Most people want to overlook 2020, however the ARK Innovation ETF (NYSEArca: ARKK) would like to ru

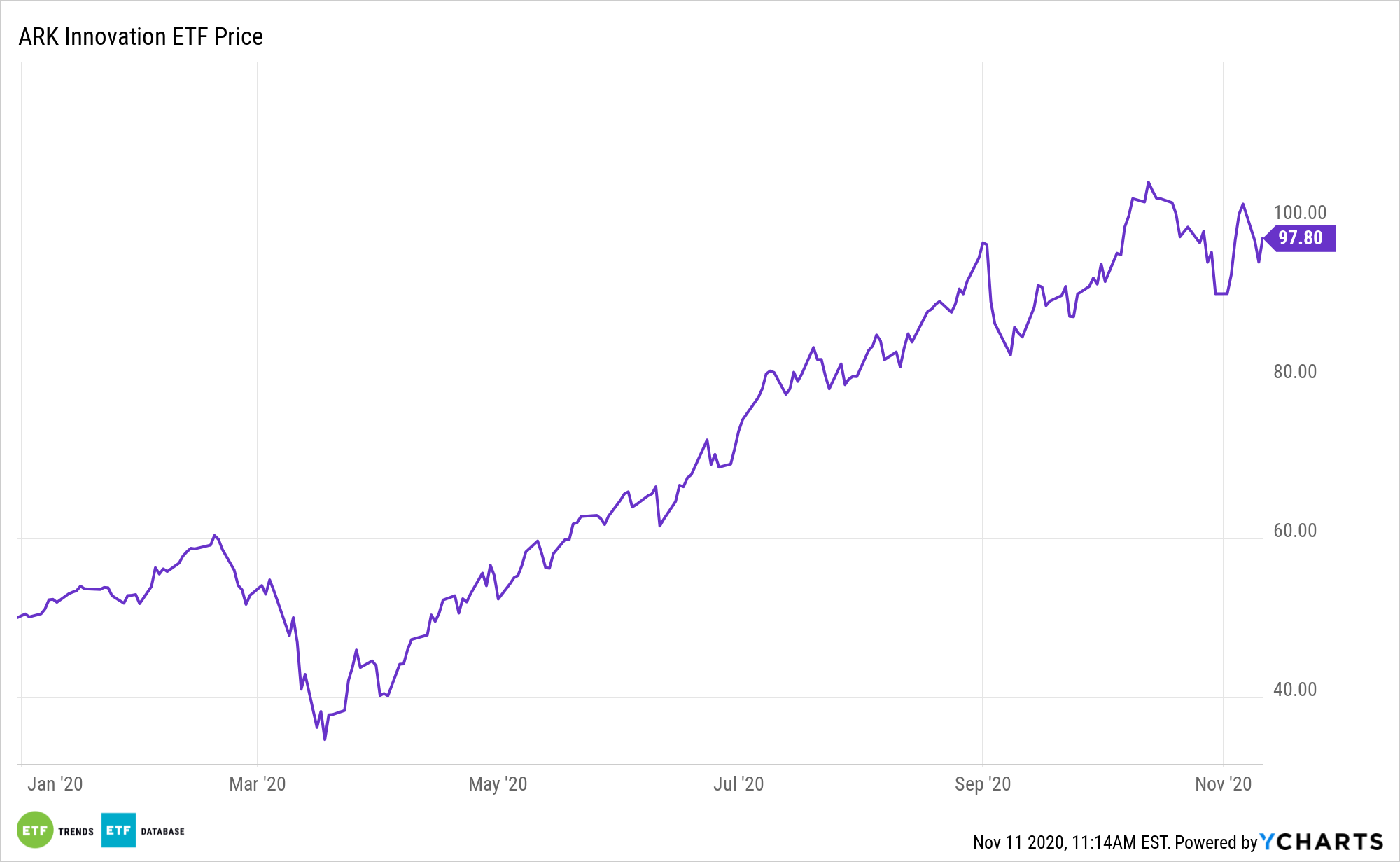

Most people want to overlook 2020, however the ARK Innovation ETF (NYSEArca: ARKK) would like to run it again. Up nearly 95%, it has grow to be the biggest actively managed fairness ETF available on the market.

“Corporations inside ARKK embody people who depend on or profit from the event of recent services or products, technological enhancements and developments in scientific analysis regarding the areas of DNA applied sciences (‘’Genomic Revolution’), industrial innovation in power, automation, and manufacturing (‘Industrial Innovation’), the elevated use of shared know-how, infrastructure and companies (‘’Subsequent Technology Web’), and applied sciences that make monetary companies extra environment friendly (‘Fintech Innovation’),” in keeping with ARK Make investments.

ARKK is including to its legendary standing the place it issues most: complete returns. However that is previous hat for an ETF with an extended historical past of topping broader benchmarks by vast margins.

“ARKK’s phenomenal CAGR of 30.97% for ARKK since inception six years in the past signifies that $10,000 invested could be price $50,469 at the moment. For some perspective, investing $10,000 within the extremely advisable passive index funds that observe the S&P 500 (SPX) equivalent to the preferred fund SPY could be price $22,298,” stories Looking for Alpha.

The ARKK ETF: Emphasizing Disruptive Names

ARKK’s success is rooted in its capability to persistently determine corporations on the corners of seismic shifts. Along with Tesla, Nvitae (NASDAQ: NVTA), Roku (NYSE: ROKU), and Sq. (NYSE: SQ) are among the many names driving ARKK upside this 12 months, to call only a few.

“Corporations that spawn additional innovation, stimulating development over prolonged time horizons. Amazon (AMZN) is a superb instance for this by way of each transformation and new companies: on-line market, e-commerce, cloud computing (AWS), AI, retail (by way of Amazon Go and Complete Meals), house (Blue Origin), streaming service (Twitch),” in keeping with Looking for Alpha.

Buyers are at all times searching for the subsequent massive factor and, lately, a lot of that search has revolved round discovering the subsequent equivalents of the famed FANG shares. Doing so is troublesome, however there are some ETFs that supply buyers publicity to the subsequent technology of hyper-growth names.

ARKK, typically often known as one of many ETFs with one of many largest weights to Tesla, sometimes holds between 35 and 55 shares. Though that’s a concentrated lineup, the fund presents vast publicity to a compelling cross-section of fast-growing themes.

“Markets tends to be myopic and infrequently at greatest reductions solely the subsequent 12 months. Thus, the market will be simply distracted by short-term worth actions, shedding give attention to the long-term impact of disruptive applied sciences. There’s a time arbitrage ARK can make the most of by searching for alternatives that supply development over 3-5 years that the market ignores or underestimates,” notes Looking for Alpha.

For extra on disruptive applied sciences, go to our Disruptive Expertise Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.