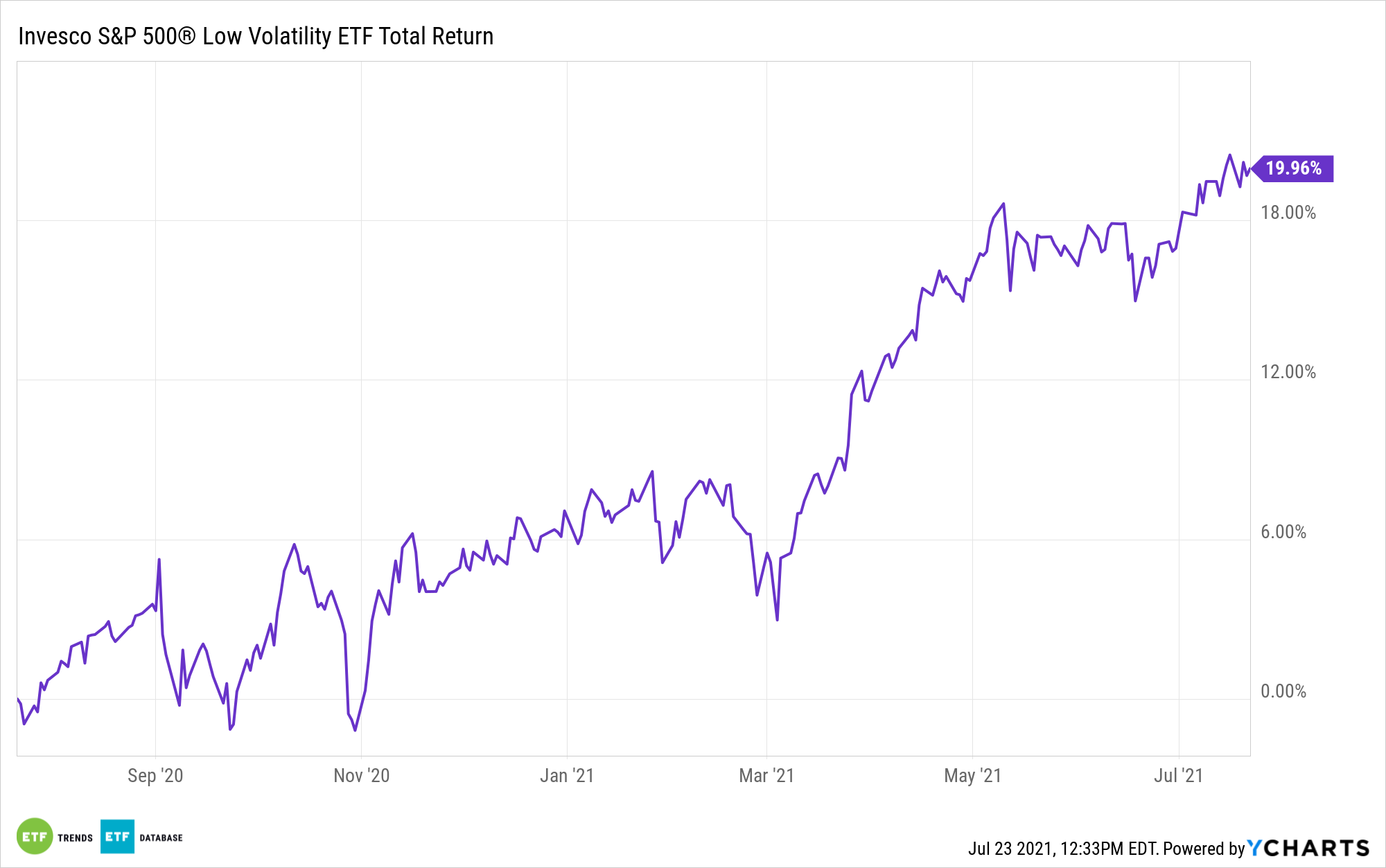

Amid hypothesis that shares could possibly be in for some bumpiness over the near-term, some traders could also be contemplating trade traded funds just like the Invesco S&P 500 Low Volatility ETF (SPLV).

That is a nice concept in its personal proper, however understanding how SPLV and different low volatility ETFs is paramount in avoiding disappointment. For its half, SPLV, one of many funds that kick-started the “low vol” motion in ETF type, tracks the S&P 500 Low Volatility Index.

At present, SPLV holds 103 shares, however the technical goal of its underlying index is to be house to the 100 S&P 500 members with the bottom trailing 12-month volatility. That is a simple sufficient idea to know, however the place many traders run into dejection with funds like SPLV is with the expectation that these merchandise present robust upside seize. That is not the target.

“However there are trade-offs. Buyers cannot have the perfect of each worlds,” writes Morningstar’s Ben Johnson. “Low-volatility methods will are likely to lag in bull markets. That is most evident within the downward slope of the road that spans the higher a part of the 1990s and extra just lately within the post-pandemic rebound. That is what traders in these methods signed up for.”

Low Vol for the Lengthy-Time period

The purpose that Johnson is driving house is that traders have to know what they’re getting with low vol ETFs. The first aim of a fund like SPLV is to maintain drawdowns decrease than a broad market or greater volatility fund when markets decline, to not be totally participatory in overt bull markets.

Figuring out that, the subsequent level traders have to account for is that an ETF like SPLV is simplest at smoothing out bumps over longer holding intervals. That is a optimistic as a result of whereas shares traditionally pattern greater over the long-term, deep drawdowns are punitive to investor outcomes.

It is potential that if an investor buys and holds an ETF like SPLV for an lengthen timeframe, say 5 or 10 years or longer, the related total returns shall be akin to the broader market’s with much less volatility. And as Johnson notes, “low volatility” is not the identical factor as “no volatility.”

“Low volatility doesn’t imply no volatility, simply much less. Low-volatility inventory funds are nonetheless inventory funds. They’re designed to be much less risky than their choice universes, and there is no query that they’ve delivered primarily based on that criterion,” provides Johnson. “However it may be harmful to equate ‘much less’ volatility with ‘low’ volatility. The previous is a extra apt description and one that may higher calibrate traders’ expectations. The latter higher describes belongings that may higher diversify fairness danger, like high-quality bonds.”

For extra information, data, and technique, go to the ETF Training Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.