

“Three and a half years of rollbacks dealing with severe litigation ensures a number of issues are ‘to-be-decided,’” mentioned Wayne D’Angelo, an vitality lawyer and associate at authorized agency Kelley Drye who has represented oil and fuel corporations and commerce associations on federal environmental points.

Extra basically, oil and fuel executives advised POLITICO, the president doesn’t actually perceive their enterprise — and his famously chaotic White Home has arrange a system the place solely a relative handful of favourite vitality executives have entry to individuals who can form coverage.

“I don’t assume it’s one in every of these items the place we as an business get in a room and say, ‘Man that was a great 4 years,’” mentioned one business govt who requested anonymity as a result of they weren’t licensed to provide their opinion to the media. “It was extra like ‘meh.’”

Added Stephen Brown, a long-time vitality lobbyist, “It’s a blended bag at greatest.”

POLITICO spoke with greater than a dozen folks tied to the business — from oil executives in Oklahoma and North Dakota to lobbyists and legal professionals in D.C. and Houston, a few of them talking anonymously to guard their relationships in an administration which will nonetheless be in energy after the November election. Whereas almost all agreed that Trump’s supportive feedback and company tax cuts have been welcomed by the business, they have been almost unanimous in additionally describing an administration that almost all felt has finished little that can survive court docket challenges and even, in some circumstances, actively harmed their total enterprise.

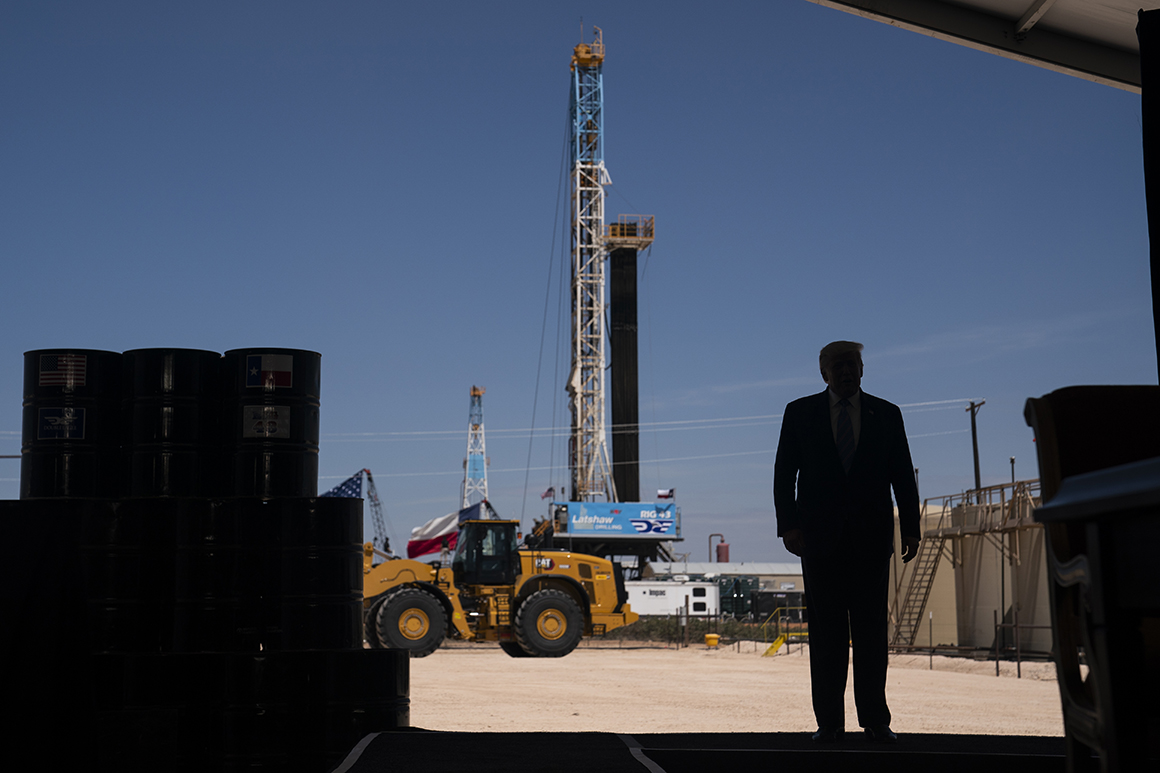

Trump has definitely promised to spice up the fortunes of fossil fuels. He’s bragged about document vitality manufacturing throughout rallies with oil-patch voters in states like Pennsylvania and Texas, whereas taking credit score for an April deal between OPEC and Russia geared toward propping up gasoline costs because the pandemic despatched demand plummeting. And after final week’s remaining presidential debate, he’s been making an attempt to persuade voters that Democrat Joe Biden plans to wipe out the oil business if he wins the White Home.

However together with the rising variety of bankruptcies, the oil and fuel sector’s debt has skyrocketed by a 3rd to nearly $180 billion. U.S. oil manufacturing has slumped by 1 / 4 from document ranges hit up to now yr, nearing ranges final seen throughout Trump’s first yr in workplace. Exports of oil, which started in the course of the Obama administration, have dropped. Vitality analysts at Platts Analytics anticipate U.S. oil shipments — which the administration had cited as proof of the nation’s “vitality dominance” — will drop by a couple of third subsequent yr from 2020 ranges.

In a symbolic indignity, the Dow delisted Exxon Mobil after greater than 90 years to make room for software program big Salesforce “to raised replicate the American financial system.”

Although a few of that ache stems from the pandemic, the business was wobbling even earlier than Covid-19 struck. Firms ended 2019 on a weak notice, shutting down drilling rigs and shedding employees due to overproduction of oil.

Oil and fuel corporations, as soon as among the many world’s most influential, are confronting a brand new set of realities, with main gamers like BP and Shell forecasting a peak in international oil demand within the subsequent few years as governments throughout the globe search to construct low-carbon economies to fight the rising threats from local weather change.

Rising and falling fortunes

Regardless of the general disappointment, many within the business nonetheless say it’s a serious victory having a backer like Trump within the White Home.

“I’ve been within the enterprise since 1982,” mentioned Robert Blair, a staunch Trump supporter and chief govt of Comanche Exploration, an oil and fuel exploration agency primarily based in Oklahoma. “I take into account this administration to be essentially the most oil-and-gas pleasant administration in my profession. By a protracted shot.”

Technological advances had lifted the business’s fortunes because the finish of the George W. Bush administration: The U.S. grew to become the world’s largest pure fuel producer in 2011, as fracking unlocked the gasoline trapped in shale fields in states like Texas and Pennsylvania, and took the highest international spot in crude oil output from Saudi Arabia in 2018 after a decadelong enlargement of that fracking know-how to grease fields.

Like different highly effective firms, oil and fuel corporations additionally scored an unequivocal win from the company tax minimize that the GOP-controlled Congress handed in 2017, which decreased the charges that corporations pay on earnings from 35 to 21 %.

However the overwhelming majority of business gamers advised POLITICO that the Trump administration total hasn’t delivered the concrete advantages they’d hoped for.

Sure, Trump signed laws in 2017 to permit drilling in Alaska’s long-protected Arctic Nationwide Wildlife Refuge. However he not too long ago reversed course to remove an even bigger prize by extending a drilling moratorium off Florida’s Gulf Coast in a bid to woo voters within the essential swing state.

That transfer additionally imposed a decadelong ban on drilling off the coasts of a number of mid-Atlantic states. It was a stark turnabout from an order Trump signed early in his time period directing the Inside Division to hasten exploration and potential drilling in all federal waters.

The reversal shocked the oil and fuel business, which had been anticipating the administration to open these areas to drilling after the election.

“What acres have they opened that we actually wished? None,” mentioned the business govt, whose firm has offshore drilling operations. “And the moratorium was very unhelpful.”

Rushed rollbacks

Oil executives additionally fear that Trump’s businesses have been so haphazard in rolling again a long time of environmental rules that that the courts will intestine these strikes. That’s assuming that Democrats don’t get an opportunity to reverse them by profitable large in November.

“If this finally ends up being a one-term administration, little or no of the regulatory adjustments will stick,” mentioned Richard Revesz, director of the Institute for Coverage Integrity at New York College, which displays lawsuits introduced towards all of the administration’s departments. “The Trump administration has tried to do lots, however it’s finished it in a very sloppy method.”

In keeping with the institute, courts with judges appointed by Democrats and Republicans have to this point dominated towards about 84 % of the 90 vitality and environmental rules, steerage paperwork and different actions by the Trump administration. Earlier Democratic and Republican administrations had a median of 30 % of their actions hit authorized obstacles.

Within the Trump period, these courtroom setbacks have included a federal choose in Montana ruling towards oil and fuel leasing plans accredited by an company head who by no means acquired Senate affirmation and the U.S. Supreme Courtroom’s rejection of EPA’s proposal for how you can decide if a enterprise’ groundwater discharge violated the Clear Water Act.

Different Trump administration actions, such because the ANWR approval, are susceptible to being reversed if Democrats take management of the White Home and the Senate. A Democratic Senate and Home may additionally undo any late-term Trump rules utilizing its Congressional Evaluation Act powers, a tactic Republicans utilized in 2017 to erase some Obama administration guidelines.

White Home spokesperson Judd Deere rejected the notion that the administration hasn’t delivered, and the administration has blamed “activist judges” for courtroom reversals.

“President Trump has rolled again dangerous rules, streamlined allowing, invested in infrastructure, and secured vitality independence for the nation,” Deere mentioned. “Anybody who means that his vitality insurance policies haven’t been profitable is misinformed.”

The administration did get some assist from a federal choose earlier this month on one in every of its largest priorities: The choose dominated that Barack Obama’s Inside Division had exceeded its authority in requiring corporations to curb emissions of the potent greenhouse fuel methane from oil and fuel operations on federal land. The ruling got here simply in time to stop the Obama-era regulation from going again into impact, after one other federal court docket had rejected the Trump administration’s effort to exchange it.

However Trump’s bold deregulatory effort — geared toward rushing up the challenge critiques required below the decades-old Nationwide Environmental Coverage Act — has been marred by sloppy writing, mentioned Dan Eberhart, chief govt of oil services-company Canary LLC and a serious Republican donor who has been usually supportive of Trump. That might make it simple for greens and conservation teams to make use of the courts to dam tasks they consider didn’t obtain strong environmental vetting.

“The environmental evaluate course of definitely wanted to be streamlined, however now tasks could also be targets for reversal after Trump leaves workplace as a result of opponents will argue the environmental course of has been shortchanged,” Eberhart mentioned. “Modernizing NEPA wanted to be finished. The method is best now. However I anticipate tasks are additionally extra susceptible now.”

Fuel export whiplash

Different missed alternatives and self-inflicted wounds embody the Trump administration’s makes an attempt to assist corporations export extra liquefied pure fuel, business officers mentioned.

The Obama administration issued the primary permits for fuel exports, profiting from the bounty created by the fracking increase, however the vitality business complained that its course of was too gradual and costly. Obama’s businesses additionally warned would-be exporters to avoid Chinese language funding of their tasks due to fears of mental property theft.

The Trump administration, in distinction, has gone all out in selling pure fuel exports — even to China. Regulators accredited fuel export tasks at a sooner clip, and Trump himself touted the advantages of LNG from the U.S. throughout a 2017 journey to Beijing.

However then Trump ramped up commerce tensions with China, and the LNG shipments to the world’s largest market — which had been steadily climbing — fell to zero for a yr.

“They’ve finished their greatest to be as useful as potential in selling the business and LNG as a complete,” mentioned Charlie Riedl, govt director of the Middle for Liquefied Pure Fuel, a commerce group. “They do no matter they’ll, actually.”

“However however,” Riedl continued, “they began a commerce warfare with the world’s largest purchaser of LNG, China.”

Commerce tensions successfully killed many of the progress potential for U.S. pure fuel exports and have far outweighed something good the administration has provided the LNG business, others within the business mentioned.

China resumed shopping for LNG cargoes once more in March below an settlement to restart purchases of some U.S. commodities, in line with authorities knowledge. However Chinese language traders are nonetheless staying away from investments in U.S. tasks below Communist Occasion directions, folks within the business mentioned, an indication that commerce tensions are nonetheless simmering below the floor.

Then got here the administration’s incapacity to gradual the unfold of the coronavirus. The ensuing financial collapse has suppressed gasoline demand as folks keep dwelling to keep away from getting contaminated, hammering the business additional.

“To the diploma that the U.S. bungled its dealing with of the pandemic in comparison with different sovereign states, that’s a macroeconomic drag on the vitality sector,” mentioned Richard Sawaya, a longtime enterprise lobbyist now engaged on behalf of oilfield companies big Halliburton.

All through these setbacks, business officers have complained in regards to the Trump administration’s dearth of certified workers. The dearth of political appointees with vitality expertise has left Trump prone to persuasion by different trusted executives and donors, together with Continental Sources Govt Chairman Harold Hamm, who sparked an oil increase in North Dakota, and Vitality Switch Companions CEO Kelcy Warren, who not too long ago donated $10 million to fundraising teams backing Trump’s reelection marketing campaign. Each have had quick access to Trump to advertise pet points resembling Vitality Switch’s Dakota Entry pipeline, whereas the business as a complete was left with few levers of affect.

“The vitality coverage mechanism for the president is thru particular person donors and pals who he’ll have a dialog with at a fundraiser and take motion the following day,” mentioned one one that has lobbied the administration who requested anonymity to talk frankly. “However there’s no significant course of to push vitality points by way of the quote-unquote ‘system’ within the White Home.”

Most firm officers have been left to work together with Francis Brooke, an financial adviser who reviews to Nationwide Financial Council Director Larry Kudlow. Vitality business officers described Kudlow, a former cable TV monetary information host, as not all the time having the bandwidth or experience essential to cope with a notoriously technical business.

Nonetheless, almost each individual interviewed mentioned they have been game-planning for a potential Biden administration. Some say they’re ready to see if the previous vice chairman reverts to the centrist insurance policies he espoused throughout his three a long time within the Senate, or whether or not he’ll shift left towards the get together’s progressive wing.

If it’s the latter, some sources mentioned they anticipate to be in worst of all positions: “Slaughtered like pigs at a trough,” as one govt put it.

Biden has promised to ban new oil and fuel leases on public land, which might all however drive the business to tug again to fields in West Texas and different privately held acreage. He would additionally probably crack down on methane emissions and spend money on the wind and photo voltaic business, which is already consuming away on the fossil sector’s market share. Although he’s insisted he wouldn’t search to ban fracking nationally, his feedback from the second presidential debate that he wished to transition away from the oil business didn’t allay fears within the oil sector, regardless that Biden walked again his remarks.

The one method for the business to search out the regulatory stability it says it craves can be for Congress to move laws enshrining Trump’s vitality and environmental insurance policies into legislation. That will make it tougher for future administrations to make use of govt actions and company rules to reimpose rules Trump has weakened.

“Whether it is true, or the notion is true, that this administration has been extra aggressive and deregulatory than most, you possibly can comply with that the following administration goes to tug that pendulum as far again, if not additional,” D’Angelo mentioned. “However it doesn’t appear to me that the pendulum is swinging backwards and forwards to search out equilibrium. The pendulum is swimming additional in every election, swinging additional out.”