By Stephen McBride The US housing market is booming. Final

By Stephen McBride

The US housing market is booming. Final month, the variety of Individuals shopping for new homes spiked to a 14-year excessive. Residence costs are rising at their quickest tempo since 1991. And US mortgage lenders simply recorded their greatest quarter in 20 years. Lenders handed out a staggering $1.1 trillion in residence loans up to now three months!

I’ve been pounding the desk on the US housing market since early 2019. And it’s nonetheless among the finest money-making alternatives in all the inventory market right this moment. Not even coronavirus might derail this runaway practice.

For instance, mortgage purposes jumped 50% this yr to their highest ranges since 2005. In different phrases, US housing is as robust because it was on the peak of the housing bubble.

However Please Perceive, This Is Nothing Like 2008

After I need the insider scoop on housing, I choose up the cellphone and name Barry Habib. Barry is the founder and CEO of main actual property advisor MBS Freeway. He spends his days speaking to the most important gamers within the US housing market.

Right here’s what Barry informed me: “Individuals who speak about a housing bubble simply don’t get it. You’ll be able to’t have a bubble when stock ranges are decrease than they’ve ever been. Housing seems to be nice to me and has for a very long time.”

The ‘08 housing bust turned off a whole lot of unusual Individuals from investing in housing. And it shattered the boldness of homebuilders, too. Scarred by the housing bust, homebuilders have been sitting on their arms for the previous decade. Census Bureau information exhibits a mean of 1.5 million houses had been constructed every year since 1959. But over the previous decade, simply 900,000 houses have been constructed per yr.

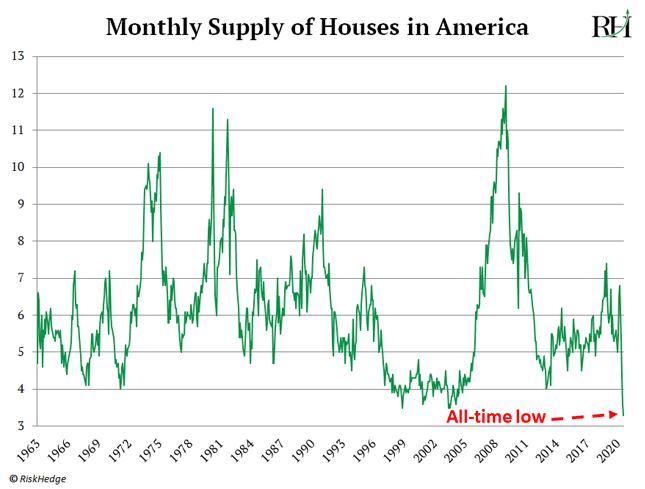

And it’s created a severe housing scarcity in America right this moment. Get this: it might take simply three months to promote each present residence available on the market. That’s the bottom quantity since data started in 1963, as you possibly can see:

Now A Flood Of Homebuyers Is Speeding Into The Market

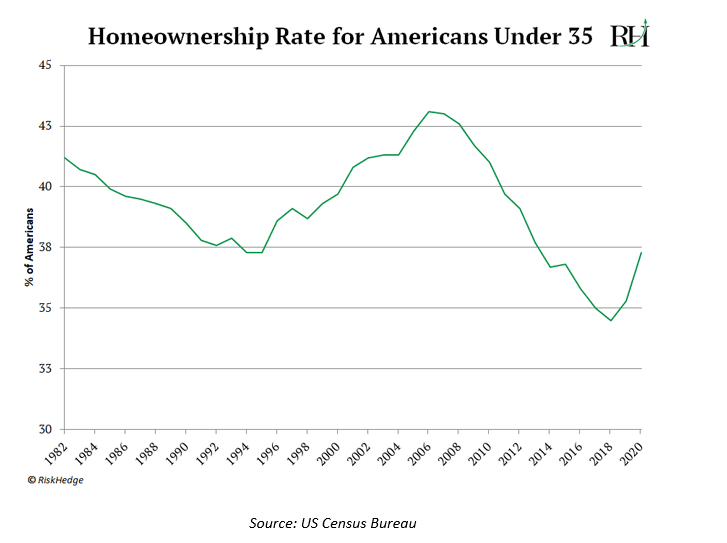

Right here’s crucial chart in all of housing. It breaks down residence possession by age. As you possibly can see, the variety of younger of us who owned a house peaked in 2005. And collapsed to document lows over the following decade:

However the indicator began to tick up in 2016. And now a wave of younger homebuyers is bursting into the market. Right this moment’s younger adults, as you most likely know, are referred to as “millennials.” They’re the biggest technology in US historical past, greater even than child boomers.

Report ranges of scholar debt pressured many younger of us to place off shopping for a house. And plenty of millennials graduated school right into a job market that had been decimated by the 2008 monetary disaster.

This pushed millennials to attend slightly longer to purchase their first houses. However as I wrote final yr, millennials aren’t children anymore. This yr, the common millennial turns 32. And guess what the median age of a primary time US homebuyer is? 31!

In response to the Nationwide Affiliation of Realtors, millennials’ share of mortgages not too long ago surpassed 50% for the primary time ever. In brief, this is the reason US housing is so robust.

And yearly for the following decade, tens of hundreds of thousands of millennials will hit home-buying age. In different phrases, a complete technology of homebuyers will quickly flood the market. At a time when there’s a huge scarcity of houses in America.

This Setup Can Solely Imply One Factor

We’re within the early innings of a brand new homebuilding growth. As Barry Habib informed me final yr, “The #1 necessary driver of residence costs is provide and demand.” Right this moment, provide is tighter than it’s ever been. And with document numbers of home hunters getting into the market, all of it however ensures the housing growth has years left to run.

If homeownership charges for younger of us get again to “regular” ranges, this would be the largest housing growth in US historical past. And which means homebuilders should construct hundreds of thousands of latest houses yearly for a minimum of the following decade.

I discussed builders have been very cautious since 2008. However now they’re lastly ramping up. The variety of constructing permits granted shot as much as their highest degree since early 2007. Ditto for brand spanking new residence “begins,” which jumped to 1.four million final month. And builder sentiment simply hit all-time highs for the second month operating.

In brief, this setup is handing us a slam-dunk revenue alternative. The Homebuilders ETF (ITB) has surged roughly 70% since I first wrote about this chance in early 2019. In the event you don’t already personal it, now could be the time to tug the set off because the US housing growth roars on.

Right here’s One other Approach To Revenue From This Unstoppable Pattern

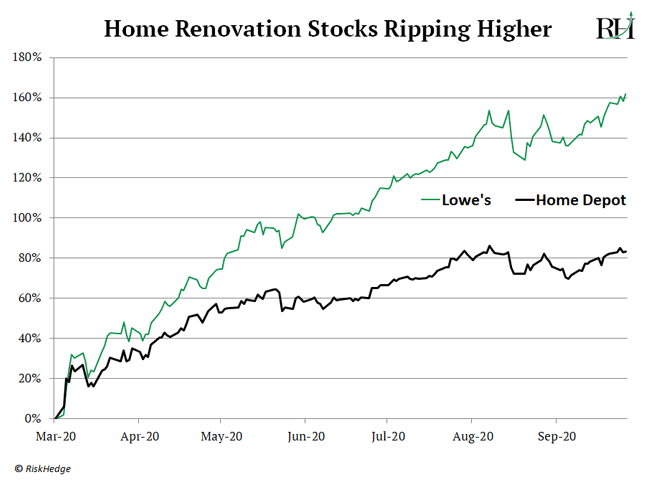

What’s the very first thing of us do once they purchase a home? They normally begin serious about renovations. With housing gross sales leaping to a 14-year excessive, residence enchancment shares are ripping increased. Residence Depot (HD) and Lowe’s (LOW) hit document highs earlier this month:

I’ll say it once more: The American housing growth has years to run. In the event you’re not invested on this pattern but, now’s the time to place your cash to work.

The Nice Disruptors: three Breakthrough Shares Set to Double Your Cash”

Get my newest report the place I reveal my three favourite shares that may hand you 100% good points as they disrupt entire industries. Get your free copy right here.

Initially revealed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.