By Nick Erickson & John Sama, Sage Advisory Most ESG bu

By Nick Erickson & John Sama, Sage Advisory

Most ESG buyers would agree that local weather change danger is at or close to the highest of their listing of sustainability points. According to the US SIF Basis’s biennial ESG “Developments Report” launched Monday, local weather change stays the highest ESG subject for cash managers, who incorporate climate change danger components to $4.2 trillion in belongings.

The long-term financial penalties of local weather change span the monetary, housing and infrastructure, agriculture, and geopolitical safety sectors, to call just a few. A 2018 report from the Intergovernmental Panel on Local weather Change (IPCC) estimated that with only a 1.5°C warming of the planet, by the yr 2100 financial losses globally would complete $54 trillion – the mixed complete annual GDP of the U.S., European Union, and China.

As with most types of excessive occasion danger, it’s unattainable to foretell the precise timing, magnitude, and value of the following disaster. Not like black swan occasions, nevertheless, that are fully surprising, local weather danger is extra of a “identified unknown.” Whereas no particular person pure catastrophe will be instantly attributed to local weather change, growing temperatures globally create circumstances which can be extra conducive to the next frequency or severity (or each) of a large number of perils, together with hurricanes, extreme storms, floods, wildfires, and droughts.

Credit score Scores Start to Replicate Local weather Dangers

To acknowledge the impression local weather change can have on municipalities, credit standing companies have lately begun to issue such dangers into their evaluations. “We glance not simply on the vulnerability of state and native governments, however their skill to handle the impression,” stated Emily Raimes, Vice President with Moody’s Public Finance Group. “Whereas we’ll be wanting on the knowledge on rising sea ranges and who could also be extra weak, we’ll even be what these governments are doing to mitigate the impression.”[1]

Earlier this yr, Sage’s report Local weather Danger and Municipal Credit score Scores appeared on the relationship between cities’ credit score scores and their degree of preparedness for climate-related occasions.[2] Using the climate knowledge set from the Notre Dame World Adaptation Initiative (ND GAIN), Sage decided that municipalities with increased credit score scores, on common, mirrored decrease ranges of total local weather danger and have been typically higher ready to take care of their anticipated degree of climate-related danger.

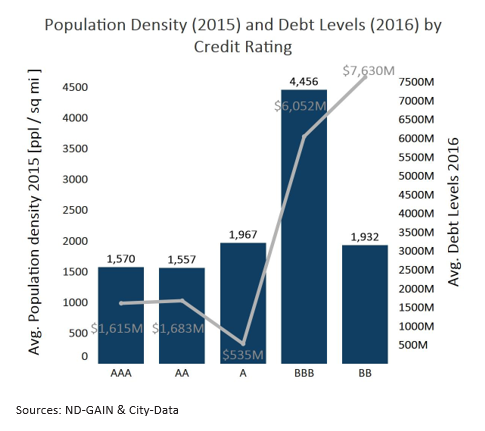

When it got here to evaluating local weather danger publicity, Sage’s research additionally discovered that inhabitants metrics mattered. Whether or not it was associated to inhabitants density for warmth, chilly, and drought danger, or the p.c of the population residing inside a flood plain space or excessive sea degree danger area, the underlying issue that had the biggest impression on a municipality’s perceived local weather danger was its inhabitants dimension and geographic placement. This relationship between inhabitants metrics, credit score high quality, and local weather danger is illustrated within the chart under.

In the case of local weather danger preparation, Sage discovered {that a} municipality’s total financial well being had the biggest affect over its respective local weather danger readiness rating. A municipality whose financial well being was good, as mirrored in its credit score worthiness, seemingly had ample monetary flexibility to help its group throughout adversarial climate-related occasions and was adequately ready for future re-occurrences. Then again, municipalities that had weaker basic financial conditions have been much less seemingly to have the ability to do both.

Municipalities Offset Dangers Via Funding

Governments giant and small depend on the $4.1 trillion municipal bond marketplace for a lot of their infrastructure work. Certainly, about two-thirds of infrastructure tasks in america are paid for by municipal bonds, and greater than 50,000 states, native governments, and different authorities have issued bonds to finance their work. That is necessary as a result of when local weather preparedness and the likelihood of adversarial occasion danger are unbalanced, it creates a domino impact. A municipality that’s unable to help its community when a major adversarial local weather occasion occurs is prone to see its residents relocate, and consequently, tax income declines. These circumstances typically result in additional erosion of a municipality’s already weak monetary situation. To fund the ensuing income hole, municipalities typically enhance their debt leverage by way of the sale of debt securities; and with a smaller and weaker tax base, they often discover their credit score scores begin to weaken.

“The place local weather danger is most related to municipalities is the place it may create an ‘acute income prescertain,’” stated Michael Rinaldi, senior director in Fitch Scores’ public finance group. “That is particularly the case for bonds backed by gross sales tax revenue the place a particular occasion can upend the financial system even for a brief time frame.”[3]

To mitigate these considerations, among the largest cities within the U.S. are beginning to fight the bodily dangers of local weather change by making investments. For instance, Kansas Metropolis, Missouri, signed a consent decree with the Environmental Safety Company (EPA) pledging $2.5 billion to improve its stormwater infrastructure, which handles each stormwater and wastewater and was constructed within the 19th century. Local weather change is causing Kansas Metropolis to expertise longer and bigger rainfall occasions, inflicting the stormwater infrastructure to overflow and spill air pollution into native lakes, streams, and rivers.[4] One other metropolis, Aurora, Colorado, developed and invested within the Prairie Waters challenge, which is designed to supply its rising inhabitants with a sustainable long-term water provide underneath drought conditions.[5] These are simply two examples of many. As of early 2019, cities have been collectively engaged on about 240 climate-related tasks totaling $47 billion, according to Moody’s Buyers Providers, which expects cities to subject a rising variety of bonds to assist finance these tasks.

Measuring & Pricing Local weather Danger is a Problem

Over the previous few years, the realities of local weather change have moved to the forefront of buyers’ minds, and a vital think about understanding and managing climate danger is making certain that it’s correctly evaluated and quantified. This is usually a tough proposition since previous local weather change knowledge could also be related to significantly completely different local weather circumstances that not replicate present danger. Moreover, the problem on this process is figuring out learn how to convert local weather knowledge right into a quantitative metric that may be included in credit score evaluation and, in the end, safety pricing. We imagine that it is necessary for ESG buyers to acknowledge that utilizing credit score scores along with a full local weather danger evaluation might help to include and quantify the related dangers related to local weather change in a securities valuation extra fully.

After recognizing the necessity to deal with local weather change dangers inside our ESG Municipal Bond Bodywork and leveraging the local weather insights supplied by the ND GAIN knowledge set, we have been in a position to create a local weather resiliency framework. This framework was constructed to operate as a separate part of our total ESG danger evaluation methodology and to supply a local weather resiliency issue that may very well be utilized to the municipal tasks which can be accredited inside our total ESG framework.

Sage’s Evaluation of ESG Impression + Local weather Resiliency + SDGs Alignment

ESG Impression Methodology

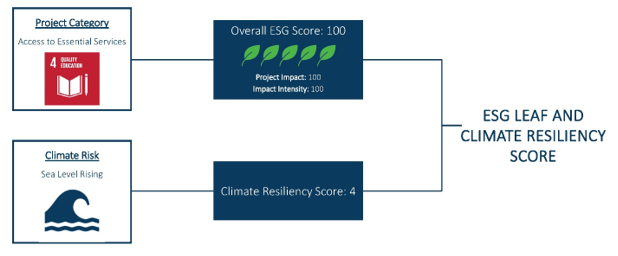

The municipality tasks that we analyze by way of our ESG framework are designed to mitigate a perceived environmental danger (i.e., clear vitality, clear water) or deal with a social subject in a group in want (i.e., accessible colleges, reasonably priced housing). These tasks are evaluated and scored on each the challenge’s anticipated impression and the depth of the impression on the group.[5] Undertaking impression evaluates the scope of the challenge and the way nicely it matches inside our ESG framework. Depth of impression appears at how a lot perceived impression the challenge could have on the underlying group being served by that challenge. A rating is derived for each the challenge impression and impression depth, and the common of those two scores yields our total ESG rating. Every safety is assigned a Sage ESG Leaf Rating based mostly upon its total rating (see under). Securities which can be three leaves and above are thought-about eligible for inclusion inside our ESG investable universe.

Local weather Resiliency Methodology

To research local weather resiliency, we started by using the info supplied by the ND GAIN local weather research. ND GAIN categorizes local weather danger into 5 teams: sea degree rise, drought, chilly, warmth, and flood. Every metropolis will be uncovered to a number of dangers, so we grouped the cities based mostly on the local weather occasion that posed probably the most danger. Every metropolis additionally has a local weather readiness rating assigned to it. By evaluating every metropolis’s respective local weather danger in relation to its readiness, we are able to assign a local weather resiliency issue to that metropolis on a scale of 1-5, with one being the bottom local weather resiliency and 5 the very best.

The addition of climate-related evaluation supplies an additional layer of danger administration and ensures that we’re being adequately compensated for the local weather danger a metropolis could face. This analysis course of permits us to provide a ranked universe of local weather valuation-adjusted ESG municipal tasks from which our portfolio managers can consider and choose. Having an consciousness of local weather danger within the municipal market is one factor, however understanding the impression that climate-related occasions can have on the underlying basic traits of a municipal bond within the type of credit standing and valuation might help our portfolio managers assemble a portfolio that’s wagerter aligned with shoppers’ danger tolerance and values.

Alignment with the Sustainable Growth Targets

Lastly, we consider every bond’s alignment with the United Nations-supported Sustainable Growth Targets (SDGs). The SDGs are a set of 17 objectives, listed under, and every purpose has underlying targets, for a complete of 169 tarwill get. In 2015 the United Nations Normal Meeting set the 2030 objectives, that are designed to be a “blueprint to attain a greater and extra sustainable future for all.”

At Sage, we imagine it is very important not solely report on a bond’s ESG traits, however to additionally acknowledge how they’re aligned with a world set of sustainability objectives.

The next bond subject is for a faculty district in South Carolina. Horry County College District issued $72 million in municipal bonds to improve and modernize their services. As a result of the proceeds are directed towards free public schooling, the bonds align with SDG purpose 4, High quality Training, and Goal 4.1, which by 2030 works to make sure that all ladies and boys full free, equitable, and high quality main and secondary college.

Because the bond issuance was for building of public schooling services and modernization, it could have a challenge impression rating of 100. And since the p.c of school-age kids residing in poverty within the district is bigger than the nationwide common, the depth of impression rating would even be 100, giving the county an total ESG rating of 100, which equates to a Sage ESG Leaf Rating of 5 leaves. In the case of local weather danger, Horry County’s greatest danger is rising sea ranges, however the county is mostly very nicely ready to deal with this local weather danger and subsequently it carries a local weather resiliency rating of 4 (out of 5).

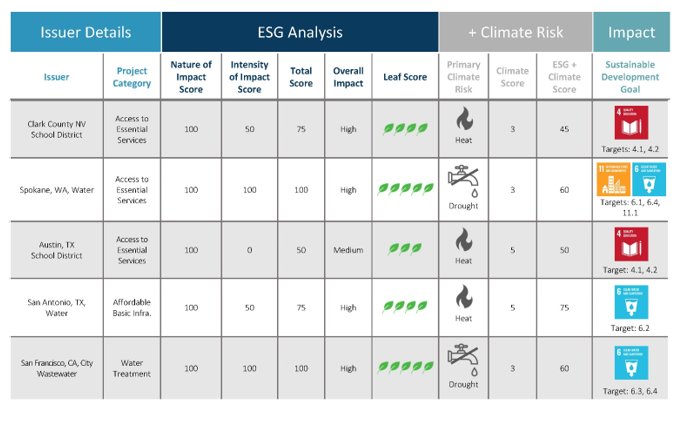

The next Impression Scorecard illustrates how Sage information our Sage ESG Leaf Rating, Local weather Resiliency Rating, and SDGs alignment for every issuer in a portfolio.

Sage’s ESG evaluation mixed with our local weather resiliency framework allows buyers to have an apples-to-apples comparability of assorted local weather dangers and their impression on credit score scores and valuations. Ideally, this evaluation helps to find out if a municipal subject is appropriately priced inside its peer group of comparable credit. A credit score that has an identical mounted revenue traits however has a distinct local weather resiliency rating ought to replicate that distinction in its valuation. In our subsequent local weather perspective, we are going to look at a case research of two municipal credit, how they differ of their local weather resiliency and the way these variations are mirrored of their present and anticipated valuations.

Initially revealed by Sage Advisory

Sources:

1. Brown, Amanda. “Local weather Change May Make Borrowing Costlier for States and Cities.” PEW. October 1, 2019.

2. “ESG Views: Local weather Danger & Municipal Credit score Scores.” Sage Advisory. Could 2020.

3. Nauman, Billy. “Municipal Bond Issuers Face Steeper Borrowing Prices from Local weather Change.” Monetary Occasions. January 7, 2020.

4. Preville, Phillip. “The Way forward for Stormwater Administration Runs Via Kansas Metropolis.” Medium. July 13, 2020.

5. “Steering and Case Research for ESG Integration: Equities and Fastened Revenue.” CFA Institute. September 12, 2018.

Disclosures

Sage Advisory Providers, Ltd. Co. is a registered funding adviser that gives funding administration companies for a wide range of establishments and excessive web price people. The data included on this report represent Sage’s opinions as of the date of this report and are topic to alter with out discover as a consequence of numerous components, equivalent to market circumstances. This report is for informational functions solely and isn’t meant as funding recommendation or a suggestion or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Buyers ought to make their very own choices on funding methods based mostly on their particular funding targets and monetary circumstances. All investments include danger and will lose worth. Previous efficiency just isn’t a assure of future outcomes. Sustainable investing limits the kinds and variety of funding alternatives obtainable, this may occasionally consequence within the Fund investing in securities or trade sectors that underperform the market as an entire or underperform different methods screened for sustainable investing requirements. No a part of this Materials could also be produced in any type, or referred to in some other publication, with out our categorical written permission. For added info on Sage and its funding administration companies, please view our website online at www.sageadvisory. com, or seek advice from our Kind ADV, which is accessible upon request by calling 512.327.5530.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.