A China country-specific trade traded fund focusing on environmentally pleasant firms has been clim

A China country-specific trade traded fund focusing on environmentally pleasant firms has been climbing because the rising nation doubles its new renewable vitality capability.

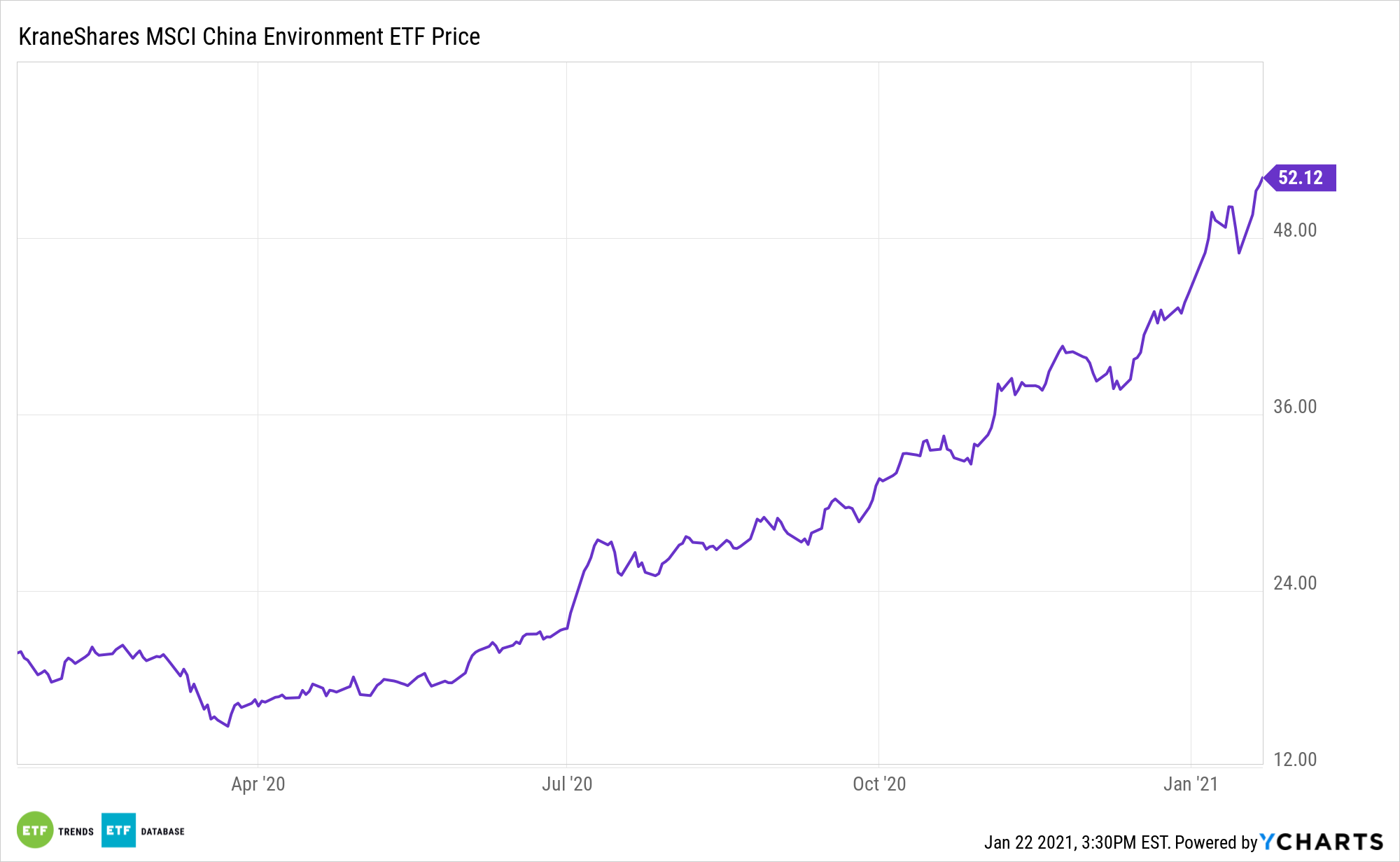

The KraneShares MSCI China Atmosphere Index ETF (KGRN) has elevated 53.3% over the previous three months, and jumped 160.7% over the previous 12 months.

The KraneShares MSCI China Atmosphere Index ETF tracks the efficiency of the MSCI China IMI Atmosphere 10/40 Index, which is comprised of securities that derive a minimum of 50% of their revenues from environmentally helpful services. The fund offers buyers publicity to Chinese language firms that target contributing to a extra environmentally sustainable economic system by making environment friendly use of scarce pure assets or by mitigating the influence of environmental degradation.

The underlying index relies on 5 key clear expertise environmental themes, together with Different Power, Sustainable Water, Inexperienced Constructing, Air pollution Prevention, and Power Effectivity.

In 2020, China greater than doubled its development of recent wind and solar energy crops year-over-year, reflecting Beijing’s pledge to chop fossil gasoline dependence and produce carbon emissions to a peak inside a decade, the South China Morning Put up stories.

In opposition to “the backdrop of carbon-neutral improvement, I believe the Chinese language authorities will are likely to undertake comparatively relaxed requirements to advertise the sector’s improvement,” Robin Xiao, an analyst with CMB Worldwide Securities Corp, advised Bloomberg.

China, which can also be the world’s largest greenhouse gasoline emitter, added 71.67 gigawatts of wind energy capability in 2020, essentially the most ever and virtually triple its 2019 ranges, in accordance with the Nationwide Power Administration. Compared, world new wind capability was elevated by 60.4GW in 2019, in accordance with knowledge from the International Wind Power Council. New solar energy capability rose to 48.2GW in 2020 after falling for 2 straight years.

“China’s smashing wind energy constructing information and persevering with with robust photo voltaic development makes the nation a high vacation spot for international clear vitality funding,” Jeanett Bergan, an government of Norway’s largest pension fund KLP, advised South China Morning Put up.

For extra information, info, and technique, go to the ESG Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.