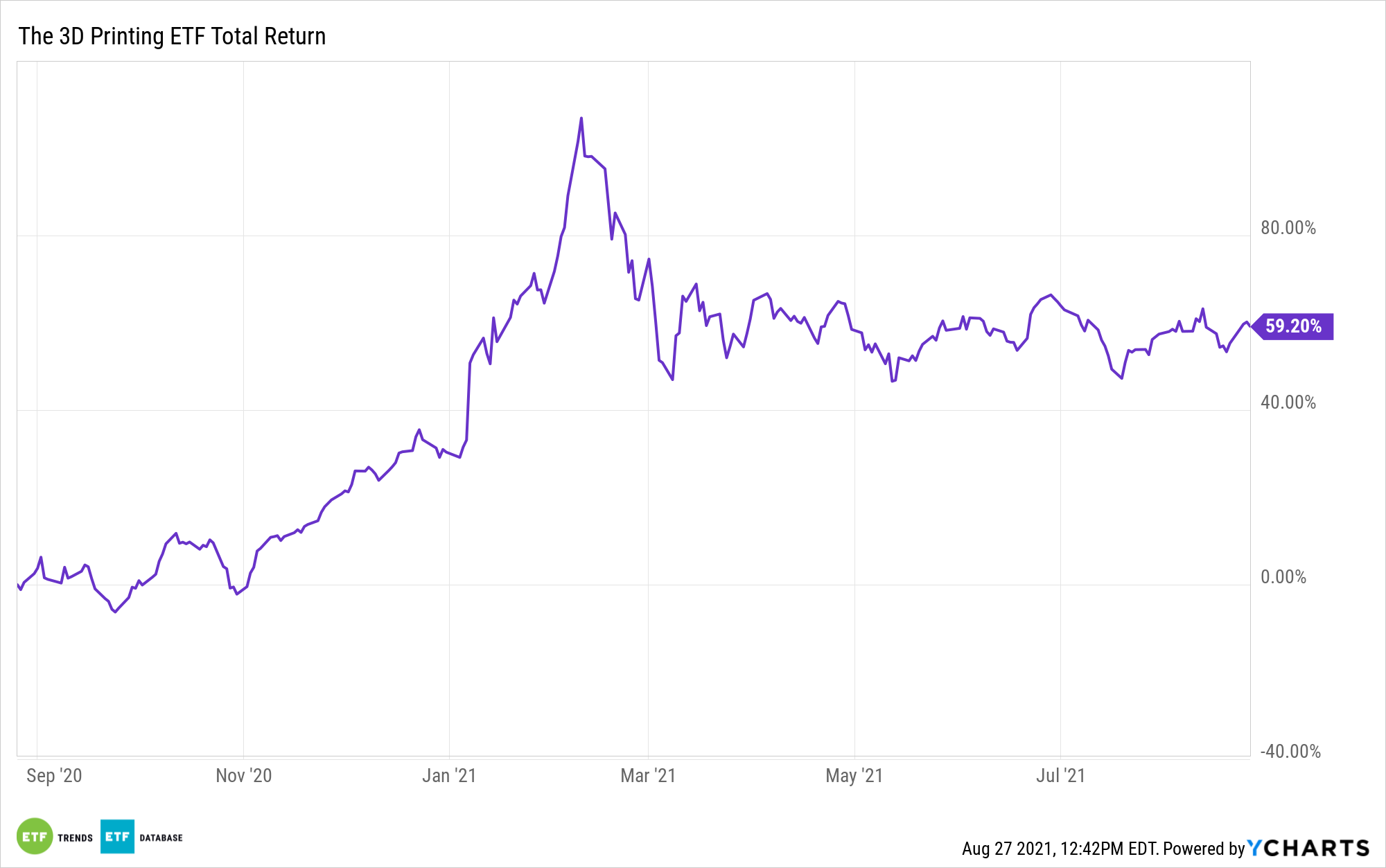

The ARK 3D Printing ETF (CBOE: PRNT) is greater by nearly 2% over the previous month. Whereas that won’t sound like a lot for an usually high-flying change traded fund, latest bullishness in PRNT may very well be the beginning of one thing extra substantive.

With a slew of industries, from vehicle manufacturing to healthcare to industrial conglomerates, discovering the associated fee efficiencies and lowered provide chain issues supplied by 3D printing, the long-term outlook for PRNT is brilliant.

“Now industries together with manufacturing, schooling and well being care are beginning to incorporate the distinctive versatility of 3D printing into their workflows,” experiences Ian Bezek for U.S. Information & World Report. “Moreover, the pandemic disrupted provide chains, elevating the utility of on-site manufacturing choices for key components. As industrial adoption of 3D printing grows, the potential market for shares on this {industry} grows with it.”

The $556 million PRNT is dwelling to 56 shares, which is a reasonably expansive lineup when contemplating that 3D printing is not an previous {industry}. That depth could be, partially, attributed to the Complete 3D-Printing Index, PRNT’s underlying index. That benchmark incorporates a broad strategy to an {industry} that many buyers suppose is slim, and the result’s a stunning quantity of depth.

“The Complete 3D-Printing Index makes an attempt to trace the value actions of shares of corporations concerned within the 3D Printing {industry}. The Index consists of fairness securities and depositary receipts of change listed corporations from the U.S., non-U.S. developed markets and Taiwan which might be engaged in 3D printing associated companies throughout the following enterprise strains: (i) 3D printing {hardware}, (ii) laptop aided design and 3D printing simulation software program, (iii) 3D printing facilities, (iv) scanning and measurement, and (v) 3D printing supplies,” in line with the index supplier.

Talking of attention-grabbing industry-level intersections, PRNT is likely one of the largest holdings within the newly minted ARK Area Exploration and Innovation ETF (ARKX). That is not a ploy by ARK to get extra eyeballs on PRNT through ARKX. Relatively, 3D printing has credible, significant purposes within the aerospace and protection {industry}.

“Protection has seen 3D printing infiltrate the manufacturing of a number of platforms, such because the printing of plane components, unmanned aerial automobiles (UAVs), submarine hulls, and elements for armoured car,” experiences Aerospace Expertise.

A number of ARKX member corporations, together with Dow element Boeing (NYSE:BA) and Lockheed Martin (NYSE:LMT), are already often utilizing 3D printing in varied manufacturing processes.

For extra on disruptive applied sciences, go to our Disruptive Expertise Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com