By: BCM Funding Group

By: BCM Funding Group

The U.S. economic system continues its pursuit of “regular” as each the manufacturing and providers PMIs ease off their post-pandemic surges into extra typical development territory. May this sign an easing in inflationary pressures as development in providers costs additionally decelerates? Banks in the meantime are easing lending requirements to provide better entry to shopper loans, however will there be excessive demand after so many used their stimulus funds to dig out of debt? And as JP Morgan publishes a considerably dour prediction for the fairness markets, bond yields all over the world have fallen as provide and new issuance stays excessive—notably within the excessive yield market. In the meantime, in commodities, Bloomberg’s commodity index hit highest degree since 2015 as oil costs bounce following OPEC’s failure to make a deal on rising manufacturing. Good factor renewables are increasing their market share… Trying globally, not everyone seems to be on the highway again to regular as China’s debt may imply they’re primed for a debt-related monetary disaster.

[wce_code id=192]

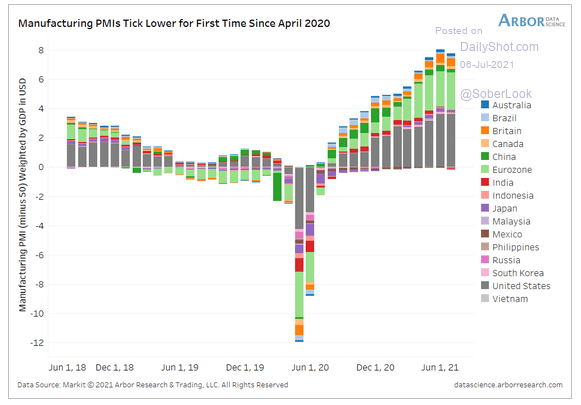

1. Unrealistically excessive PMI surges post-pandemic are starting to normalize in stable development territory:

Supply: Arbor Analysis and Buying and selling, from 7/6/21

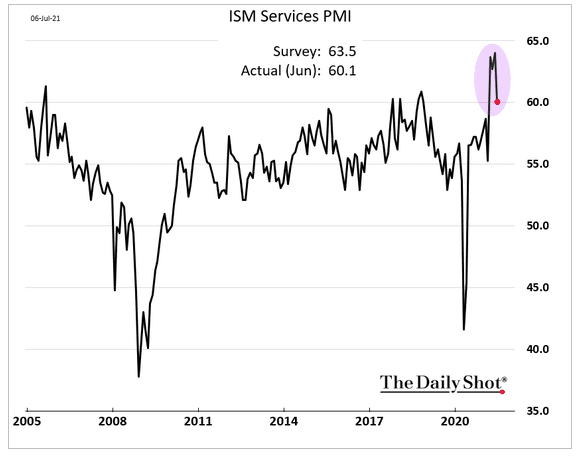

2. “Normalization” continues. Each the report highs following the pandemic lows usually are not regular. Any studying 50 or increased denotes a rising service economic system.

Supply: The Day by day Shot, from 7/7/21

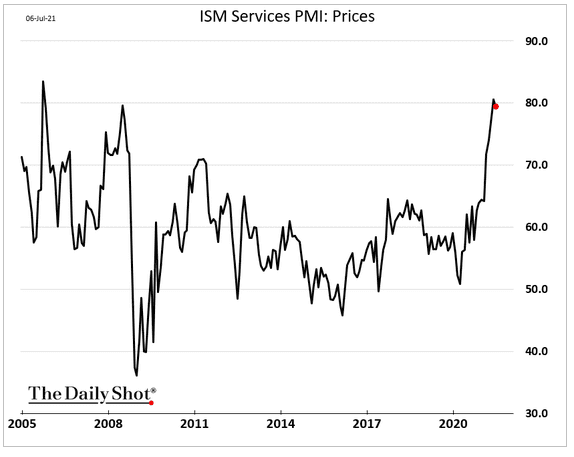

3. Have the inflationary pressures peaked?

Supply: The Day by day Shot, from 7/7/21

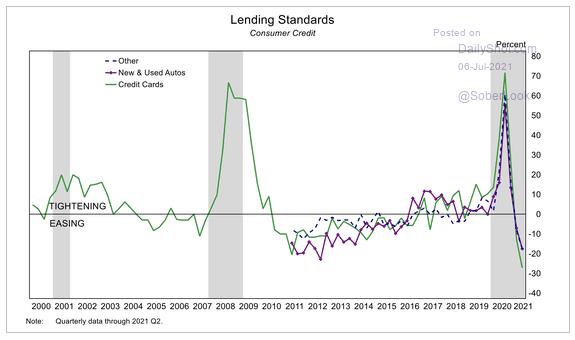

4. Banks, flush with low-cost money, want to lend and decreasing their lending requirements to take action:

Supply: Mizuho Securities/ Macrobond, from 7/6/21

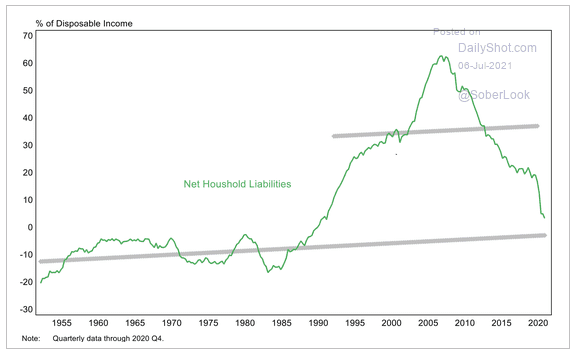

5. But many households have taken the federal government stimulus and financial savings from the shortage of pandemic spending to repay their debt:

Supply: Mizuho Securities/ Macrobond, from 7/6/21

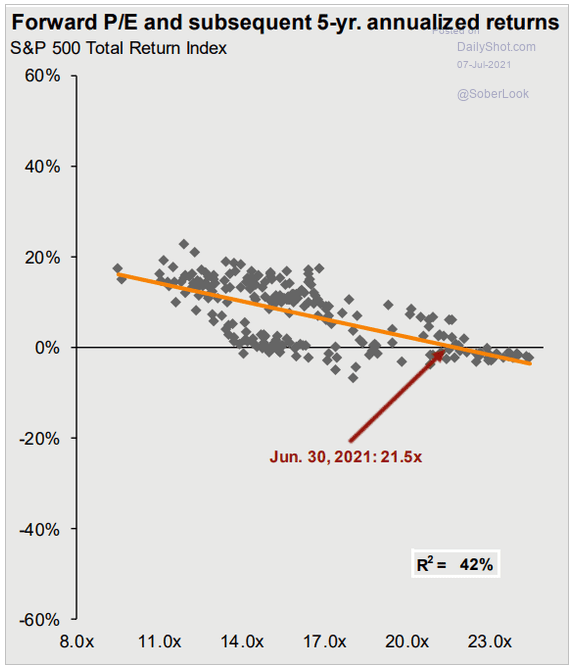

6. JP Morgan sees fairness returns flat to down for the following 5 years. The query is “How?” Sluggish development or a doozy of a correction round some good years…

Supply: JP Morgan, from 7/7/21

7. Bond yields are additionally in search of “regular” and are actually on the backside of the rising channel:

Supply: The Day by day Shot, from 7/7/21

8. Market demand and Treasury provide has been outstanding:

Supply: BofA International Analysis, from 7/6/21

9. File low charges and spreads have been a boon for junk bond issuance:

Barclays Analysis, from 7/6/21

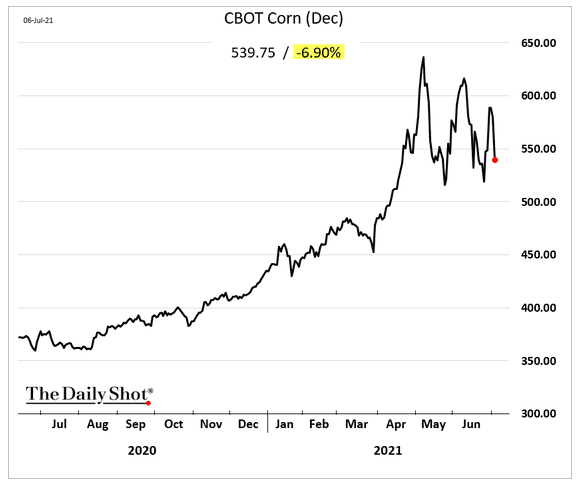

10. Commodities are additionally in search of “regular”. Corn has been unstable however is within the pattern channel:

Supply: The Day by day Shot, from 7/7/21

11. Vitality and aluminum worth surges have prolonged the general commodity worth rally:

Supply: The Day by day Shot, from 7/7/21

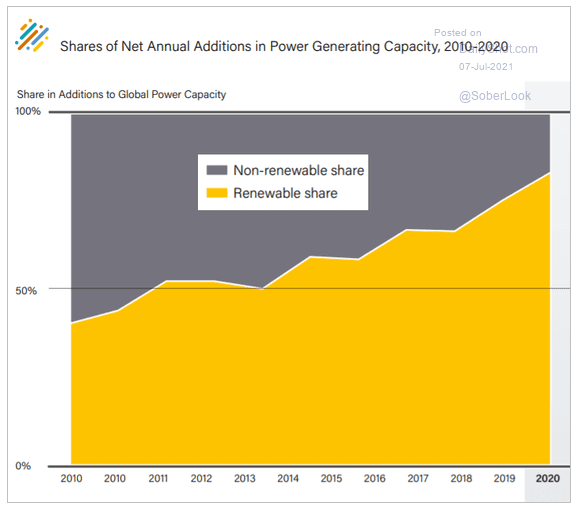

12. Whereas vitality costs proceed to rise, the vast majority of new electrical energy technology is from renewables:

Supply: The Day by day Shot, from 7/7/21

13. Is China establishing their very own debt-related monetary disaster?

Supply: The Day by day Shot, from 7/6/21

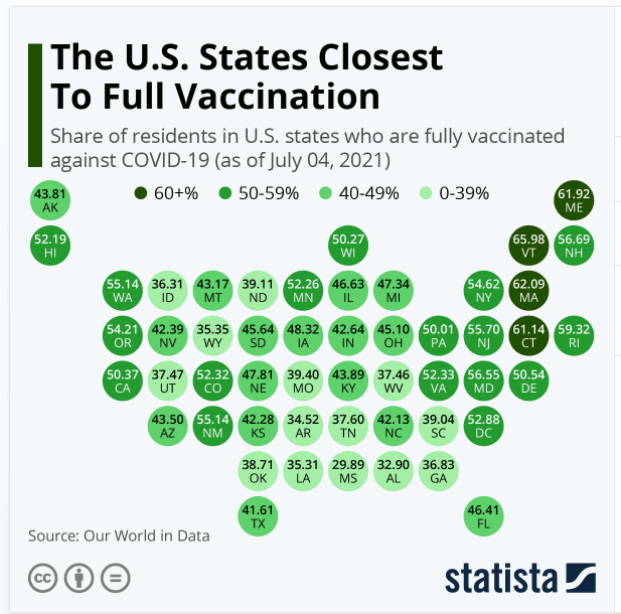

14. How protected are you?

Supply: Statista, from 7/7/21

This text was contributed by Beaumont Capital Administration Funding Group, a participant within the ETF Strategist Channel.

For extra insights like these, go to BCM’s weblog at weblog.investbcm.com.

Disclosure: The charts and info-graphics contained on this weblog are sometimes primarily based on knowledge obtained from third events and are believed to be correct. The commentary included is the opinion of the writer and topic to vary at any time. Any reference to particular securities or investments are for illustrative functions solely and usually are not supposed as funding recommendation nor are they a advice to take any motion. Particular person securities talked about could also be held in consumer accounts. Previous efficiency is not any assure of future outcomes.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.