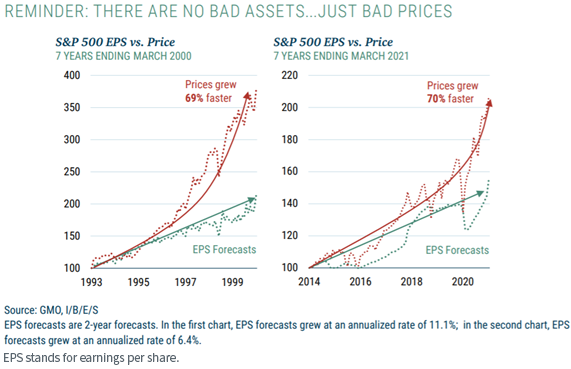

The crew at GMO just lately got here out with their mid-year investor letter and one chart raised some alarm bells.

Within the chart beneath, we see that within the seven years ending March 2000, earnings forecasts have been rising at a really wholesome clip—over 11% per 12 months. The difficulty was that pleasure for know-how shares was so excessive that costs grew 69% sooner.

Within the seven years ending March 2021, costs have now grown 70% greater than earnings forecasts.

These rising value ranges are symbolic of extra elevated market valuations—which will get magnified in market capitalization-weighted indexes that lean heavier into shares which can be already rising essentially the most.

Reconnecting Shares with their Earnings

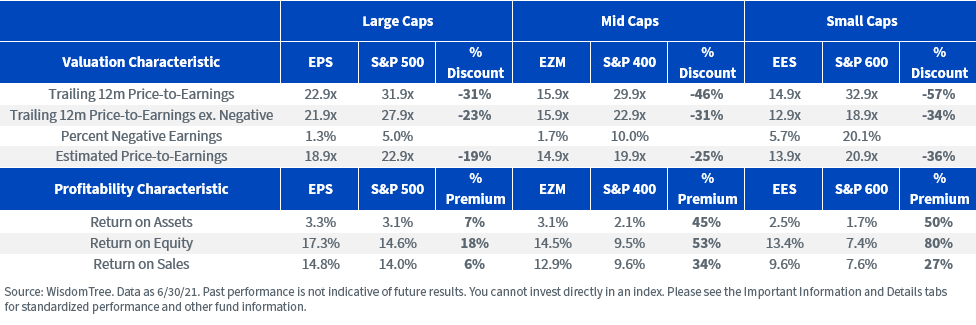

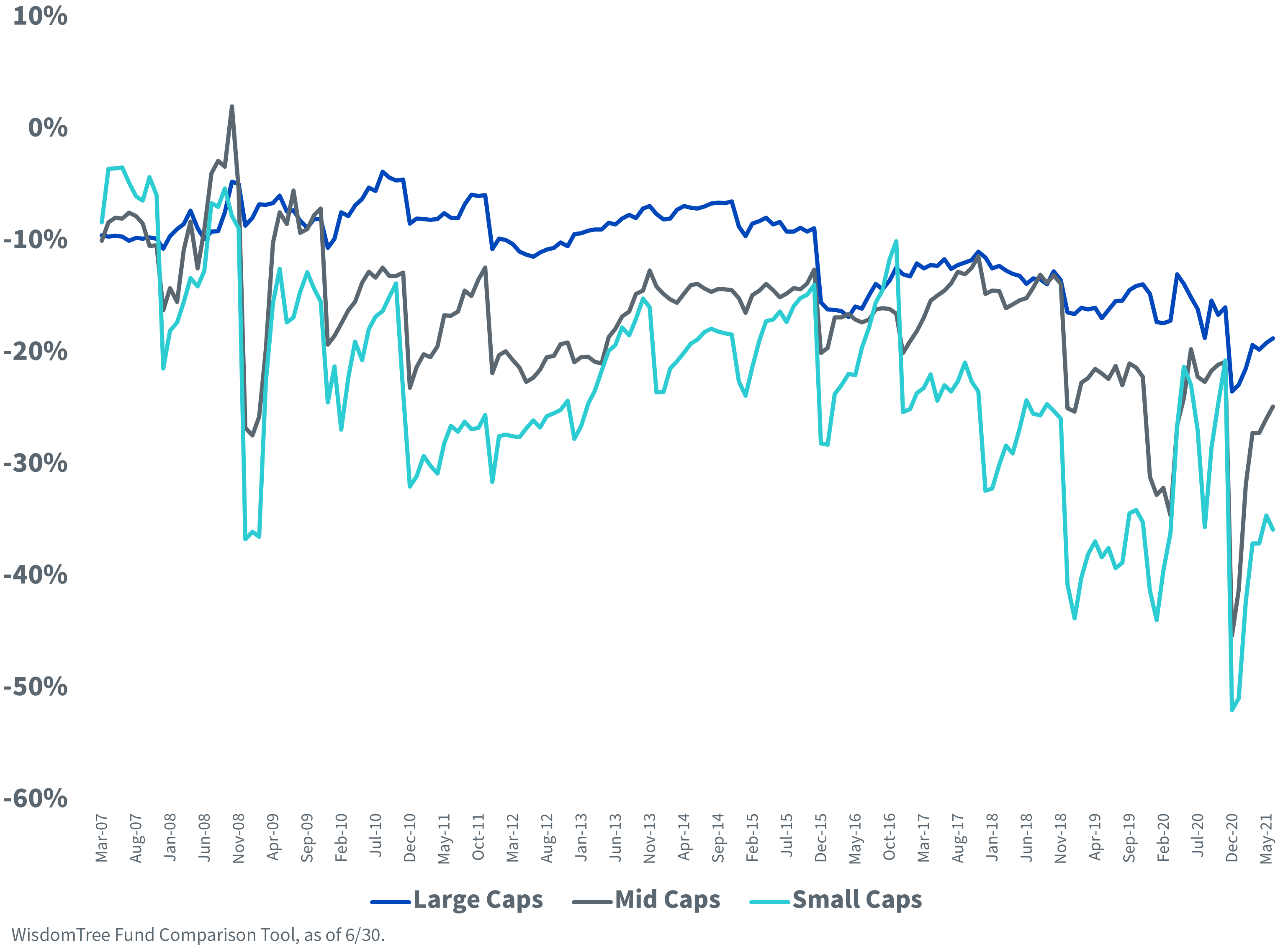

In February 2007, WisdomTree launched a set of earnings-weighted inventory indexes that reconnects inventory allocations to their underlying earnings. The valuation reductions we see at the moment on this earnings-weighted household are a few of the widest gaps in comparison with their market cap-weighted counterparts that we’ve seen since inception.

Utilizing trailing earnings, which makes the market look costlier, the valuation gaps for WisdomTree’s earnings-weighted methods in comparison with the S&P household of market cap-weighted benchmarks, ranges from 31% for massive caps to 57% for small caps.

Utilizing estimated earnings for 2021, the valuations look extra affordable for the cap-weighted market: round 23 instances for S&P 500 and 20–21 instances for mid and small caps.

The low cost for WisdomTree’s earnings-weighted methods utilizing forward-looking earnings ranges from 19% for big caps to 36% for small caps.

Typically, one assumes you sacrifice high quality and profitability and get ‘junkier’ shares if you search for valuation reductions. However the earnings-weighted strategy and extra danger screens we added to our Indexes have led to profitability premiums throughout all dimension segments. You possibly can see this in revenue margins (return on gross sales), ROE or ROA metrics.

Within the beneath tables, we evaluate the WisdomTree U.S. LargeCap Fund (EPS), WisdomTree U.S. MidCap Fund (EZM) and WisdomTree U.S. SmallCap Fund (EES) relative to their corresponding market cap-weighted Indexes, based mostly on dimension.

For standardized efficiency of the Funds within the desk, please click on their respective ticker: EPS, EZM, EES.

For definitions of phrases within the desk, please go to the glossary.

Ahead P/E Ratios: The Earnings-Weighted Reductions

The extra market valuations rise, the extra essential we imagine it’s to reconnect inventory weights with their underlying earnings. As traders discuss extra in regards to the worth rotation, WisdomTree’s household supplies very broad-based diversified publicity to those dimension segments, with out having particular valuation cutoffs to type the market and solely choose a subset of the market.

These Indexes begin with all worthwhile firms of their universes, after which weight these firms by their core earnings streams and make changes for essentially the most dangerous shares of their universe. Now might be a very good time for each parts of this decrease valuation and risk-controlled course of.

Initially printed by WisdomTree, 8/12/21

Essential Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Funds focusing their investments on sure sectors and/or smaller firms improve their vulnerability to any single financial or regulatory improvement. This may occasionally end in higher share value volatility. Please learn every Fund’s prospectus for particular particulars relating to the Fund’s danger profile.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which incorporates funding aims, dangers, prices, bills, and different info; learn and contemplate rigorously earlier than investing.

There are dangers concerned with investing, together with potential lack of principal. Overseas investing entails forex, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms could expertise higher value volatility. Investments in rising markets, forex, mounted revenue and different investments embrace further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency isn’t indicative of future outcomes. This materials incorporates the opinions of the writer, that are topic to alter, and may to not be thought-about or interpreted as a advice to take part in any explicit buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t a assure that any methods mentioned will work beneath all market circumstances. This materials represents an evaluation of the market surroundings at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety particularly. The person of this info assumes the complete danger of any use made from the knowledge supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Traders searching for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI info could solely be used in your inside use, might not be reproduced or re-disseminated in any kind and might not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI info is meant to represent funding recommendation or a advice to make (or chorus from making) any form of funding determination and might not be relied on as such. Historic knowledge and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI info is supplied on an “as is” foundation and the person of this info assumes the complete danger of any use made from this info. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI info (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this info, in no occasion shall any MSCI Social gathering have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or another damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can’t make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.