By Daybreak Pennington Generally, a development that you ju

By Daybreak Pennington

Generally, a development that you just need to play — like privacy-focused search engine DuckDuckGo or highway security drone/AI firm RoadBotics — doesn’t have a viable public solution to spend money on it.

That does not imply you might have miss out. You’ll be able to play right this moment’s hottest tendencies proper on the general public markets … even when an organization by no means IPOs.

The REIT Solution to Play Hashish

Say you wished to make the most of the explosion of brick-and-mortar hashish dispensaries which have popped up over the previous eight years.

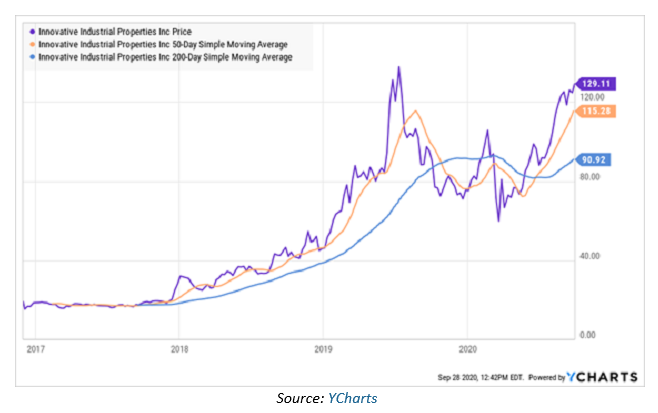

Modern Industrial Properties (IIPR) grew to become the primary listed hashish Actual Property Funding Belief in 2016. That was marijuana legalization’s greatest 12 months… one-fifth of the nation lived in a state that had made it authorized in a roundabout way.

Irrespective of the place you or I personally stand on this matter, it was clear that some states had been transferring ahead. All the businesses that may come and go over the following essential years would wish bodily house to develop, course of, and promote product.

REITs are primarily autos for buyers to pool their cash collectively to spend money on actual property property.

And IIPR shareholders might have made some huge cash.

There’s additionally the bonus that REITs are required to pay out 90% of their taxable earnings to unitholders. IIPR’s final dividend announcement, payable in October, was for $1.17 per share. It’s paid out $7.81 per share since then as effectively.

REITs supply one solution to open a secret door to personal corporations. This is one other…

Hit a Bull’s-Eye With This BDC

Enterprise growth corporations, or BDCs, supply the identical entry for these “within the know.”

BDCs had been created in 1980 when Congress handed an modification to the “Funding Firm Act of 1940.” This created a brand new class of corporations that would supply companies with debt and fairness capital. And they might give buyers a chance to spend money on personal, small and mid-sized US corporations.

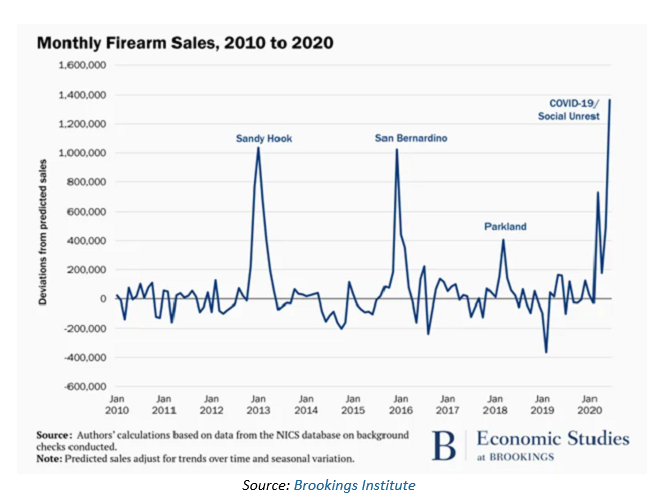

One BDC on my radar is Compass Diversified Holdings (CODI) as a solution to play the current spikes in firearm gross sales.

This chart relies on background verify knowledge and never essentially firearms bought. Nevertheless it does present some particular spikes over the previous 10 years… the best being in 2020.

Based on a July Wall Avenue Journal article, massive pops in gun gross sales had been usually a results of gun aficionados and Second Modification supporters stocking up.

However this time round, sellers estimate that 40% of gross sales are going to first-time patrons.

I’m not right here to argue for or in opposition to weapons. I’m right here to level out that I noticed this development and wished to spend money on one thing slightly totally different… gun safes.

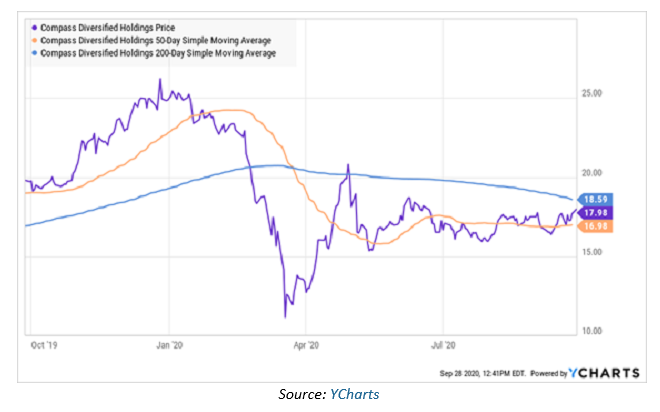

CODI: The Final “Protected” Funding

These new gun homeowners are going to want to start out eager about the place they could retailer their firearms and ammo. It must be away from the palms of the grandchildren or anybody with sticky fingers.

And actually, the necessity for safes comes from extra than simply weapons…

Some individuals determined that that is the 12 months to replenish on shiny metals… some individuals determined to replenish on money.

What I discovered was that gun protected corporations are all personal, together with Liberty Protected, which holds the most important market share within the protected & vault manufacturing business.

Connecticut-based Compass, nevertheless, bought 96% of that firm in 2010.

Since then, Compass been working with administration to broaden manufacturing capabilities and pursue natural development initiatives.

Even when you do not personal considered one of its Liberty safes, you may need one other of its merchandise in your house.

For those who’ve ever used a chafing dish, for instance, chances are high the gasoline that you just used to maintain your meals heat got here from The Sterno Group—considered one of Compass’s holdings.

CODI additionally holds different corporations like child provider maker Ergobaby… tactical gear vendor 5.11… and gun and ammo maker Velocity Out of doors.

BDCs are additionally required to pay out most of their taxable earnings to unitholders. CODI at the moment pays out 36 cents each quarter.

At a present worth of round $17.28, that’s an 8.1% yield.

In our zero-interest price world, this can be a nice income-generating play so as to add to your portfolio. One that ought to see a surge in earnings because of the tendencies of 2020.

Daybreak Pennington is the Editorial Director at Mauldin Economics.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.