By Frank Holmes, CEO, U.S. Funds Per week after reporting e

By Frank Holmes, CEO, U.S. Funds

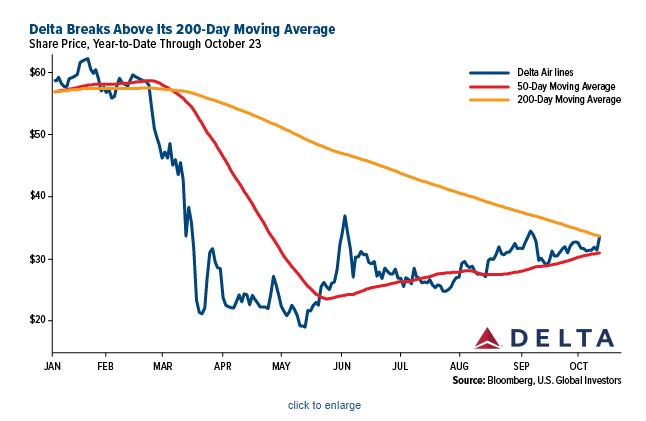

Per week after reporting earnings, Delta Air Strains jumped greater than 7 % final Thursday after the service introduced it could proceed to dam the center seat till not less than January of subsequent 12 months. This improve helped its share value climb above the 200-day shifting common for the primary time since February, which many merchants see as a bullish sign.

Delta and Alaska Airways would be the solely remaining main U.S. carriers that also block the center seat after Southwest Airways begins filling the seat on December 1. The low-cost service stated in a tweet that it could unblock the center seat after November 30, citing a physique of analysis that helps the notion that masks and air flow sufficiently defend passengers from the virus.

Among the many research was the one I shared with you the week earlier than final. The Division of Protection (DoD) discovered that mask-wearing passengers are at very low threat of being infecting with the coronavirus, even on a packed flight.

“It’s a very protected atmosphere with the entire air-filtering know-how and carrying masks,” Southwest CEO Gary Kelly instructed CNBC final week. “The science helps that.”

We proceed to see the home airline trade get well off the April lows. Yesterday, the variety of individuals cleared to fly business within the U.S. was slightly below 1 million. That was the second highest pandemic-era quantity since Sunday, October 18, when greater than 1,032,000 passengers boarded flights.

Goldman: Get Prepared for a Commodities Bull Market

Jet regrade—the relative energy of jet gasoline costs versus diesel—seems to be primed for a bull market in 2021 as flight demand continues to extend, in line with Goldman Sachs. By subsequent summer time, jet gasoline demand is predicted to be larger by 3.9 million barrels per day than the place it stands proper now.

Amongst different commodities that would additionally surge subsequent 12 months, the funding financial institution says, are silver, copper, gold, pure fuel and Brent crude oil.

In a observe to shoppers, Goldman analysts cited a weaker greenback, inflation and extra financial and financial stimulus as causes for a possible rally in commodity costs. A 12-month return of 30 % is forecast for the S&P GSCI, which tracks 24 commodities from all commodity sectors. Industrial metals, together with copper, may improve 5.5 %; treasured metals, 18 %; and power, greater than 42 %.

Goldman sees the worth of gold averaging $2,300 an oz in 2021, whereas silver is projected to common $30 an oz.

Right here at U.S. World Traders, we’re very bullish on commodities, notably industrial and treasured metals. The manufacturing PMI in various international locations exhibits that factories are increasing capability on a larger variety of new orders. In August, the U.S. manufacturing PMI registered 56.0, the best studying since November 2018. The PMI in China—the world’s largest importer of metals and different uncooked supplies—was 51.5 final month, properly above the five-year common of 50.6.

As I’ve famous earlier than, commodities proceed to look remarkably low-cost relative to shares. Beneath is a chart displaying the ratio between the S&P GSCI and S&P 500. At no different time going again to 1972 have commodities been as undervalued as they’re immediately. If Goldman’s projections change into correct, now could possibly be an exceptional shopping for alternative.

Physician Copper Briefly Crosses Above $7,000 a Tonne, Thanks in Massive Half to China

“Physician copper” is so named as a result of its value is seen as a very good indicator of financial well being. If that’s the case, then the economic system isn’t almost as dangerous as we thought it was.

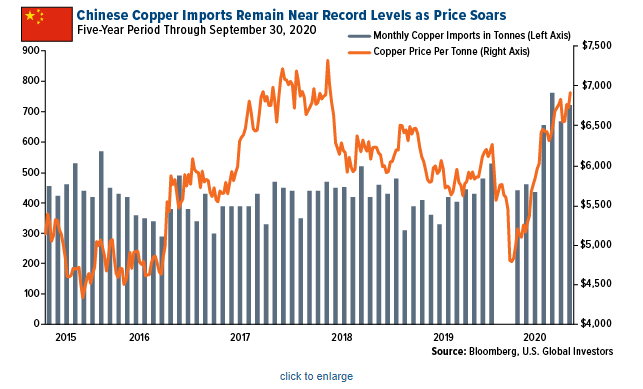

In intraday buying and selling final Wednesday, copper briefly crossed above $7,000 a tonne, its highest degree since June 2018. From its low in late March, the pink steel has risen near 50 % on hopes of additional authorities stimulus and elevated demand, notably from the renewable power trade and China.

In July, China’s copper imports hit an all-time excessive of 762,210 tonnes as the federal government unleashed stimulus geared toward constructing bridges, roads, railroads, broadband and extra.

That features renewable power initiatives equivalent to wind and photo voltaic. In keeping with a report this month by the World Wind Power Council (GWEC), China led the world in including new offshore wind capability in 2019, with 2.Four gigawatts (GW) put in, representing almost 40 % of whole new wind energy throughout the globe.

The market cap of China’s LONGi Inexperienced Power Expertise, the world’s largest solar energy firm, lately climbed larger than that of oil main China Nationwide Offshore Oil Company (CNOOC), the nation’s largest oil and fuel producer. This not solely represents a major shift in power traits, but it surely’s additionally extremely supportive of copper costs.

I count on China’s urge for food for metals and different uncooked supplies to maintain tempo because it continues to stimulate its economic system—which managed to develop, I ought to add, an traditionally low and but spectacular 4.9 % within the third quarter in comparison with the identical interval final 12 months.

We’ll obtain third-quarter financial information for the U.S. on Thursday this week. I hope to see an enormous enchancment over the second quarter, when actual GDP fell at an annual charge of 31.Four %, in line with Bureau of Financial Evaluation (BEA).

Digital Junior Mining Expo

I’m very excited to share with you that I’ll be taking part within the first-ever Digital Junior Mining Expo, that includes 10 prime junior mining corporations. This digital occasion is co-hosted by my pals at Streetwise Reviews, and it’ll happen Thursday, November 12, at 1:00 pm Japanese. What’s extra, it’s completely free.

To register for the occasion, please click on right here. I hope you’ll be a part of us!

Initially revealed by U.S. Funds, 10/26/20

All opinions expressed and information offered are topic to alter with out discover. A few of these opinions is probably not acceptable to each investor. By clicking the hyperlink(s) above, you’ll be directed to a third-party web site(s). U.S. World Traders doesn’t endorse all info equipped by this/these web site(s) and isn’t accountable for its/their content material.

The S&P 500 Inventory Index is a widely known capitalization-weighted index of 500 widespread inventory costs in U.S. corporations. The S&P GSCI is widely known as a number one measure of common value actions and inflation on the earth economic system. It gives buyers with a dependable and publicly accessible benchmark for funding efficiency within the commodity markets.

Holdings could change each day. Holdings are reported as of the latest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Traders as of (09/30/2020): Delta Air Strains Inc., Alaska Air Group Inc., Southwest Airways Co.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.