Women now occupy 30% of the seats on govt boards of the S&P 500 corporations, stories Bloomberg. Bloomberg discovered that 251 corporations as of July had a minimal of 30% feminine management when 13 extra seats have been added to govt boards.

The shift comes as a push for ESG is made each from buyers and by laws that require variety on boards of administrators and displays a elementary change for corporations. Whereas the typical variety of feminine administrators remained at 3.Three of a mean board measurement of 11 administrators, the addition of extra seats has pushed the share larger.

The give attention to gender variety is one which has been highlighted for an extended time frame. With pushes for higher racial and ethnic variety, extra adjustments lie on the horizon.

This month Nasdaq garnered SEC approval of a proposition that might require corporations that checklist on its exchanges to fulfill minimal variety necessities on the board, or else clarify why they aren’t in compliance.

Corporations that checklist shares on Nasdaq exchanges could be required to reveal race and gender, with the purpose of requiring U.S. corporations to have a minimum of one feminine director in addition to one other board member who self-identifies as both a racial minority or a member of the LGBTQIA group, in accordance with CNBC.

“These guidelines will enable buyers to achieve a greater understanding of Nasdaq-listed corporations’ strategy to board variety, whereas making certain that these corporations have the flexibleness to make selections that greatest serve their shareholders,” SEC Chair Gary Gensler stated in a press release.

As of 2020, Nasdaq present in a examine it performed that over 75% of the businesses itemizing on its exchanges wouldn’t have met the brand new authorised necessities.

‘ESGA’ Invests in All Facets of ESG

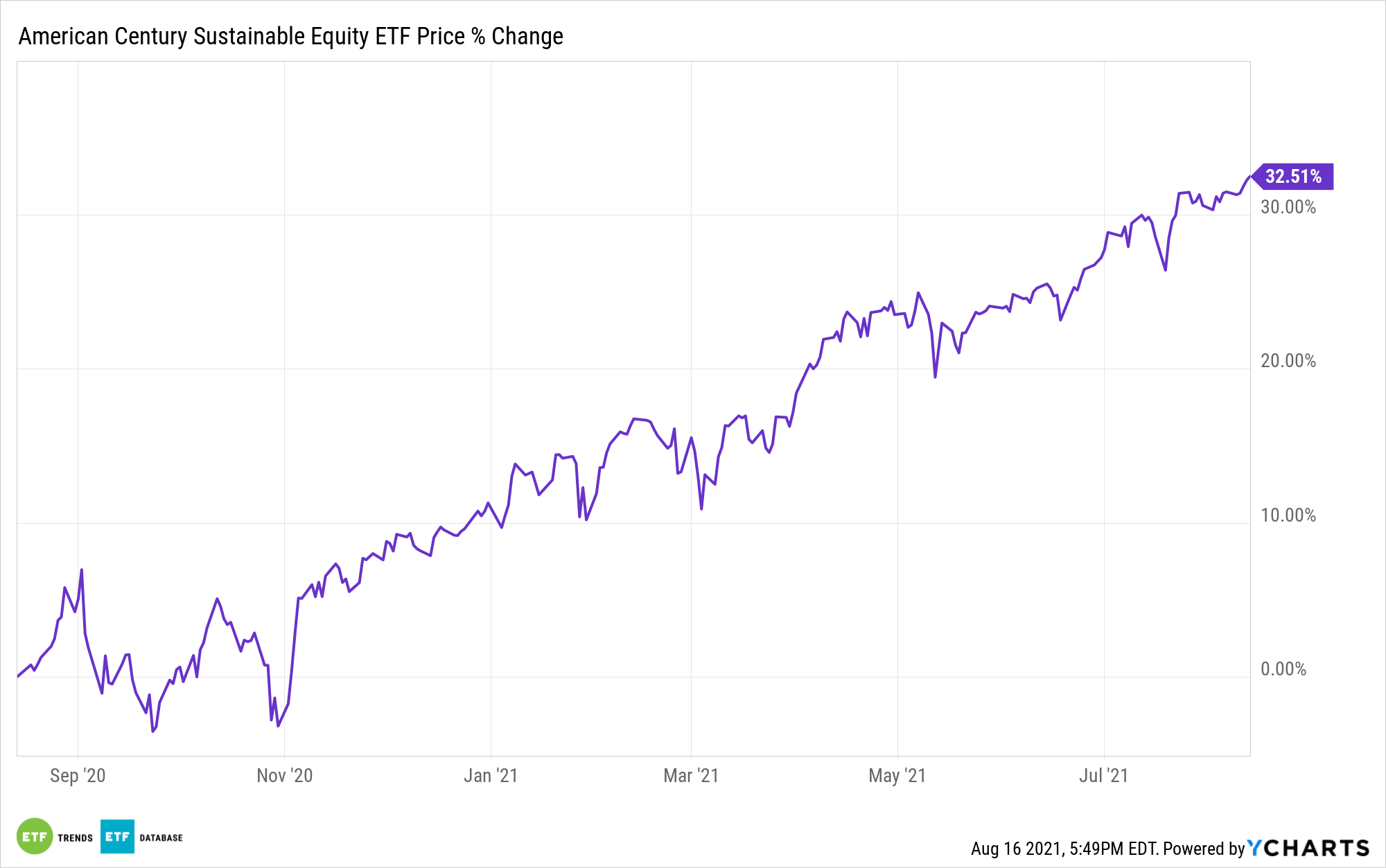

The American Century Sustainable Fairness ETF (ESGA) takes a holistic strategy when measuring the ESG efficiency of an organization, weighing environmental impression, turnover of staff, and company management to call just some. The fund invests in U.S. massive cap corporations with massive development and worth potential that rank extremely on ESG metrics.

ACI’s proprietary mannequin assigns a rating to every safety for monetary metrics and a separate rating for ESG metrics, then combines them for an general rating.

The best-scoring securities are chosen inside every sector, making a portfolio with robust efficiency and better ESG rankings than the shares within the S&P 500 Index.

The fund is a semi-transparent ETF, that means that allocations are disclosed on a quarterly foundation, not each day. As of its final disclosure, ESGA held corporations like Alphabet (GOOGL), House Depot (HD), and Microsoft (MSFT).

ESGA has a complete annual fund working expense of 0.39% and whole property of $150 million.

For extra information, data, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.