By: BCM Funding Crew

By: BCM Funding Crew

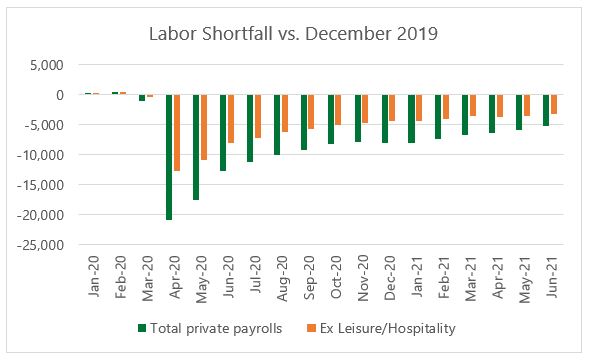

Within the first quarter we mirrored on the superb dichotomy between Q1 2020 and Q1 2021, and but, regardless of the fast modifications we’ve seen up to now 18 months, we would dare check with Q2 2021 as “predictable”. Most of the main tendencies we talked about final quarter stay firmly in place. The U.S. economic system continues to reopen, as is the case with many different international locations world wide. Shoppers, sitting on a glut of ~$3.5 trillion in extra financial savings1 from the pandemic restrictions and authorities help throughout the crises, have begun to spend it. Employment, regardless of some volatility within the information, is returning to prior ranges with probably the most affected industries including jobs on the quickest fee.

[wce_code id=192]

Supply: U.S. Bureau of Labor Statistics, Beaumont Capital Administration (BCM). Knowledge for the interval December 2019 by way of June 2021.

Whereas we’ve been optimistic concerning the economic system for a while now, we’ve additionally cautioned that within the quick time period, the fairness markets are not the economic system. Regardless that the fairness markets have continued to march ahead together with the economic system, Q2 bolstered the concept actions in securities markets are far much less predictable than the final economic system. Because the quarter progressed, markets turned hyper-focused on inflation and inflation expectations. This finally led to a change in inventory market management, amid falling rates of interest, with growth-type equities typically outperforming value-type equities. Curiously, this era of outperformance among the many kind of development equities which have traditionally benefitted from low inflation comes at a time when economists and customers alike appear targeted on the potential to overshoot on inflation. As we talked about final quarter, the efficiency of worth shares relative to development shares has adopted inflation expectations very intently. To complicate issues additional, market-based inflation expectations stay close to latest highs, regardless of rates of interest falling throughout the quarter. Whereas there’s no motive markets should be logically constant, we consider these worth actions do inform an fascinating story.

Whereas we’ve been optimistic concerning the economic system for a while now, we’ve additionally cautioned that within the quick time period, the fairness markets are not the economic system. Regardless that the fairness markets have continued to march ahead together with the economic system, Q2 bolstered the precept that actions in securities markets are far much less predictable than the final economic system. Because the quarter progressed, markets turned hyper-focused on inflation and inflation expectations. This finally led to a change in inventory market management, amid falling rates of interest, with growth-type equities typically outperforming value-type equities. Curiously, this era of outperformance amongst equities which have traditionally benefitted from low inflation comes at a time when economists and customers alike appear targeted on the potential to overshoot on inflation. As we talked about final quarter, the efficiency of worth shares relative to development shares has adopted inflation expectations very intently. To complicate issues additional, market-based inflation expectations stay close to latest highs, regardless of rates of interest falling throughout the quarter. Whereas there’s no motive markets should be logically constant, we consider these worth actions do inform an fascinating story.

The catalyst for this alteration was the June Fed assembly by which the Federal Reserve seemingly acknowledged inflation may very well be much less transitory and Chairman Powell instructed the potential for a fee improve in 2023. Traders typically interpreted this as a extra hawkish tone, inflicting inflation expectations and rates of interest to say no following the assembly. The value actions appear to mirror a change in long-term inflation expectations greater than short-term ones. The market nonetheless expects the Federal Reserve to offer a protracted leash within the quick time period, however plainly the leash might not lengthen as far into the longer term as beforehand thought.

Efficiency of Worth Shares Relative to Progress Shares Has Adopted Inflation Expectations

Supply: Koyfin, Beaumont Capital Administration (BCM). Knowledge for the interval 4/5/2021 by way of 7/6/2021.

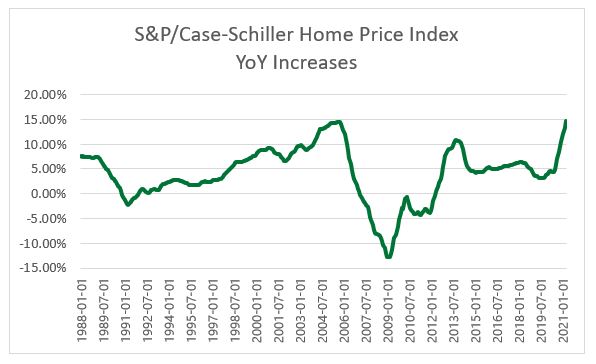

The controversy between how persistent inflation will probably be is prone to rage on for fairly a while, however there isn’t a debating that it’s right here and having an impact. The Might CPI studying of 5% was the best in almost 20 years. Though there are some indicators of moderation, housing costs continued to develop at a number of the highest charges in historical past and even rents—an early sufferer of the pandemic—have surged previous prior ranges. Nonetheless, housing markets have began to chill off with each builders and patrons giving pause on the backdrop of such giant worth will increase. The sort of restraint doesn’t coincide with a number of the extra speculative conduct we’ve seen in corners of the fairness markets (meme shares, SPACS) or in cryptocurrencies (regardless of some latest declines). This may increasingly indicate that we haven’t reached a degree of extra within the broad economic system, as has been the case throughout previous waves of inventory market hypothesis.

Supply: Bloomberg, Beaumont Capital Administration (BCM). Knowledge for the interval 1/1/1987 by way of 4/1/2021.

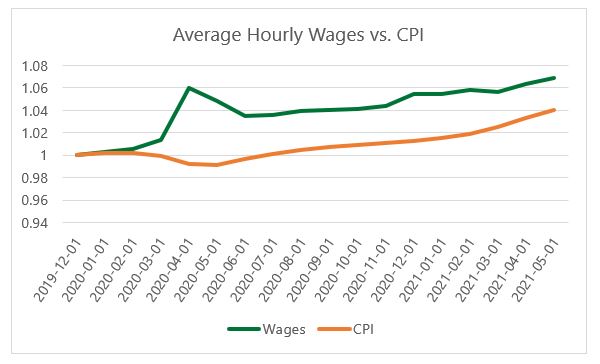

With companies struggling to seek out employees—particularly on the low finish of the wage scale—and job openings persevering with to exceed unemployment, it isn’t stunning that wages have outpaced common inflation to this point within the Covid restoration. This comes on the heels of a multi-decade interval of comparatively stagnant actual wage development, most notably on the decrease finish. Wages will possible be the one most related indicator in figuring out how lengthy inflation persists. If wages improve, it places extra money within the fingers of marginal customers, which might drive spending on objects that make up the inflation basket; in the event that they don’t, inflation might merely revert to prior ranges as the availability shortages from financial shutdowns wane and alleviate common pricing strain.

Supply: Federal Reserve Financial institution of St. Louis. Federal Reserve Financial Knowledge, Financial Analysis Division. Knowledge for the interval 6/1/2016 by way of 6/1/2021.

This brings us again to the concept we contemplated in final quarter’s letter: demand-driven economics might result in a brand new financial regime characterised by larger development, rising wages, and extra significant inflation. The prior regime was arguably created on the outset of the monetary crises, which incited a powerful financial response and a lackluster fiscal response. This era was additionally characterised by additional proliferation of the web, which enabled almost limitless provide of products, maybe aiding within the discount of general costs whereas inserting the worth on discovering and producing demand.

Conversely, over the previous yr there was an enormous fiscal response to the pandemic. As well as, Covid has compelled provide restrictions throughout markets, driving inflation larger with a considerable amount of worth being positioned on assembly demand. Simply-in-time provide chains can’t shut down for 15 months after which reopen with out points. Shortages have prompted worth spikes in commodities similar to lumber and for completed items like laptop chips. A few of these disruptions will take months whereas others might take years to totally resolve. Within the meantime, acute shortages of labor and items have pushed costs larger.

The tug of warfare between these two opposing forces has created a a lot totally different market than we’ve seen over the vast majority of the previous decade, and whether or not that persists will stay the dominant focus for buyers.

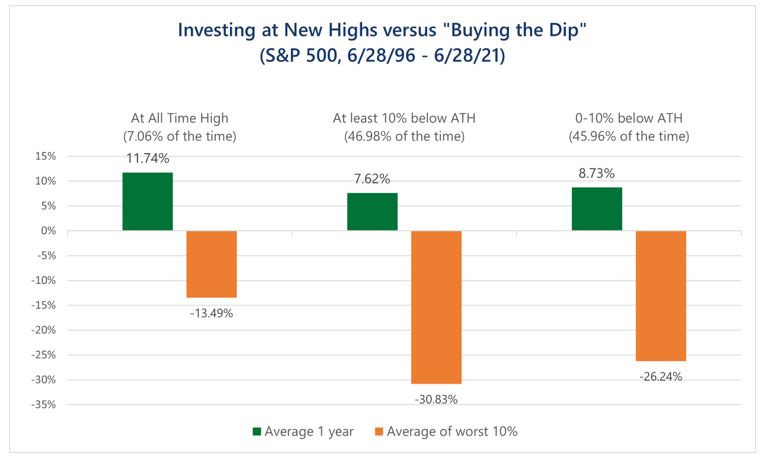

On the heels of traditionally robust latest returns throughout fairness markets, in addition to pockets of speculative conduct, one may assume buyers ought to be extraordinarily cautious going ahead. When allocating in an unsure future, we don’t assume buyers essentially have to worry a market charging to new highs. In reality, markets making new highs usually symbolize the most secure occasions to take a position, even when they aren’t essentially probably the most opportunistic.

Supply: Bloomberg, Beaumont Capital Administration (BCM). Knowledge for the interval 6/28/1996 by way of 6/28/2021.

Whereas the restoration might proceed to be directionally predictable, we all know that the markets is not going to be. The present surroundings might essentially appear speculative just because buyers have lower than the same old info to go off as we recuperate from such an anomalous occasion. This could proceed to drive large swings inside sectors of the market even with a wholesome financial backdrop. We proceed to consider Decathlon’s strategy is as helpful as ever in one of these surroundings. Relative alternatives could also be shorter-term and even more durable to capitalize on with no systemic course of, and buyers can doubtlessly profit from robust markets whereas defending in opposition to a change in pattern ought to it happen.

This text was contributed by Dave Haviland, Portfolio Supervisor and Managing Accomplice at Beaumont Capital Administration, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Sources and Disclosures:

1Cornerstone Macro, WSJ Each day Shot, 6/30/21

Disclosures:

Copyright © 2021 Beaumont Capital Administration LLC. All rights reserved. All supplies showing on this commentary are protected by copyright as a collective work or compilation below U.S. copyright legal guidelines and are the property of Beaumont Capital Administration. It’s possible you’ll not copy, reproduce, publish, use, create spinoff works, transmit, promote or in any manner exploit any content material, in complete or partially, on this commentary with out categorical permission from Beaumont Capital Administration.

Previous efficiency isn’t any assure of future outcomes. Index efficiency is proven on a gross foundation and an funding can’t be made straight in an index.

This materials is offered for informational functions solely and doesn’t in any sense represent a solicitation or supply for the acquisition or sale of a selected safety or different funding choices, nor does it represent funding recommendation for any individual. The fabric might comprise ahead or backward-looking statements concerning intent, beliefs concerning present or previous expectations. The views expressed are additionally topic to alter primarily based on market and different situations. The data introduced on this report is predicated on information obtained from third celebration sources. Though it’s believed to be correct, no illustration or guarantee is made as to its accuracy or completeness.

As with all investments, there are related inherent dangers together with lack of principal. Inventory markets, particularly overseas markets, are risky and might decline considerably in response to opposed issuer, political, regulatory, market, or financial developments. Sector and issue investments focus in a specific trade or funding attribute, and the investments’ efficiency might rely closely on the efficiency of that trade or attribute and be extra risky than the efficiency of much less concentrated funding choices and the market as an entire. Securities of firms with smaller market capitalizations are usually extra risky and fewer liquid than bigger firm shares. International markets, significantly rising markets, could be extra risky than U.S. markets as a result of elevated political, regulatory, social or financial uncertainties. Fastened Earnings investments have publicity to credit score, rate of interest, market, and inflation danger.

Diversification doesn’t guarantee a revenue or assure in opposition to a loss.

The Commonplace & Poor’s (S&P) 500® Index is an unmanaged index that tracks the efficiency of 500 broadly held, large-capitalization U.S. shares. Indices usually are not managed and don’t incur charges or bills. The S&P Small Cap 600® Index is an unmanaged index that tracks the efficiency of 600 broadly held, small-capitalization U.S. shares. The MSCI World Index is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed markets. The MSCI World ex-U.S. Index is a free float-adjusted market capitalization weighted index that’s designed to measure the fairness market efficiency of developed markets, excluding the US. The MSCI ACWI Index captures giant and mid-cap illustration throughout 23 Developed Markets and 26 Rising Markets international locations. The MSCI ACWI Index ex-U.S. captures giant and mid-cap illustration throughout 22 Developed Markets and 26 Rising Markets international locations, excluding the US. The Bloomberg Barclay’s U.S. Combination Bond Index is a broad base index and is commonly used to symbolize funding grade bonds being traded in the US.

“S&P 500®”, and “S&P Small Cap 600®” are registered emblems of Commonplace & Poor’s, Inc., a division of S&P International, Inc. MSCI® is the trademark of MSCI Inc. and/or its subsidiaries.

For Funding Skilled use with shoppers, not for impartial distribution. Please contact your BCM Regional Guide for extra info or to handle any questions that you might have.

Beaumont Capital Administration LLC, 75 2nd Ave, Suite 700, Needham, MA 02494 (844-401-7699)

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.