It’s not simply the long run. Traders can use synthetic intelligence of their portfolios with property just like the QRAFT AI Enhanced U.S. Massive Cap Momentum ETF (AMOM).

AMOM is an actively-managed trade traded fund that goals to supply buyers with long-term capital appreciation by using a proprietary synthetic intelligence system to pick large-capitalization U.S. shares to be held within the portfolio. The fund seeks to realize its funding goal by investing at the very least 80% of its internet property, plus the quantities of any borrowings for funding functions, in securities of U.S.-listed large-capitalization firms.

Similar to a sailboat wants wind to maneuver, merchants want momentum as a way to play value motion. That is the impetus for AMOM’s methodology, which focuses on equities exhibiting sturdy momentum.

As such, AMOM seeks to carry shares with publicity to the momentum issue. The fund makes use of synthetic intelligence to find out how an organization’s momentum over a sure interval would change and/or have an effect on the corporate’s efficiency over time and recommends a weighting of such firm primarily based on its potential for optimum return as in comparison with different firms.

As well as, AMOM affords issue publicity and could also be acceptable for buyers searching for publicity to the momentum issue. Lastly, since AMOM features as an funding technique primarily based on cutting-edge know-how, QRFT could also be acceptable as an options allocation.

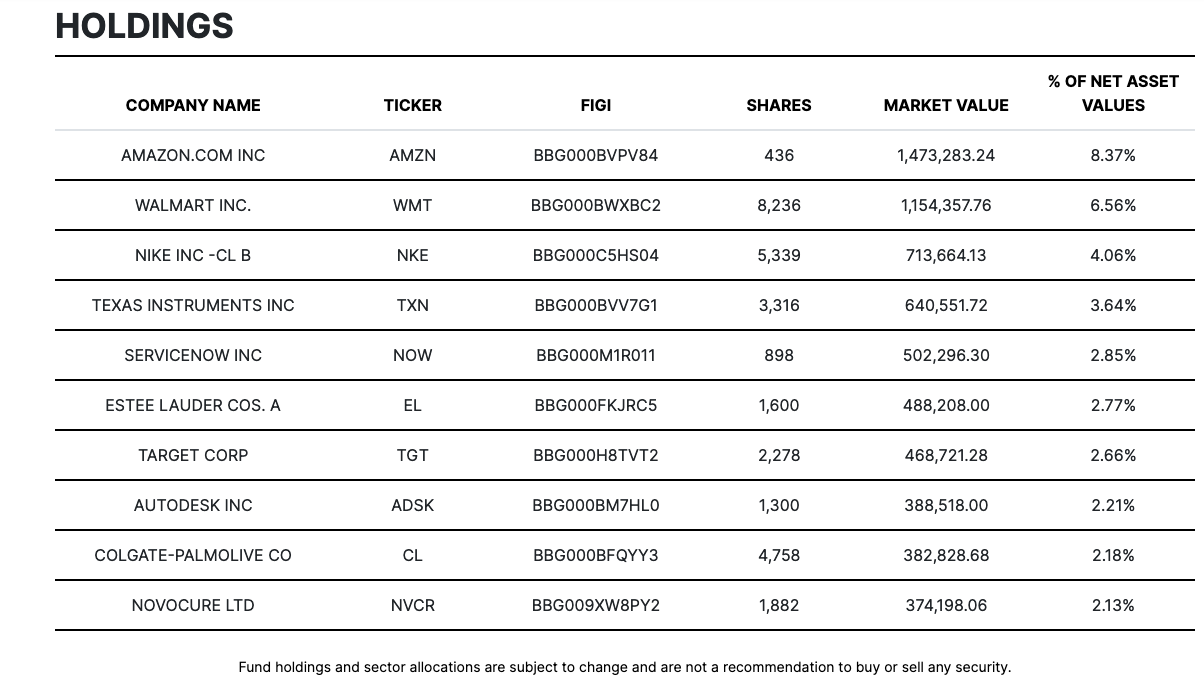

Amazon Tops AMOM’s Momentum Combine

A have a look at AMOM’s high holdings would not present a one-sided skew in the direction of large tech, highlighting the fund’s momentum combine in numerous sectors. The biggest holding, on the time of writing, is Amazon at 8.37%.

The web retail large will truly be reporting its first quarter earnings outcomes on April 29. As such, AMOM shall be one to observe ought to Amazon ship blockbuster earnings.

Early indications are optimistic.

“Most buyers will in all probability be feeling optimistic in regards to the e-commerce and know-how large’s report,” a Motley Idiot article printed in Nasdaq famous. “The corporate has a strong current observe report of simply beating — typically crushing — its personal steering and Wall Road’s consensus estimates on each the highest and backside traces.”

“Within the final three quarters of 2020, Amazon’s earnings exceeded analysts’ expectations by a whopping 606% (second quarter), 67% (third quarter), and 95% (fourth quarter),” the article added.

For extra information and data, go to the Sensible Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.