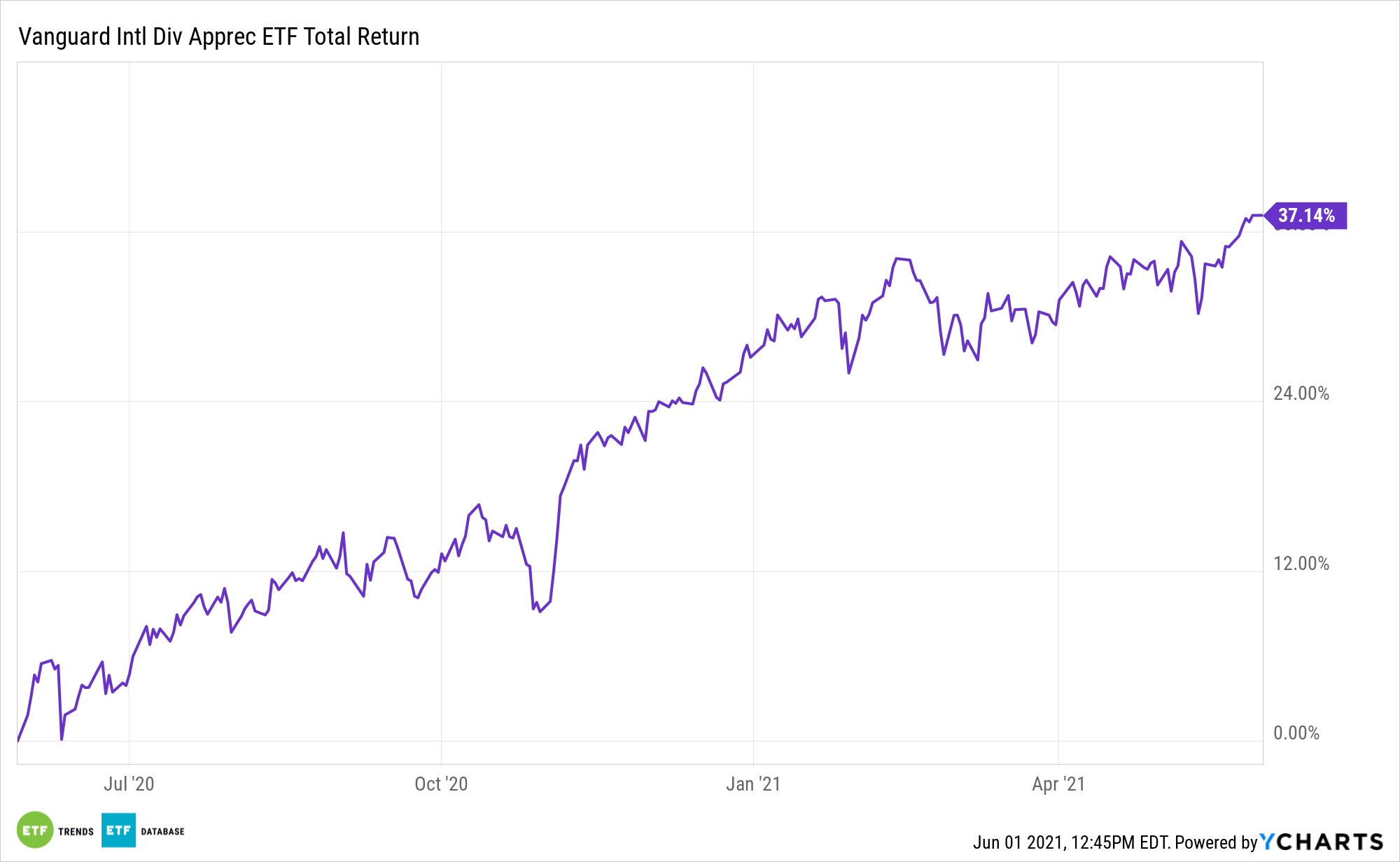

There is a dividend resurgence brewing in 2021, however that development is not confined to home shares. After paring or suspending payouts following the onset of the coronavirus pandemic, loads of worldwide corporations wish to restore and develop their payouts.

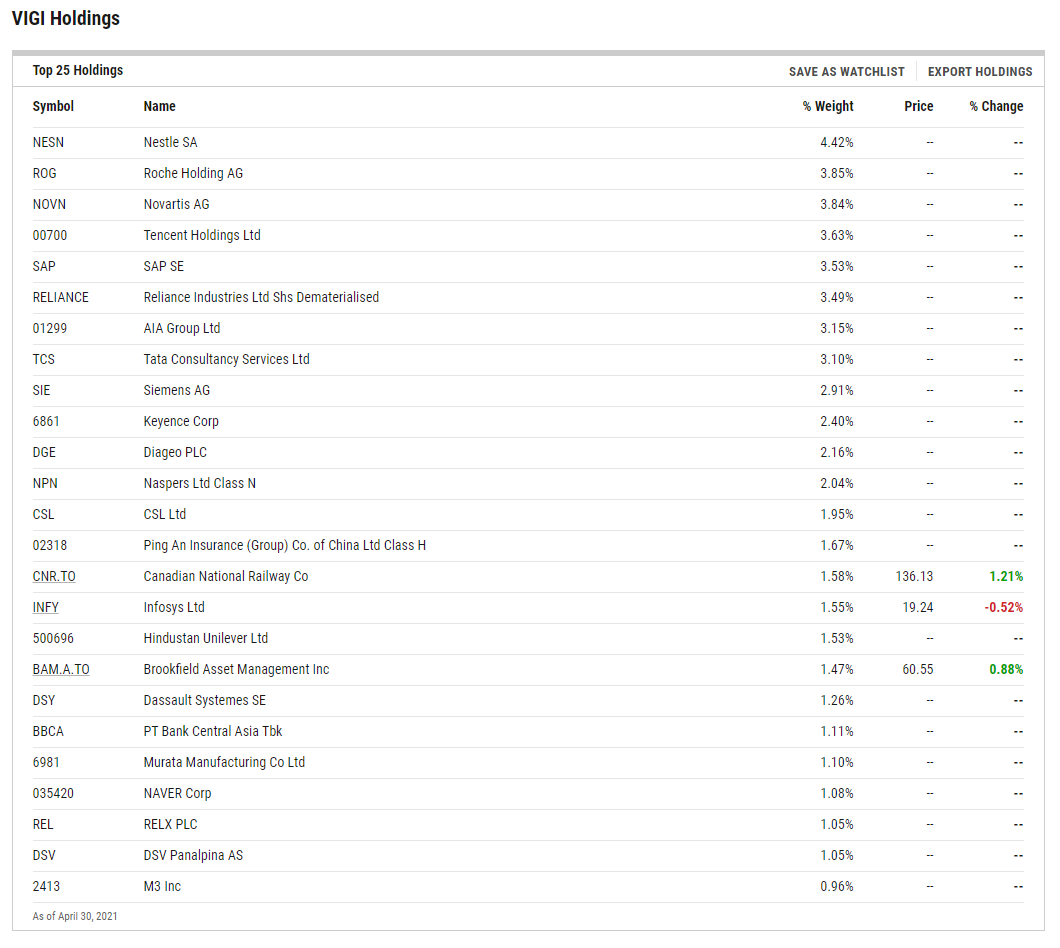

That might carry the Vanguard Worldwide Dividend Appreciation ETF (NasdaqGM: VIGI) into focus. VIGI tracks the NASDAQ Worldwide Dividend Achievers Choose Index. The fund is a world offshoot of the beloved Vanguard Dividend Appreciation ETF (NYSEArca: VIG), the most important home dividend trade traded fund by property.

Past the plain distinction in geography, the first distinction between the 2 funds is that VIG’s parts should have a minimal dividend enhance of 10 years whereas VIGI parts are required to have payout hike streaks of seven years. These mandates are vital as a result of some ex-U.S. markets are coming off stretches of dividend duress.

“After a really unhealthy yr in 2020 which noticed document declines in European dividends, we’re inspired to see them coming again rapidly and strongly,” in response to Janus Henderson analysis.

Practically 40% of VIGI’s 292 holdings are European corporations, a positioned bolstered by a 16.3% weight to Switzerland – one of many steadiest dividend locations in Europe. Due to annual funds by prescription drugs giants Roche and Novartis, VIGI’s second- and third-largest holdings, respectively, Switzerland was the third-largest international dividend payer within the first quarter behind the U.S. and the U.Okay, in response to Janus Henderson.

Extra Than European Energy to ‘VIGI’

European dividends are bouncing again and that would show helpful for VIGI within the again half of 2021, however the fund is pushed by extra than simply Europe. The developed Asia-Pacific area, together with Japan and Australia, are contributors to the VIGI story too.

Japanese corporations have a number of the strongest steadiness sheets on the earth, and after years of being tight-fisted with their money, corporations on the earth’s third-largest economic system have more and more embraced shareholder rewards reminiscent of buybacks and dividends. In Australia, payouts are on firmer footing due to hovering commodities costs, that are supporting payout hikes amongst mining corporations.

“We count on to see extra large payouts from miners within the coming months, offering a big enhance to the Australian dividend whole,” added Janus Henderson.

Japan and Australia mix for 18.3% of VIGI’s geographic weight, in response to Vanguard information.

All in all, VIGI will not be a devoted developed markets fund. It allocates nearly 26% of its weight to rising markets shares. Constructive first-quarter motion in creating economies was largely led by Brazil, India, and Malaysia, in response to Janus Henderson. India is VIGI’s third-largest nation publicity at 12%.

For extra information, info, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.