The carbon emissions market is rising as extra members purchase and promote their extra carbon emissions allowances, creating a possible alternative for merchants to get in the midst of these transactions via a thematic alternate traded fund technique.

Massive carbon emitters like metal producers obtain emission allowances and might purchase extra to remain below more durable emissions tips. In the meantime, corporations that fall under these carbon emission limits can promote their extra carbon emissions allowances on the open market.

This new marketplace for carbon emissions has created a possibility for merchants looking for to revenue from strikes within the value of carbon and typically even guess on the route of costs, the Wall Road Journal experiences.

In line with knowledge supplier Refinitiv Holdings Ltd, the world’s carbon markets, which cowl Europe and smaller markets in locations like California and New Zealand, expanded 23% final 12 months to €238 billion, or $281 billion.

Whereas this nascent market stays small in comparison with among the world’s extra developed multi-trillion greenback markets, trade specialists argue that there’s progress potential. Wooden Mackenzie, an power consulting agency, calculated that international carbon market might develop to $22 trillion by 2050.

Preliminary indicators of progress are already exhibiting. For instance, the European Union revealed plans to develop its market. China has even began its personal restricted buying and selling system primarily based on carbon buying and selling. The Biden administration additionally likes placing a value on carbon, however the U.S. stays far behind different economies in developing with a standardized plan.

Wanting forward, the worth of the carbon market is projected to exceed the oil market’s worth by 2030, and even as quickly as 2025 if extra fast motion is taken and rules are enacted, based on former oil dealer Hannah Hauman, who leads Trafigura’s carbon desk.

Nevertheless, some warn that the market is difficult to cost as a result of unfastened requirements since there are not any clearly outlined guidelines on cross-border buying and selling.

“The issue is defining what are high-quality carbon credit,” Chris Leeds, head of carbon-markets improvement at Commonplace Chartered PLC, advised the WSJ.

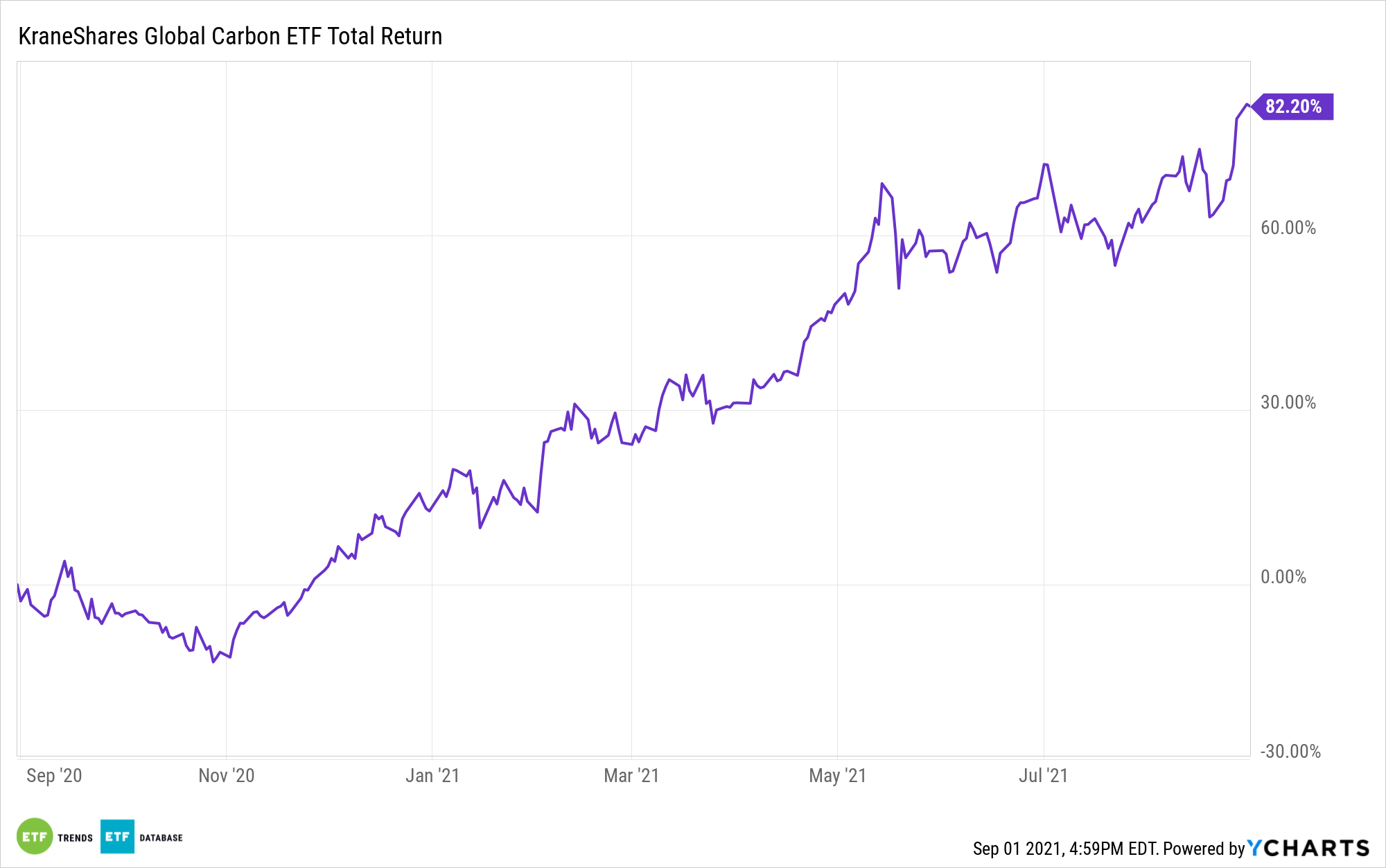

As a approach to acquire publicity to this rising alternative, the KraneShares International Carbon ETF (KRBN) can assist buyers entry the carbon allowances futures market.

KRBN tries to replicate the efficiency of the IHS Markit’s International Carbon Index, which presents broad protection of cap-and-trade carbon allowances by monitoring the most-traded carbon credit score futures contracts. The index introduces a measure for hedging danger and going lengthy for carbon costs whereas supporting accountable investing. At the moment, the index covers the main European and North American cap-and-trade applications: European Union Allowances (EUA), California Carbon Allowances (CCA), and the Regional Greenhouse Gasoline Initiative (RGGI).

For extra information, data, and technique, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com